As Rush’s Neil Peart once wrote, “Changes aren’t permanent, but change is” – a sentiment that rings especially true in the fast-evolving digital economy. The natural ebbs and flows of business cycles are amplified by the speed of digital transactions, while emerging technologies continuously introduce new assets to investors’ radar.

Few sectors embody this transformation more than crypto, where innovation and growing mainstream adoption are reshaping the financial landscape. Observing these shifts from KBW, 5-star analyst Bill Papanastasiou highlights a potential trend toward greater adoption of digital assets.

“In our view, we are at an important juncture in the evolution of digital assets (in particular Bitcoin). The pro-crypto United States government and securities regulators have shown strong support in establishing a more favourable environment and will be working hand-in-hand to introduce a comprehensive digital asset framework, which is expected to accelerate adoption, enhance institutional involvement, and integrate the asset class with traditional financial markets,” Papanastasiou opined.

With this backdrop, Wall Street’s analysts have selected two bitcoin-focused stocks for investors looking to capitalize on the crypto space’s advance. These companies are big proponents of Bitcoin, an asset that can put in motion a digital gold rush when the market runs hot.

Now, let’s dive into the TipRanks database to see what the Street has to say about these crypto players – and why they could be compelling buys.

CleanSpark (CLSK)

The first bitcoin miner we’ll look at, CleanSpark, is a company committed to a clean future and to promoting low-carbon renewable energy sources. CleanSpark is a pure-play bitcoin miner, with corporate offices in Utah and Nevada and bitcoin mining facilities in Wyoming, Tennessee, Mississippi, Georgia, and New York. The company takes pride in its operations as an example of both sustainable energy production and profitable bitcoin mining ops – the energy used comes from power projects featuring wind, solar, nuclear, and hydro power generation.

CleanSpark’s operations are extensive, and that is reflected in the company’s vital stats. The company has a total fleet of 217,272 miners deployed, with a combined hashrate of 40.1 EH/s as of January 31 this year. In January, the last month with reported results, CleanSpark produced 626 bitcoin and had total holdings of 10,556 bitcoin, making January 2025 the first month in which the company’s bitcoin holdings have exceeded 10,000. The company sold 22.47 bitcoins during the month to support its operations.

Earlier this month, CleanSpark released its financial results for fiscal 1Q25, the quarter that ended on December 31. In that quarter, the company reported revenues of $162.3 million, up an impressive 119% year-over-year and some $5.9 million better than had been anticipated. At the bottom line, CleanSpark’s EPS of 85 cents was 35 cents per share better than expected. The company finished the quarter with total current assets – bitcoin and cash – of $1.2 billion. Of that total, $276.6 million was listed as cash; the bulk of the company’s current assets are held in bitcoin.

This bitcoin miner has caught the eye of Needham analyst John Todaro, who is rated by TipRanks among the top 1% of the Street’s analysts. Todaro is impressed by the company’s ability to grow its bitcoin mining hashrate, as well as by its deep pockets; he writes of CleanSpark, “Our investment thesis is driven by: 1) operational leverage as the company expands hash rate (25% growth) while costs grow at a slower pace (5-7%). CLSK today has the lowest G&A expenses per EH in our universe. 2) Attractive valuation as CLSK trades at the largest discount in our coverage universe, yet is one of the most efficient miners with a quality mgmt. team. And lastly, 3) the company has a robust balance sheet of over 10,000 bitcoin which provide financing flexibility (we see little equity dilution needed in 2025). Additionally, we believe CLSK could begin clipping an attractive 5%+ per annum yield on its bitcoin stack.”

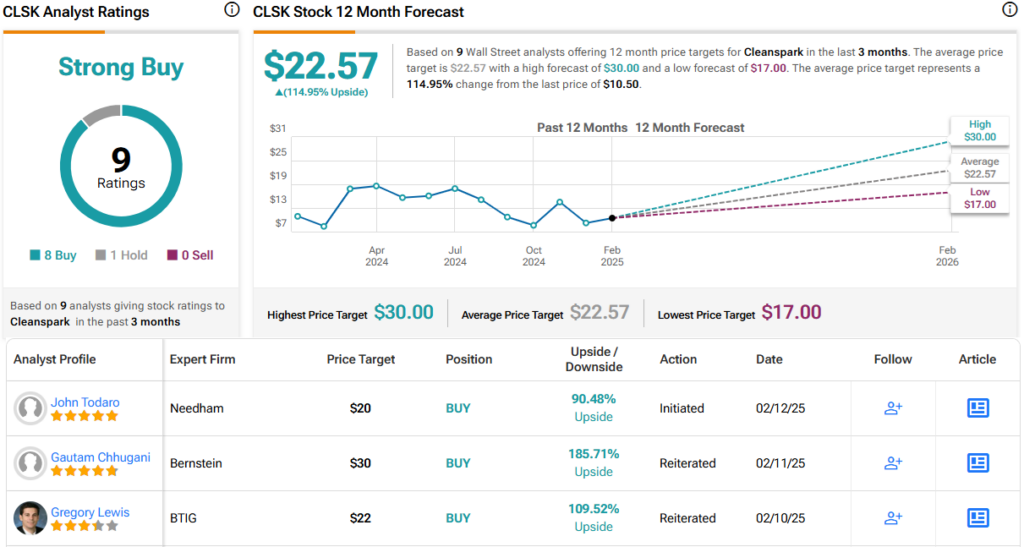

Todaro goes on to put a Buy rating on CLSK shares, with a $20 price target that points toward a one-year upside potential of 90.5%. (To watch Todaro’s track record, click here)

