The banking world feels like a high-stakes poker game. The chips are flying, the players are tense, and the dealer (i.e., the global economy) keeps throwing wild cards. Tariffs are spiking, markets are swinging, and whispers of a recession are growing louder. Yet, JPMorgan Chase (JPM), Bank of America (BAC), and Morgan Stanley (MS) are still at the table, brushing off market anxiety like seasoned risk takers.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The three banking giants are navigating a landscape where intense trade wars, interest rate uncertainty, and highly volatile markets change sentiment by the day. And yet, they are doing better than most investors can imagine.

In the Trump era, banking sector investors should be bullish. There is plenty of legitimate optimism about the prospect of deregulation, rollbacks of capital requirements and consumer fee restrictions, and the big elephant in the room—crypto—all of which are expected to enhance profitability for major banks.

JPMorgan Chase (NYSE:JPM) | The Titan Tiptoeing Through Turbulence

JPMorgan Chase is the guy who walks into a storm and somehow comes out looking sharp. Their Q1 was pretty much a flex, revenues reaching $46 billion, up 8% from last year, and a net income landing at $14.6 billion, driven by a 48% surge in equities trading. CEO Jamie Dimon, never one to sugarcoat, pointed to market volatility from Trump’s tariff threats as a boon for their trading desks. But he’s not blind to the clouds gathering. With a 50% chance of a global recession on his radar, Dimon’s team is bracing for impact, upping provisions for loan losses to $3.3 billion from $1.9 billion a year ago.

Still, JPM is positioned to keep winning, thanks to its sheer scale and, in my view, exciting tech bets. Some investors may not be aware, but JPM has been sinking billions into AI and digital platforms, with their UK digital bank, Chase, eyeing European expansion.

In the meantime, their 4,970+ U.S. branches and $4.1 trillion in assets under management are a fortress, giving them room to maneuver. The name comes with a catch—net interest income (NII) is under pressure. With the Fed signaling rate cuts, potentially cutting the federal funds rate to 3.9% by late 2025, their $94.5 billion NII forecast could take a hit. Still, JPM is built to withstand the storm.

Is JPMorgan a Buy, Sell, or Hold?

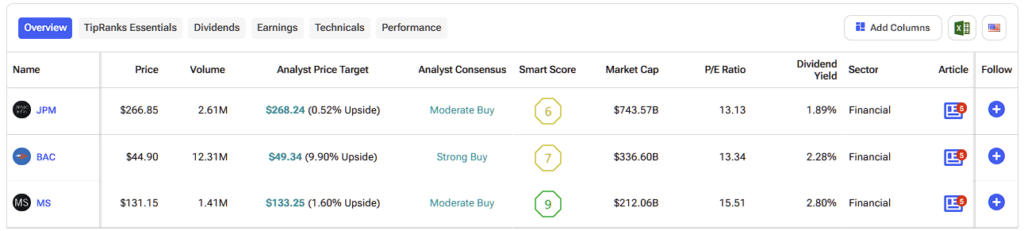

Currently, most analysts are bullish on JPM stock. The stock features a Moderate Buy consensus rating based on 12 Buy and seven Hold ratings assigned in the past three months. No analyst rates the stock a sell. JPM’s average stock price target of $268.24 implies less than 1% upside over the next twelve months. In other words, the stock could already be fully valued at today’s levels.

Bank of America (NYSE:BAC) | The Steady Eddie in a Shaky Market

Bank of America had a steady and reassuring Q1, though results were tempered by a cautious economic outlook. The company beat expectations with an EPS of 90 cents and $27.51 billion in revenue, up 5.9%, thanks to a consumer banking arm churning out $14.6 billion in NII. CEO Brian Moynihan’s voice was calm but firm on the earnings call, highlighting their “resilient” consumer spending and tight underwriting (think 2009-level discipline). Their card services and auto loans are also humming, with a 4% year-over-year rise in credit and debit card usage.

There could be a sting in the tail for BAC, however, through its exposure on Main Street. Middle-market lending and a domestic-heavy portfolio shield them from global trade chaos, and they’re projecting NII growth of 6-7% for the year, aiming for ~$15.6 billion in Q4. But the M&A slowdown is a thorn in their side. Tariff fears and market volatility are pushing dealmaking to late 2025, crimping investment banking fees. Plus, their stock is trading at a premium, 1.51x price-to-tangible book, making it less of a bargain, in my view. BAC’s playing a safe hand, but in this market, safe doesn’t mean untouchable.

Is Bank of America a Buy, Sell, or Hold?

There are 20 analysts offering price targets on BAC stock via TipRanks. Today, the stock has a Strong Buy consensus rating based on 17 Buy and three Hold ratings over the past three months. No analyst rates the stock a sell. At $49.34, BAC’s average price target implies a ~10% upside over the next twelve months.

Morgan Stanley (NYSE:MS) | Wealth Wizard in a World of Woes

Despite volatility hampering the global markets, Morgan Stanley is also doing pretty well these days. They posted $17.7 billion in revenue and a $2.60 EPS in Q1, beating estimates on the back of a 45% jump in equities trading and a wealth management business cashing in on record-highs in several key markets. CEO Edward Pick was practically beaming about their global reach, from Japan’s MUFG partnership to India and China ops. Their private credit business hit $20 billion in committed capital, a big win in a tough market.

The key behind its continued successes is MS’s wealth management unit, posting robust fee growth, up 8% to $7.3 billion, backed by $94 billion in net new assets. But the results were not flawless. Investment banking revenue fell to $1.6 billion, missing estimates due to a 22% drop in M&A advisory fees as clients balked at trade war uncertainties. Overall, I see MS as a cautiously optimistic pick for those who want to take a bet on an M&A deal volume rebound. Still, deglobalization trends, including tariffs and geopolitical tensions, could hinder Morgan Stanley’s international growth.

Is Morgan Stanley a Good Stock to Buy?

Morgan Stanley is currently covered by 15 analysts on Wall Street, who appear to be a bit more guarded with the name. MS stock carries a Moderate Buy consensus rating, based on five Buys and 10 Hold ratings over the past three months. MS’s average stock price target of $133.25 implies ~1% upside potential over the next twelve months.

Big Banks to Benefit in the Trump Era

Each of the three banking giants offers compelling strengths alongside notable risks. Overall, they present a mix of opportunity and risk, especially in light of Donald Trump’s return to the White House. His pro-business stance and expected push for deregulation bode well for the sector and are likely to form tailwinds for the big three U.S. banks.

JPMorgan is thriving on market volatility but remains exposed to the risk of interest rate cuts. Bank of America continues to leverage its strong consumer base but is feeling the chill from a slowdown in M&A activity. Meanwhile, Morgan Stanley is betting on wealth management and global diversification while navigating trade tensions that could intensify under Trump’s tougher foreign policy.

Tariffs, inflation, and geopolitics will keep testing all three, but with Trump’s administration likely to take a more bank-friendly approach, I believe these institutions—already leaders in their field—are poised to emerge as long-term winners.