Bullish (NYSE:BLSH) shares are indeed being just that in Thursday’s trading, with investors giving the thumbs up to the cryptocurrency exchange operator following its first quarterly readout as a public company.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

As of writing, shares are up 11% after Q2 revenue hit $57 million, down 6% vs. the year-ago period, but ahead of the $55.8 million consensus estimate. The company reported a profit of $108.3 million, or 93 cents per share, reversing a loss of $116.4 million, or $1.03 per share, in the same period last year and beating Wall Street’s -$0.05 forecast. Excluding one-time items, the company reported an adjusted loss of $6 million, compared with an adjusted profit of $4.8 million in 2Q24.

Looking ahead, for Q3, the company is calling for adj. revenue between $69.0 million and $76.0 million, well above consensus at $57.1 million. Bullish also anticipates adj. EBITDA of $25.0 million to $28.0 million and trading volume in the range of $133.0 billion to $142.0 billion.

The stock has been on the markets for little over a month and has already showed some dizzying tendencies, first surging to $118 before pulling back more than 50%.

But the upwards trajectory has been resumed, and that is not surprising, says Canaccord’s Joseph Vafi, an analyst ranked amongst the top 2% of Street stock experts. “Against a backdrop of high expectations post its IPO, Bullish delivered in its first quarter as a public company,” said the 5-star analyst.

Vafi is encouraged by several factors, including the strong pricing performance so far in Q3, ongoing robust growth in subscription services, the anticipated full rollout of options trading in Q4, and an upgraded Q3 outlook.

Additionally, as expected, Bullish confirmed that its U.S. digital asset trading and custody operations have received both a BitLicense and a Money Transmission License from the NYDFS. “With the BitLicense, Bullish can now engage in virtual currency activities in NY state and, in our view, we see this as the biggest short-term catalyst for growth in the BLSH investment case,” he explained.

Even though U.S.-based institutions aren’t trading with Bullish yet, Vafi thinks most are aware of the platform, suggesting that the path to a “nice ramp” could start sooner rather than later. That said, he expects it will still take time for major institutions to fully onboard, but nevertheless views the setup positively looking into next year.

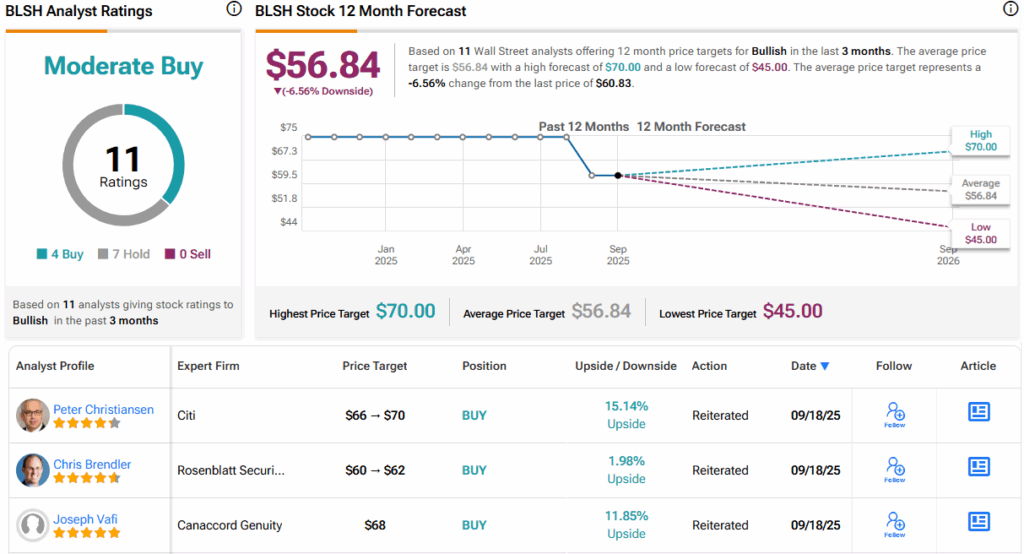

To this end, Vafi reiterated a Buy rating on BLSH shares, alongside a $68 price target, implying the stock will gain 12% over the one-year timeframe. (To watch Vafi’s track record, click here)

Elsewhere on the Street, the stock claims an additional 3 Buys and 7 Holds, for a Moderate Buy consensus rating. However, the shares have now surpassed the $56.84 average target. (See BLSH stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.