In times of geopolitical tension, the stock market can start to get a little volatile. We’ve seen these situations play out many times before, and this time is no different as the Ukraine situation begins to intensify. As the U.S. and Russia ratchet up tensions, companies operating in the defensive sector are positioned to outperform.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

It is one reason why investors should take a look at Lockheed Martin (LMT). Despite the risk of the Aerojet Rocketdyne (AJRD) deal collapsing, I am bullish on the long-term prospects of this leading defense contractor.

Lockheed is the largest defense contractor in the world, and it has also dominated the Western market for high-end fighter aircraft with its F-35 program. Lockheed’s segments also include rotary & mission systems, which is mainly the Sikorsky helicopter business; missiles and fire control, which creates missiles and missile defense systems; and space systems.

Year-to-date, Lockheed’s share price is up over 11%, which is in stark contrast to the broader market. In comparison, the S&P 500 has lost approximately 5% of its value.

Strong Q4 Results

Outside of geopolitical tensions that are no doubt propping up the stock in the short term, the company recently announced strong Fiscal 2021 Q4 results. Earnings of $7.47 per share beat by $0.27, and revenue of $17.73 billion beat by $70 million.

It was a strong rebound quarter for Lockheed after it posted a rare miss on the top line in the prior quarter. It also generated $4.3 billion in cash from operations and repurchased $2.1 billion worth of shares for cancellation.

Lockheed also released its Fiscal 2022 outlook in which it expects to post full-year earnings of $26.70 per share and generate $66 billion in revenue. This compares to analysts’ estimates for earnings of $26.36 per share and revenue of $66.39 billion.

FTC Sues to Block Aerojet Deal

While the company ended the year on a strong note, management did warn that the Aerojet takeover was at risk. The FTC sued to block the transaction, and as a result, Lockheed was faced with two options

- Fight the lawsuit in court

- Walk away from the merger agreement.

The company noted that it would take approximately 30 days to decide on which course of action to take. However, it appears increasingly likely that Lockheed will not fight the FTC lawsuit.

While disappointing, the $4 billion acquisition is not a make-or-break endeavor for Lockheed.

Contract Wins

It is also worth noting that Lockheed Martin continues to lock in defensive contracts. Since the company’s Q4 report, it has landed a few notable contracts.

In late January, it landed a $1.42 billion Air Force contract for the C-130J mission sustainment support effort. The contract provides logistics support and sustainment of the C-130J aircraft fleet. This is a long-term contract with an expected completion date of 2032.

It then announced two additional contracts for $685 and $102 million for Naval Air Systems. Both contracts were fixed-price modifications to previously awarded contracts and are expected to be completed by December 2022.

Wall Street’s Take

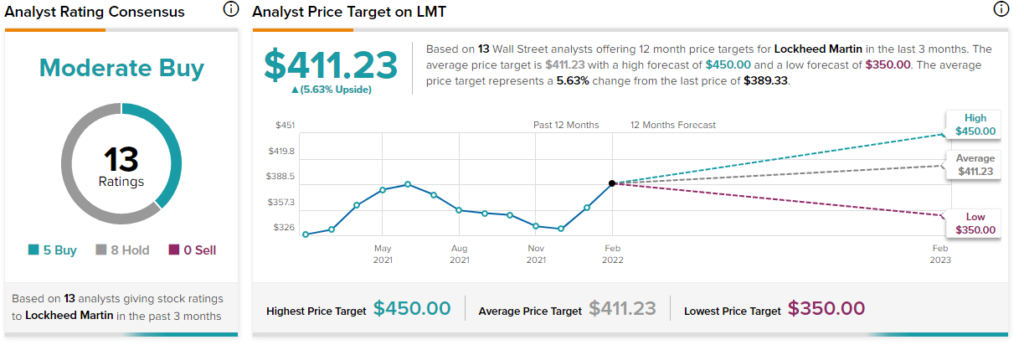

Turning to Wall Street, Lockheed Martin earns a Moderate Buy consensus rating based on five Buys, eight Holds, and no Sell ratings.

The average Lockheed Martin price target of $411.23 puts the upside at 5.63%.

Conclusion

All-in-all, Lockheed Martin is one of the best defensive contractors in the world. It typically performs very well against estimates, and as geopolitical tensions rise, the defense industry is one of the few that are poised to buck any weakness.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure