Stock picking is going to get a bit more difficult in the near term, if the word coming out of Goldman Sachs is accurate. The firm’s strategist, Peter Oppenheimer, sees a combination of rising bond yields and high stock valuations working together to tighten up overall gains in the equity markets.

“The faster any rise in yields, the bigger the impact on equities,” Oppenheimer says, and adds, “Given the valuation of equities, it’s going to be a speed bump.”

But even with the stock rally looking at a possible shift to lateral movement, there are still paths forward. Oppenheimer notes, “Diversification is the opportunity that investors have in a flatter market environment.”

Diversification is a common strategy for a more careful approach to portfolio management, and while Oppenheimer is advocating that sort of caution, his colleagues among the Goldman stock analysts are busy selecting stocks where they see solid potential for gains.

We ran two of their recent recommendations through the TipRanks database and it looks like the Street is in agreement with the Goldman view here – both are rated as Strong Buys by the analyst consensus. let’s see what sets them apart.

Jazz Pharmaceuticals (JAZZ)

For biotech firms, getting a medicine approved and on the market is akin to finding the Holy Grail – and Jazz Pharmaceuticals has a wide range of such approved products, in both the neuroscience and oncology fields. These commercialized medications ensure that Jazz, even though it also maintains an extensive pipeline of new drug research projects, runs a mostly consistent quarterly profit. From an investor’s perspective, this biotech offers a ‘best of both worlds’ situation, with a record of solid revenues and sales plus the high potential of promising drug candidates in the trial clinic.

Among the company’s existing and approved medications, three were named by the company as ‘key growth drivers’ in the first quarter of this year. These three showed a combined year-over-year revenue increase of 12%; two came from Jazz’s neuroscience portfolio, and the third from the oncology side. From lowest to highest growth, the three key revenue generators were Epidiolex, a cannabidiol used in treating seizures, with net product sales up 5% y/y; Xywav, a drug used in the treatment of excessive daytime sleepiness, with a 14% gain in net product sales; and the oncological medication Rylaze, a treatment for acute lymphoblastic leukemia, which saw a 20% increase in net product sales.

Turning to the pipeline, we find that the company’s drug candidate zanidatamab is the subject of multiple clinical studies. These studies are looking at zanidatamab as both a monotherapy and combination therapy, in the treatment of a wide range of cancers. Among these studies is the trial of zanidatamab in the treatment of HER2-positive biliary tract cancer. The company on June 1 released positive data from the Phase 2b HERIZON-BTC-01 clinical trial of zanidatamab in previously treated, unresectable, locally advanced, or metastatic HER2-positive biliary tract cancer; the data showed that zanidatamab “demonstrated sustained and durable antitumor responses.”

Just a few days prior to this data release, Jazz announced that the FDA had granted a Priority Review for the BLA, Biologics License Application, for zanidatamab in the previously treated, unresectable, locally advanced, or metastatic HER2-positive biliary tract cancer indication. The PDUFA date for the review is set as November 29, 2024.

In addition, Jazz at the beginning of June delivered presentations at SLEEP 2024, the 38th annual meeting of the Associated Professional Sleep Societies. The presentations highlighted the safety and efficacy of Xywav, which as noted is the company’s approved drug to combat excessive daytime sleepiness.

For Goldman analyst Andrea Tan, part of the appeal of this company is the quality of the pipeline. She writes of the stock, “While debate has been on the outlook for the sleep business (and Epidiolex, to some degree), we are optimistic on the emerging pipeline to support the longer-term growth profile… The continuing investment in R&D and the early stage pipeline alongside business development (JAZZ has $8bn in incremental balance sheet capacity if it were to lever up to 5x 2024 EBITDA) serve as sources of growth. With the name trading at a higher relative discount to the S&P than its 5-yr average, we see JAZZ as attractive at current levels.”