Overall, the stock has a Strong Buy consensus rating from Wall Street’s analysts, based on 9 recent reviews with a lopsided split of 8 Buys to 1 Hold. The shares are priced at $10.50, and their average target price of $22.57 is even more bullish than the Needham view, suggesting a 115% gain in the coming year. (See CLSK stock forecast)

Strategy, Inc. (MSTR)

Next up is Strategy, which earlier this month rebranded itself. You may know the firm under its previous, longer name of MicroStrategy; now, as Strategy, the company has adopted a stylized ‘B’ as a logo, emphasizing its role as a bitcoin treasury. The company did not change its stock ticker, and with its market cap of more than $87 billion, it is now the largest corporate bitcoin treasury.

Strategy has retained its core business as a provider of business intelligence and artificial intelligence software, giving its customers access to high-end, AI-powered, cloud-based data services at any enterprise scale. The company has more than 35 years of experience in data analytics.

The stock has been a huge winner in recent times, having gained a huge 379% over the last 12 months, but that has nothing to do with software.

That’s because the Michael Saylor-led company has positioned itself as a bitcoin treasury, making acquiring as much BTC as possible its primary objective. Strategy currently holds more than 478,000 bitcoin, and the company’s investors can tap into that value and the return it generates.

Bitcoin activity aside, the company’s revenues and earnings have been fluctuating. In the last reported quarter, 4Q24, Strategy showed a top line of $120.7 million, down 3.1% year-over-year and missing the forecast by $2.03 million. At the bottom line, the company reported a steep net loss, as earnings were impacted negatively by a one-time bitcoin impairment of more than $1 billion; the company’s non-GAAP EPS in the quarter came to negative $3.20.

Despite the rocky quarter, KBW’s Bill Papanastasiou is attracted to this name. He sees high potential in Strategy’s growing role as a bitcoin treasury and writes of the stock, “We view MSTR as an attractive proxy for investors seeking levered Bitcoin exposure with additional torque from accretive Bitcoin purchases that are fueled by highly demanded security issuances and a valuation that exceeds net asset value… In our view, a massive value unlock will be when applications are developed on top of the Bitcoin protocol as it is the most secure, decentralized, and valuable public network. Down the road, MSTR could represent a consolidator and strategic director of future ecosystem development that drives greater utility and use cases, which could help transform Bitcoin into a more productive asset. Strategy’s participation could also help ‘bootstrap’ applications that compete directly with other smart contract platforms.”

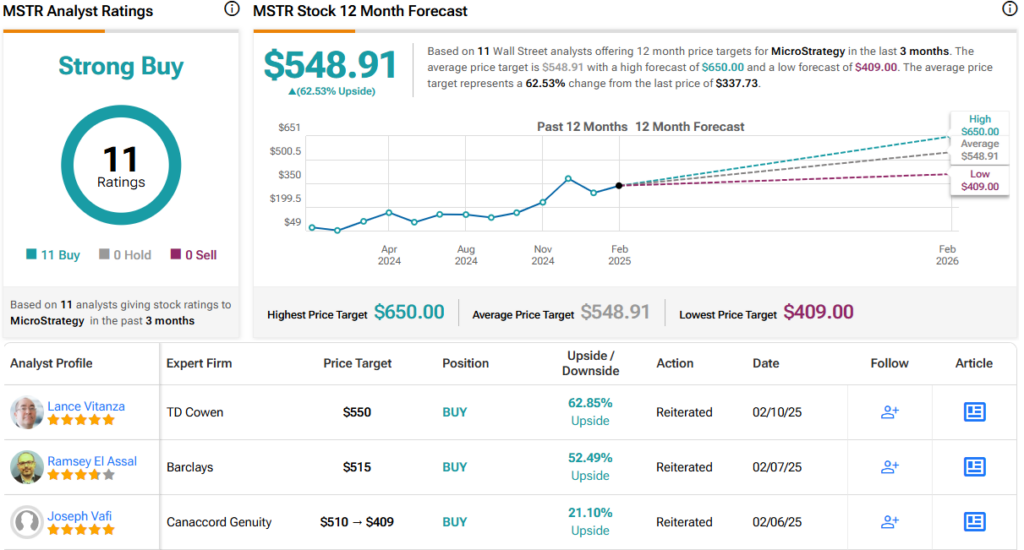

Papanastasiou gives MSTR shares an Outperform (i.e., Buy) rating, with a $560 target price that implies a 66% potential gain in the next 12 months. (To watch Papanastasiou’s track record, click here)

All 11 of this stock’s recent analyst reviews are positive, making the Strong Buy consensus rating unanimous. The stock is currently selling for $337.73, and its $548.91 average price target suggests that it has a gain of 62.5% in store for the coming year. (See MSTR stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.