Wall Street’s major banking firms build their reputations, in part, on their ability to see the dark future clearly. JPMorgan has a storied name on the Street, and the banking giant’s Asset Management team has recently been casting its collective eye forward.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

“We are increasingly convinced that the pandemic will leave behind few economic scars, however we expect the policy interventions at the height of the crisis will have a long-lasting impact on markets… Our overall message is optimistic,” said John Bilton, head of global multi-asset strategy.

Keeping that in mind, we’re taking a look at two stocks recommended by some of JPMorgan’s top analysts. These are analysts who stand tall among their peers, ranking in the top 10% of Wall Street pros covered by TipRanks. Impressively, the firm’s analysts believe each ticker could climb over 50% higher in the year ahead. Let’s take a closer look.

BTRS Holdings (BTRS)

We’ll start with BTRS Holdings, or Billtrust, a leader in the payment processing niche. BTRS serves business customers in the US, with a B2B accounts receivable automation software platform. This holding company’s subsidiaries provide solutions for cloud-based software and integrated payment processing, including online ordering, invoicing, remittance capture, and accounts receivable. The company boasts over 40 verticals covering a range of industries, and a 98% customer retention rate.

Just last month, BTRS made a move to expand the value of its platform, through its acquisition of Belgium’s iController, a B2B collections software provider. The acquisition cost BTRS $58 million, which was paid for from cash on hand. iController will become a BTRS subsidiary, and continue operating in Belgium and the Netherlands – expanding BTRS’ footprint in Western Europe.

This move put some of BTRS’ cash holdings to sound use. The company finished Q3 this year with over $265 million in liquid assets, before the acquisition. BTRS also reported revenues of $41.4 million in Q3, up an 8% year-over-year. The gain was driven mainly be a solid performance in software and payments; that segment saw revenue increase by 21.5% yoy, to reach $26 million.

Even with that, however, the stock dropped sharply this year, losing 45% of its value. Yet, JPMorgan’s 5-star analyst Tien-tsin Huang sees the current low share price as a chance to buy in.

“Broad-based momentum across the business drove net revenue mildly ahead of expectations. Management suggested greater upside in the key Software/Payments segment,” Huang noted. “We think relative valuation is attractive… Stock is trading at a low enough discount now that compounding steady high-teens plus gross profit growth should be good enough for the stock to compound higher as sentiment improves from stable to improving growth.

To this end, Huang gives BTRS an Overweight (i.e. Buy) rating, with a $15 price target predicting 72% share growth in the year ahead. (To watch Huang’s track record, click here)

Overall, it’s clear from the Strong Buy consensus that Wall Street agrees with the bullish outlook here. The consensus view is based on a unanimous 5 recent reviews. The share price stands at $8.72 and the average price target of $14.20 implies ~63% upside potential. (See BTRS stock analysis on TipRanks)

Vonage Holdings (VG)

The second JPM pick we’ll look at is Vonage, a tech company in the telecom industry. Vonage has put together a package combining high tech know-how with telecom service, and offers its customers VOIP and cloud communications for contact center applications and communications APIs.

Vonage is working to change the way people think about using communications technology. The company noted the shift toward remote work and virtual connections during the pandemic – and especially how that increased the value of networked remote systems and internet communications. Vonage’s products include platforms to bundle these services together, along with legacy telecom systems. These products are flexible and scalable, designed to meet the needs of each customer.

The approach is working for Vonage, which has shown sequential gains in every quarter of this year, along with year-over-year gains. The 3Q21 report gave $358.3 million at the top line, and for the 9 months ending Sept 30, the company reported $1.04 billion in revenues. The 3Q revenue was up 12% you, and the 9-month total was also up 12%. These gains were driven by VCP revenue, which was up 25%, and API revenue, which gained 43%.

Vonage predicts plenty of future opportunity, at least in part due to pandemic related changes in customer engagement. According to a company study, many of the communications tech changes which the corona crisis pushed forward are likely to permanent – and customer do not see this as a bad thing. In fact, 47% of global consumers reported increasing their use of digital channels for business engagement in the last year-and-a-half, and 87% expect to maintain the higher level of digital engagement, or increase it, in the coming year.

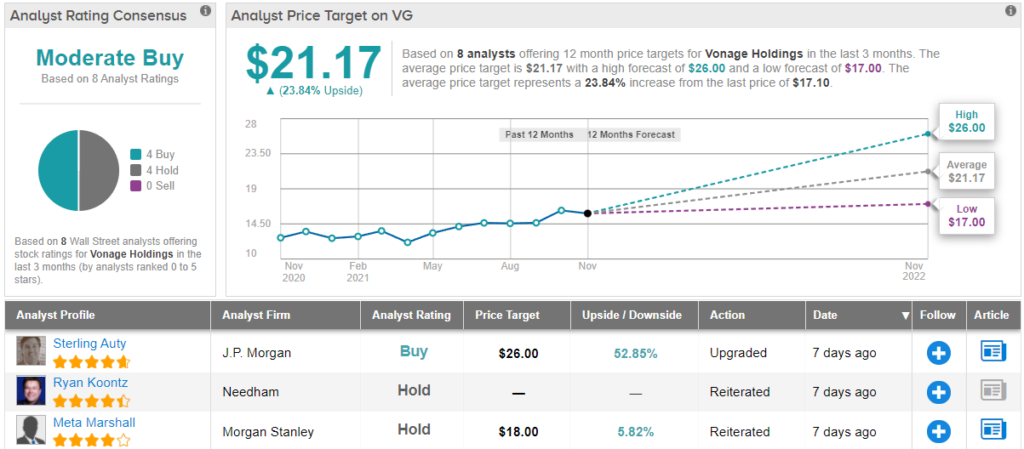

So it should come as no surprise that JPMorgan’s 5-star analyst Sterling Auty has upgraded VG shares, from Neutral to Overweight (i.e. Buy).

Backing his stance, Auty writes: “The company’s transformation efforts are still underway as it pertains to honing the product and channel focus, but VCP now represents 80% of total revenue and all signs point to further execution in this area of the business. Despite the fact that communications names have greatly underperformed the software space year-to-date, Vonage is trading at 3.4x EV/Sales which still represents a significant discount to peers. This discount coupled with improving fundamentals underpin our belief that Vonage will continue to see outsized performance going forward.”

In line with this upbeat outlook, Auty puts a $26 price target on VG shares, implying an upside of 52% for the next 12 months. (To watch Auty’s track record, click here)

While JPM is bullish, the Street is evenly split here. The 8 analyst reviews on record are evenly split, with 4 Buys and 4 Holds, for a Moderate Buy consensus. The average price target here is $21.17, suggestive of ~24% one-year upside. (See VG stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.