Consumer staples stocks Coca-Cola (NYSE:KO), Mondelez International (NASDAQ:MDLZ), and The Hershey Company (NYSE:HSY) are scheduled to announce their second-quarter earnings this week. These three snack-providing companies delivered upbeat Q1 earnings, as their pricing power and productivity efforts helped in offsetting the impact of higher costs due to inflation. A Q2 beat could be at hand, as Wall Street expects revenue and earnings of KO, MDLZ, and HSY to increase year-over-year in Q2, although continued macro pressures and certain other headwinds might impact volumes. Also, some analysts anticipate the benefits of higher pricing to gradually wane.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

In general, companies in the consumer staples sector, like beverage and snack food makers, experience resilient demand during a challenging macro backdrop compared to consumer discretionary companies. Let’s have a look at analysts’ expectations for these three big players in the consumer staples space.

Analysts’ Q2 Expectations

Coca-Cola is scheduled to announce its results on July 26, followed by Mondelez and Hershey on July 27.

Analysts expect Coca-Cola’s Q2 revenue to increase about 4% year-over-year to $11.7 billion and adjusted EPS to grow nearly 3% to $0.72. In the first quarter, the company’s revenue rose 5% to almost $11 billion, fueled by higher prices and strong demand. Further, adjusted EPS increased to $0.68 from $0.64 in the prior-year quarter.

An extensive geographical presence, continued innovation, including a focus on healthier beverages, and a portfolio of global brands are expected to drive the company’s performance.

Coming to Mondelez International, the maker of chocolates, biscuits, and baked snacks, impressed investors with a beat-and-raise quarter in April. Steady demand and the company’s decision to protect its margins by hiking prices drove an 18.1% rise in Q1 revenue to $9.2 billion and a 6% rise in adjusted EPS to $0.89.

However, analysts expect revenue to rise about 13% to $8.2 billion in Q2, marking a deceleration compared to Q1. Adjusted EPS is projected to increase 3% to $0.69. During the Q1 earnings call, CFO Luca Zaramella said that the company’s upgraded full-year outlook reflects the resilience of consumer consumption across its product categories. Nevertheless, the CFO cautioned that Mondelez’s Q2 results might see “some more disruption for the remaining pricing.”

Finally, we look at Hershey, which experienced solid demand for its candy and chocolates in the first quarter, even as it increased prices. The company’s Q1 adjusted EPS jumped 17% to $2.96, with net sales rising 12.1% to $2.99 billion.

While Hershey raised its full-year net sales and earnings outlook to the high end of its previous guidance range, the company warned that Q2 might be its “most challenging quarter” due to the pull-forward of some shipments from Q2 into Q1 and tough comparisons with the prior-year quarter.

Analysts expect Hershey’s Q2 net sales to rise 5.4% to $2.5 billion and adjusted EPS to increase 6.1% to $1.91.

What is the Price Target for KO?

Ahead of Q2 results, Barclays analyst Lauren Lieberman reduced the price target for KO to $69 from $73 last week, but maintained a Buy rating. Within staples, Lieberman continues to prefer names that have greater visibility to volume growth and those which are trading at attractive valuations on a relative basis.

Heading into the Q2 results, the analyst thinks that investors are “hard pivoting” away from rewarding margin-driven beats and giving more importance to sales and volumes, as benefits from pricing move past their peak.

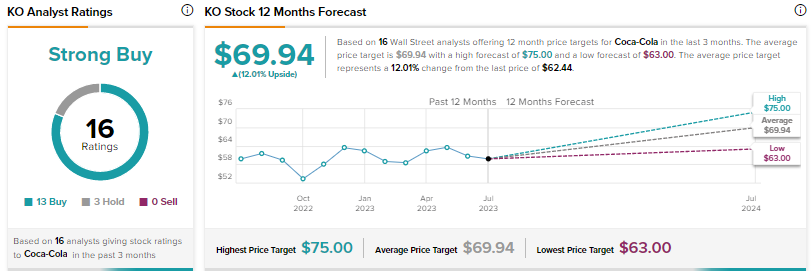

Wall Street’s Strong Buy consensus rating on KO stock is based on 13 Buys and three Holds. The average price target of $69.94 implies 12% upside. Shares are down almost 2% year-to-date.

Is MDLZ Stock a Good Buy?

On July 11, Piper Sandler analyst Michael Lavery lowered his price target for MDLZ to $82 from $83 and reiterated a Buy rating on the stock. The analyst continues to believe that Mondelez has “best-in-class brands” with solid “white space” growth prospects for its core brands in key markets.

That said, Lavery sees risk to Q2 volumes from European Union pricing negotiations, which could slow down or pause shipments to the retailers while talks are being held. The analyst also sees the possibility of lost distribution, mainly with discounters. Accordingly, Lavery lowered his Fiscal 2023 EPS estimate to $3.20 from $3.25 to reflect these potential risks.

Mondelez International stock scores a Strong Buy consensus rating, backed by 15 Buys and two Holds. At $82.06, the average price target implies about 11% upside. Shares have risen 11% so far this year.

Is Hershey a Good Stock to Buy Now?

On Friday, Erste Group analyst Stephan Lingnau downgraded Hershey to Hold from Buy, citing higher valuation compared to peers and the impact of rising prices for cocoa and sugar in recent months on the company’s margins.

Hershey scores a Moderate Buy consensus rating based on six Buys and 11 Holds. The average price target of $273.93 implies 11.1% upside. Shares have advanced 6.5% year-to-date.

Insights from Options Activity Ahead of Q2 Print

TipRanks now presents options activity, to help investors plan their trades ahead of earnings releases.

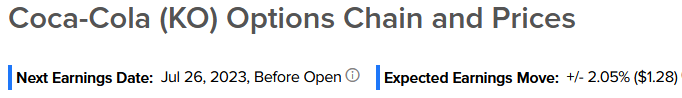

Options traders are pricing in a 2.05% move on Coca-Cola earnings. The stock has averaged a 0.89% move in the last eight quarters.

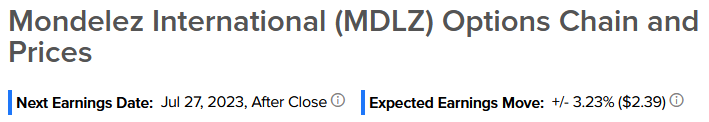

Coming to Mondelez, options traders are pricing in a 3.23% move on earnings. The stock has witnessed an average move of 2.7% in the last eight quarters.

For Hershey, options traders are pricing in a 2.88% move on earnings. The stock has averaged a 2.04% move in the last eight quarters.

The anticipated moves mentioned above are determined by computing the at-the-money straddle of the options closest to the expiration after the earnings announcement.

Learn more about TipRanks’ option tool here.