A panic in the markets? Maybe, or maybe not yet, but the ingredients are present. June’s inflation numbers came out yesterday, and the print was worse than expected, at 9.1% annualized, the highest run since 1981. Looking forward, market watchers expect the Fed to get more aggressive in its anti-inflationary stance.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The next FOMC meeting, where interest rates are considered is scheduled for later this month; there is a 72% consensus expectation for a 75 basis point hike, which would put the key rate in the 2.25% to 2.5% range. And for those who don’t agree with that, the odds for a full percentage point hike are up to 28%.

The key question, for now, is will the Fed get aggressive enough. It’s a commonly held truism that interest rates need to meet or exceed the rate of core inflation before they start to apply the brakes, and the Fed won’t get near that rate before the end of the year.

This puts investors in a fix. No matter what they do, inflation is going to gnaw away at their assets for at least the next six months – so now is the time to take defensive measures, to minimize those losses. One common protective move: get into high-yield dividend stocks.

Stocks generally will offer the best cushion against inflation, especially the reliable high-yield dividend payers. First, stocks have a long-term history of showing gains despite nearer-term losses. And second, dividend stocks offer a steady income stream, that help to offset losses elsewhere.

With this in mind, we’ve used TipRanks’ database to pinpoint two of the market’s dividend champs, with long histories of keeping the payments reliable, and high yields that offer some chance to soften today’s inflationary environment. Let’s take a closer look.

Viper Energy Partners (VNOM)

We’ll start with Viper Energy, one of the many mineral rights companies operating in the Texas oil patch. Specifically, Viper holds an asset portfolio with more than 26,000 net royalty acres, the lands where the company owns mineral rights and derives income from oil and gas drilling activities. There are some 275 gross wells paying royalties to Viper, from an average Q1 production of 18,144 barrels of oil per day.

This production brought Viper a net income of $16.6 million in 1Q22, or 23 cents per diluted common share. The company’s total royalty income for the quarter, or gross revenue, came in at $193.09 million. The EPS was up 155% year-over-year, while the top line grew 100% in the same time.

Of particular interest to dividend investors, Viper’s cash for distribution in the quarter came to $74.2 million. The company distributed some 70% of this total in the form of dividends, which here declared at 67 cents per common share and paid out in May. That dividend was up from 47 cents declared in the previous quarter, and represented the seventh consecutive increase in the payment. At the current rate, the dividend annualizes to $2.68 per common share and gives a yield of 10.6%. With inflation running at 9.1%, the high yield on VNOM’s dividend offers the chance for a positive real return.

Among the bulls is Truist 5-star analyst Neal Dingman who takes a bullish stance on Viper shares.

“Viper finds itself in a sweet spot as volumes and prices continue to rise along with the typical minimal costs. The company is confident over volumes throughout the year given increased line of sight, and we see little to impact today’s strong commodity prices. The unique mineral structure enables investors to take advantage of such opportunities as [high percentage] of cash available for distribution was [sic] recently returned to unit holders and the strong payout is likely to continue,” Dingman opined.

Dingmann uses these comments to back up his Buy stance on the stock, and his $45 price target implies a 12-month gain of ~82% in the offing. Based on the current dividend yield and the expected price appreciation, the stock has ~93% potential total return profile. (To watch Dingmann’s track record, click here)

Overall, Wall Street is sanguine about this stock, having given it 8 positive analyst reviews in recent weeks, for a unanimous Strong Buy consensus rating. The shares are selling for $24.70 and their $40.13 average price target indicates room for ~62% one-year upsides potential. (See VNOM stock forecast on TipRanks)

Brigham Minerals (MNRL)

The next high-yield dividend stock we’re looking at is another mineral rights hydrocarbon player. Brigham Minerals owns assets in five major oil and gas basins which, together, make up some of North America’s richest energy production regions. Brigham’s portfolio boasts some 93,400 net royalty acres in North Dakota’s Williston Basin, the Oklahoma SCOOP/STACK systems, the DJ Basin of Colorado and Wyoming, and the Midland and Delaware Basins in Texas and New Mexico.

Brigham’s assets generated record quarterly results for the company in 1Q22. Production volumes hit 12,031 barrels of oil equivalent per day, which was up 31% from the previous quarter and was driven by a 21% increase in volume from the Texas Permian formations. Royalty revenues on this production hit $70 million, an increase of 49% from 4Q21 and up 107% year-over-year. Earnings showed the strongest increase, with diluted EPS more than tripling from 20 cents in the year-ago quarter to 62 cents in 1Q22.

These solid results supported another record for Brigham – a record dividend payment. The common share dividend came to 60 cents in 1Q22, a total that included a 16-cent base and a 44-cent variable payment. The combined 60 cents represented – like with Viper, above – the seventh straight quarter of dividend increases, and going forward, the $2.40 annualized payment gives a yield of 10.5%.

These facts lie behind analyst Derrick Whitfield‘s optimistic view of the company.

“In our view, Brigham offers investors exposure to the best geology in the Lower 48 while maintaining geographic and operator diversification… Quantitatively, we estimate Brigham can return 100% of its enterprise value by 2031, offering significant value now and potential upside in the future. The company also maintains minimal leverage (2022E Fwd. Net Debt / EBTIDA of 0.1x). Overall, the company’s technical expertise and ability to take advantage of accretive deals in the near term with ground game capital provide a differentiated setup for 2022 and 2023,” Whitfield commented.

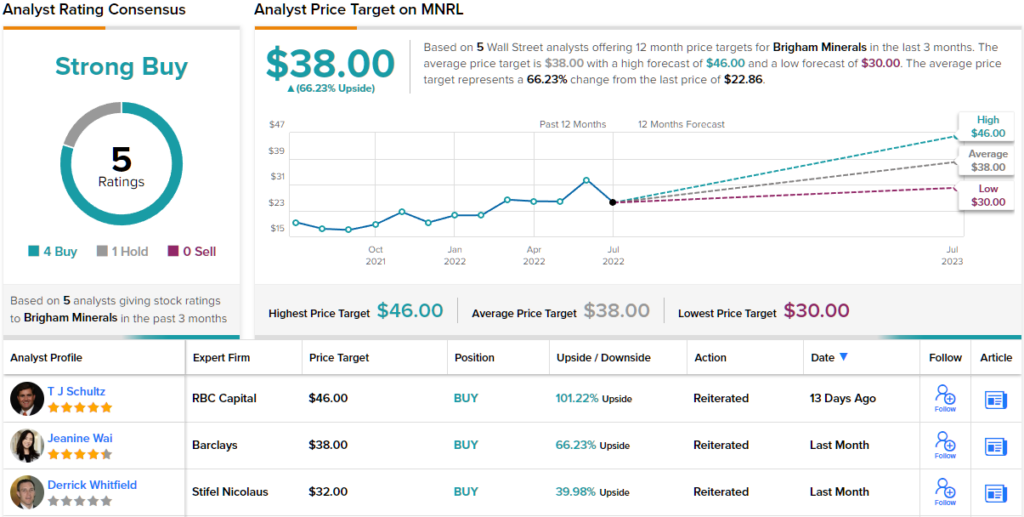

Putting his stance into solid numbers, Whitfield gives MNRL shares a Buy rating with a $32 price target, suggesting the stock has an upside potential of ~40% by next summer. (To watch Whitfield’s track record, click here)

The Strong Buy consensus rating on Brigham is based on a 4 to 1 split between the Buys and Holds among the analyst reviews. The shares are selling for $22.86 and their $38 average target implies a 66% one-year upside from that level. (See MNRL stock forecast on TipRanks)

To find good ideas for dividend stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.