Johnson & Johnson (NYSE:JNJ) is an iconic name in the healthcare and consumer goods industries. While the company’s Consumer segment has now been spun off, its Innovative Medicine (formerly referred to as Pharmaceutical) and MedTech businesses are more than capable of propelling the company to great heights. Its robust third-quarter results were proof of that. Furthermore, J&J is a regular dividend payer, demonstrating the company’s stability in the face of economic volatility. As a result, I am bullish on JNJ.

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

The Bull Case for JNJ Stock

Johnson & Johnson decided to split its Consumer segment from its business in 2021. It completed the spin-off of consumer health company Kenvue (NYSE:KVUE) in August of this year, holding a 9.5% stake in the company. The plan was to concentrate on its Innovative Medicine and MedTech businesses.

J&J may not be the same company known for brands like Benadryl, Listerine, and Band-Aid following the spin-off. However, it is still profitable and will most likely grow stronger now that it is focusing on its core businesses. This is evident from its stellar third-quarter results.

J&J’s Innovative Medicine division has been critical in the development of life-changing drugs. In the first nine months of 2023, this segment alone generated $41 billion in sales.

In the third quarter ended October 1, the Innovative Medicine segment’s sales increased by 5.1% to $13.9 billion, contributing 65% to total revenue. Stelara, J&J’s immunology drug, has been flourishing, with total sales increasing by 16.9% year-over-year to $2.8 billion in Q3. Plus, Tremfya, used for the treatment of adults with moderate-to-severe plaque psoriasis, saw a 22.2% increase in sales to $891 million in the third quarter.

In the third quarter, J&J’s oncology drugs Darzalex (used for multiple myeloma) and Erleada (used for prostate cancer) added $3.1 billion to total revenue.

In Q3, total reported sales increased by 6.8% year on year to $21.4 billion, exceeding the consensus estimate of $21.03 billion. Adjusted earnings per share (EPS) increased by 19.3% to $2.66, surpassing analysts’ expectations of $2.51.

Furthermore, J&J’s ongoing investment in research and development has resulted in significant medical advances. R&D expenses accounted for 16.2% of total sales in Q3, totaling $3.44 billion.

J&J is also working to rapidly expand its MedTech segment, which could be a significant growth driver now that the artificial intelligence market is thriving. In Q3, this segment’s sales grew by 10% year-over-year to $7.5 billion.

Plus, the company has entered the burgeoning robotic surgery market with its Ottava system. The global robotics market is expected to be worth $18.4 billion by 2027. Currently, peer Intuitive Surgical (NASDAQ:ISRG) dominates the robotic surgery space, which will be difficult to challenge. However, I believe JNJ, with its ability to innovate, will be able to establish itself in this market in the coming years.

The Challenges J&J Faces

Despite its many successes, Johnson & Johnson has faced many challenges. Legal battles, particularly regarding product liability and lawsuits, are nothing new for the company. J&J talcum powder litigation issues have continued to weigh on its stock, which is down 11% year-to-date compared to the S&P 500’s (SPX) gain of about 23%.

Its resilience and commitment to transparently dealing with these issues while upholding its values have been admirable. Despite ongoing challenges, J&J has a robust pipeline of products, plus many more are awaiting regulatory approval. With its focus now solely on its Innovative Medicine and MedTech businesses, the company is expected to keep growing.

Looking ahead, management expects full-year revenue growth of around 7.2% to 7.7%. Adjusted EPS is forecast to rise by 12.7% to 13.3%, respectively, compared to 2022.

J&J is a Dividend King

There is another reason investors have always liked J&J. The company is a Dividend King, having increased its dividends for the last 61 years, implying the stability of its business operations.

Its dividend yield is 3.02%, significantly higher than the sector average of 1.5%. Additionally, its dividend payout ratio of 44.8% ensures that dividend payments are sustainable and still leave room for growth.

Is JNJ a Buy, According to Analysts?

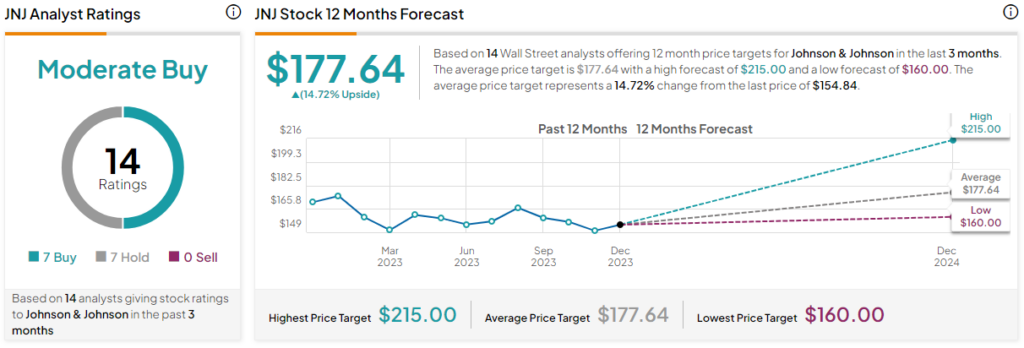

Overall, Wall Street rates JNJ stock as a Moderate Buy. Out of the 14 analysts that cover the stock, seven rate it a Buy, while seven rate it a Hold. The average JNJ stock price target is $177.64, which is 14.7% above current levels.

The Bottom Line on Johnson & Johnson

Healthcare is a defensive industry that will never run out of demand, regardless of the economic situation. With a strong pipeline already in place and more products on the way, J&J is poised for a brighter future, even without its Consumer segment.

Moving forward, J&J aims to further advance healthcare technology, expand its global reach, and contribute to a healthier, more sustainable world. With a legacy built on a century and a half of dedication, Johnson & Johnson’s story is one of resilience, innovation, and an unwavering commitment to return to shareholders. Therefore, I believe this growth and income stock is a smart pick for 2024.