Launched in 2017, the JPMorgan U.S. Quality Factor ETF (NYSEARCA:JQUA) is one of a growing number of “quality factor” ETFs offered by asset managers in recent years that look to invest in companies with strong fundamentals such as healthy balance sheets, strong profitability, and earnings growth. Let’s take a look at JQUA and see why it’s worthy of investor consideration.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

What Does the JQUA ETF Do?

JQUA is JPMorgan’s (NYSE:JPM) quality factor ETF with $1.7 billion in assets under management (AUM). JQUA tracks the JP Morgan US Quality Factor Index, and JPMorgan says it “utilizes a rules-based approach that matches Russell 1000 sector weights and selects stocks based on quality and profitability characteristics.”

Its goal is to give its investors exposure to higher-quality stocks while reducing single-stock risks. It invests in large-cap and mid-cap stocks, and in keeping with its theme of “quality,” it looks to identify stocks that show “profitability, quality of earnings, and solvency,” according to the ETF’s prospectus.

One aspect of JQUA that is important for investors to note is that it will invest at least 80% of its funds in this underlying index but that it can invest up to 10% of its assets in exchange-traded futures contracts.

The fund is managed by a seasoned team of four portfolio managers, who collectively boast 61 years of industry experience and 50 years at JPMorgan between them. JQUA also pays a dividend and currently yields 1.3%.

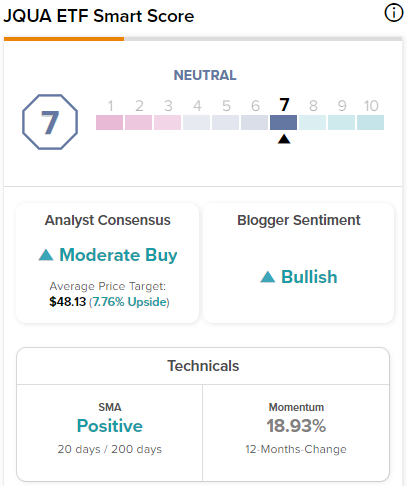

JQUA features a Neutral ETF Smart Score of 7 out of 10. The Smart Score is a proprietary quantitative stock scoring system created by TipRanks. It gives stocks a score from 1 to 10 based on eight market key factors. The score is data-driven and does not involve any human intervention. A Smart Score of 8 or higher is equivalent to an Outperform rating, while a Smart Score of 4 to 7 is considered Neutral, placing JQUA at the higher end of the Neutral range.

JQUA’s Well-Balanced Portfolio

JQUA is very diversified. Not only does it sports 262 holdings, but its top 10 holdings make up under 20% of the fund, meaning that investors aren’t exposed to undue risk in a handful of large holdings. Below, you’ll find an overview of JQUA’s top 10 holdings using TipRank’s holdings tool.

Based on JQUA’s investment criteria, it’s unsurprising to see that its top holdings are stocks that most investors would consider to be blue-chip names, such as mega-cap tech names like Meta Platforms (NASDAQ:META), Nvidia (NASDAQ:NVDA), Apple (NASDAQ:AAPL), Microsoft (NASDAQ:MSFT) and Alphabet (NASDAQ:GOOGL).

However, the fund isn’t limited to just technology names. The tech sector makes up 30.9% of the fund, which is its largest weighting, but it also has double-digit percentage weightings in the consumer discretionary sector, healthcare, and industrials. Global payment networks Visa (NYSE:V) and Mastercard (NYSE:MA) also appear in JQUA’s top 10 holdings, as does Warren Buffett‘s Berkshire Hathaway (NYSE:BRK.B) conglomerate.

Eight of JQUA’s top 10 holdings feature Smart Scores of 8 or above (equivalent to an Outperform rating).

Is JQUA Stock a Buy, According to Analysts?

Turning to Wall Street, JQUA has a Moderate Buy consensus rating, as 59.51% of analyst ratings are Buys, 34.91% are Holds, and 5.58% are Sells. At $48.13, the average JQUA stock price target implies 7.8% upside potential.

Long-Term Performance

JQUA launched in 2017, so while it hasn’t been around for long enough to measure its performance over the course of a decade or more, we can begin to ascertain its long-term track record. As of the end of June, JQUAL had a one-year return of 20.8%. Over a three-year time horizon, it posted an impressive annualized total return of 15%. Lastly, over the past five years, its total annualized return is a solid 12.7%.

JQUA vs. The Market

JQUA’s returns have been solid, but you always want to track an ETF’s performance against the broader market to get a true gauge of how it is performing. Many ETFs fail to beat the market over time. Using the Vanguard S&P 500 ETF (NYSEARCA:VOO) as a proxy for the S&P 500 (SPX), we can measure JQUA’s performance against that of the broader market.

As of the end of June, VOO had a total return of 19.5% over the past year and annualized total returns of 14.6% and 12.3% over the past three and five years, respectively. Therefore, JQUA has beaten the broader market over each of these three time frames, albeit by a relatively narrow margin.

Separately, as JQUA focuses on companies with strong balance sheets and healthy profitability, it is worth checking out how it performed during a down market, as these are defensive qualities. In 2022, which was a difficult year for the market, JQUA lost 13.5%, which may not sound great, but it was better than the S&P 500’s loss of 18.2%, and it held up far better than the Nasdaq (NDX) — for example, the Invesco QQQ Trust ETF (NASDAQ:QQQ) struggled to a loss of 32.6% last year.

Below, you can take a look at a comparison of JQUA versus VOO using TipRanks’ ETF Comparison Tool, which enables investors to compare up to 20 ETFs at a time based on a wide array of customizable criteria.

JQUA Has a Reasonable Expense Ratio

This ETF features a relatively reasonable expense ratio of 0.12%. With this fee structure in place, a JQUA investor putting $10,000 into the ETF would pay $154 over the course of 10 years, assuming the fee remains constant and that the fund returns 5% per year.

Investor Takeaway

There isn’t really anything spectacular or novel about JQUA or its strategy of focusing on companies with strong fundamentals, but its diversified portfolio of blue-chip holdings, moderate expense ratio, and market-beating performance (albeit by a slim margin) make it a worthy option for investor consideration.

This isn’t the type of ETF that you are buying with the expectation of it going parabolic or soaring to any type of massive short-term gains, as indicated by its Neutral ETF Smart Score and the modest upside potential from analyst ratings. Although that being said, this usually isn’t a realistic expectation to begin with. However, it does look like a steady, reliable ETF that investors can view as a solid long-term holding based on the reasons discussed above.