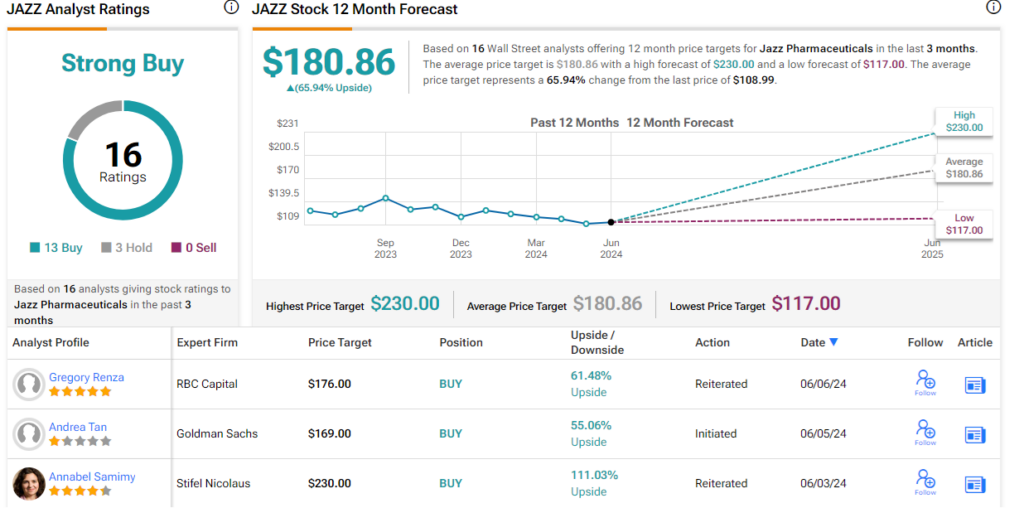

Tan goes on to initiate her coverage with a Buy rating and a $169 price target that implies a robust 55% one-year upside potential. (To watch Tan’s track record, click here)

The Strong Buy consensus rating on JAZZ is based on 16 reviews that include 13 Buys to 3 Holds, and the stock’s $180.86 average price target is even more bullish than the Goldman view, suggesting a 66% upside from the current share price of $108.99. (See JAZZ stock forecast)

Zeekr Intelligent Technology (ZK)

The next stock on our Goldman-backed list is Zeekr Intelligent Technology, the electric vehicle brand partly owned by the Chinese automotive giant, Geely. Zeekr is a luxury EV brand, focused on combining European styling and performance with the latest in advanced production and manufacturing processes. The company’s models feature the Zeekr 001, a five-seat hatchback crossover and the Zeekr X, a luxury urban SUV. In addition, the company has a six-seat MPV, the Zeekr 009, and is working on an upscale luxury sedan. The company’s cars are pure-play battery EVs, and feature high-end software and hardware applications to enhance the driving experience.

Zeekr is new to the stock market, having gone public this past May, and will report its first set of quarterly results on June 11. When we look back at the IPO, we find that the company went public via the initial sale of 21 million American Depositary Shares on Wall Street. ZK currently has a market cap of $5.86 billion.

At the beginning of this month, Zeekr announced its delivery numbers for May 2024, and showed a strong year-over-year gain. This past May, the company delivered 18,616 vehicles, for a y/y increase of 115%. Since it began making deliveries, Zeekr has delivered a cumulative total of 264,397 electric vehicles.

This Chinese EV maker has caught the attention of Goldman’s EV expert, Tina Hou. She opens up her coverage of the newly public stock by noting some of Zeekr’s clear strengths, before giving her long-term outlook: “We believe ZEEKR is in a better position to compete by adopting an asset-light manufacturing model leveraging its parent company’s (Geely) factory capacity, which helps alleviate heavy upfront capex burden. Geely’s mature supply chain also gives ZEEKR an edge on cost, as exhibited by ZEEKR’s higher vehicle contribution margin of 18.2% (vs. Nio/XPeng’s 16.2%/3.7%). ZEEKR had Rmb3bn net cash and Rmb2.3bn in operating cash flow in 2023. However, we expect negative operating cash flow of Rmb-4bn in 2024E (vs. Nio/XPeng of Rmb-10bn/-6.5bn) and expect FCF to turn positive in 2027E given ongoing competition.”

For Hou, this adds up to a stock worth buying now. She gives it an initial rating of Buy, with a $34 price target that points toward 44% gain on the one-year horizon. (To watch Hou’s track record, click here)

Overall, ZK shares get a Strong Buy from the analyst consensus, based on 3 unanimous Buy ratings set for this new stock. The shares are priced at $23.66 and the $34.67 average price target suggests an upside of 46.5% for the year ahead. (See Zeekr’s stock analysis)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.