Johnson & Johnson (JNJ) has been a mainstay in the healthcare sector, known for its diverse portfolio and reliable dividend payouts. Even with the legal issues surrounding its talc powder products, JNJ’s strong financial performance, innovative pipeline, and 63-year streak of dividend increases make it appealing for value and income-focused investors. For long-term investors, JNJ presents a chance to invest in a blue-chip company with a history of consistent dividend growth at a discounted price this August.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

For those reasons stated, I’m bullish on Johnson & Johnson stock.

The Numbers Behind JNJ’s Undervaluation

First, let’s examine JNJ’s valuation to better appreciate the stock. As of August 2024, JNJ is trading at $160.56, with a forward P/E ratio of 20.56, which is 33.5% lower than the sector’s average of 20.76. Additionally, JNJ’s trailing twelve-month (TTM) PEG ratio is 0.58.

Lower P/E and PEG ratios typically indicate that the stock is undervalued compared to its peers, making it an attractive option for value investors. This undervaluation presents an attractive opportunity for investors seeking a stable, dividend-paying stock with potential for capital appreciation.

Another good reason to consider JNJ is its impressive record of 63 consecutive years of dividend growth, earning the esteemed title of “Dividend King.” The current forward annual dividend rate is $4.96, yielding 3.09%. This yield is significantly higher than the S&P 500’s average, making JNJ an attractive option for income-focused investors.

JNJ’s Legal Challenges and Their Impact

We can’t overlook Johnson & Johnson’s legal issues, especially when expressing bullishness for the stock. The company has been dealing with a heap of legal troubles, primarily centered around its talc-based products. The core of the legal challenges stems from allegations that JNJ’s talc products, including its iconic baby powder, allegedly contained asbestos and caused various forms of cancer, particularly ovarian cancer and mesothelioma.

This led to tens of thousands of lawsuits against the company. As of August 2024, there are 57,782 ongoing lawsuits against the company.

In response, JNJ agreed to a $700 million settlement with 42 U.S. states, far exceeding the $400 million initially set aside. In May 2024, JNJ proposed a $6.48 billion settlement to resolve baby powder ovarian cancer lawsuits, part of a larger $8.9 billion settlement offer over 25 years. However, this proposal is still under debate among plaintiffs’ lawyers.

Financially, J&J has set aside billions for these potential settlements. It’s hitting its cash flow, but thanks to the firm’s diverse product range, it still has strong financials. However, there’s no denying that these lawsuits and the bad press have dented its image and finances.

These legal issues also weighed on JNJ’s stock price, contributing to its undervaluation. If the company can resolve these problems, it could lift a big weight off the stock, potentially boosting its price and confirming its undervalued status.

JNJ’s Financial Resilience

True, the last segment doesn’t instill much confidence in the stock. However, Johnson & Johnson (JNJ) has shown impressive financial resilience and growth, especially given its legal challenges.

In Q2 2024, J&J reported a solid performance, with sales growth of 4.3%, hitting $22.4 billion. Even better, its operational growth was 6.6%, which gives us a clearer picture of its performance without currency fluctuations affecting the results.

Also, If we exclude the COVID-19 vaccine from the equation, J&J’s adjusted operational growth jumps to 7.1%. This suggests the company’s core business segments perform strongly, even as the pandemic-related revenue streams normalize.

Breaking it down, the U.S. market saw a remarkable 7.8% increase in sales. The international markets weren’t far behind, with a 5.1% growth. This balanced performance across geographies speaks to the company’s global strength and diversified portfolio.

However, while sales grew, net earnings took a hit, decreasing by 12.8% to $4.7 billion. This decline was mainly due to one-time special charges. We see a different story when we consider adjusted earnings, which exclude these special charges and intangible amortization. Adjusted net earnings actually increased by 1.6% to $6.8 billion.

It’s also worth mentioning that J&J has made some strategic moves recently, including the acquisition of Shockwave Medical, which is expected to bolster the company’s position in the cardiovascular technology space.

What’s Ahead for Johnson & Johnson?

The future looks very positive for Johnson & Johnson, which increases my confidence in the stock. The company is well-positioned for continued growth and forecasts an annual operational growth rate of 5-7% from 2025 to 2030, driven by new assets expected to achieve $5 billion in peak annual sales.

J&J has updated its full-year 2024 guidance. It now expects an adjusted operational EPS of $10.01, compared to the previous range of $10.60 to $10.75. The company now expects adjusted operational sales growth between 5.5% and 6.0%, up from the previous guidance.

This updated outlook has been a factor in recent acquisitions like Shockwave Medical, Proteologix, and NM26 Bispecific Antibody, which should boost J&J’s market position. The company’s optimism is backed by progress in oncology, immunology, and cardiovascular health – areas poised to significantly boost revenue.

Is Johnson & Johnson Stock a Buy, According to Analysts?

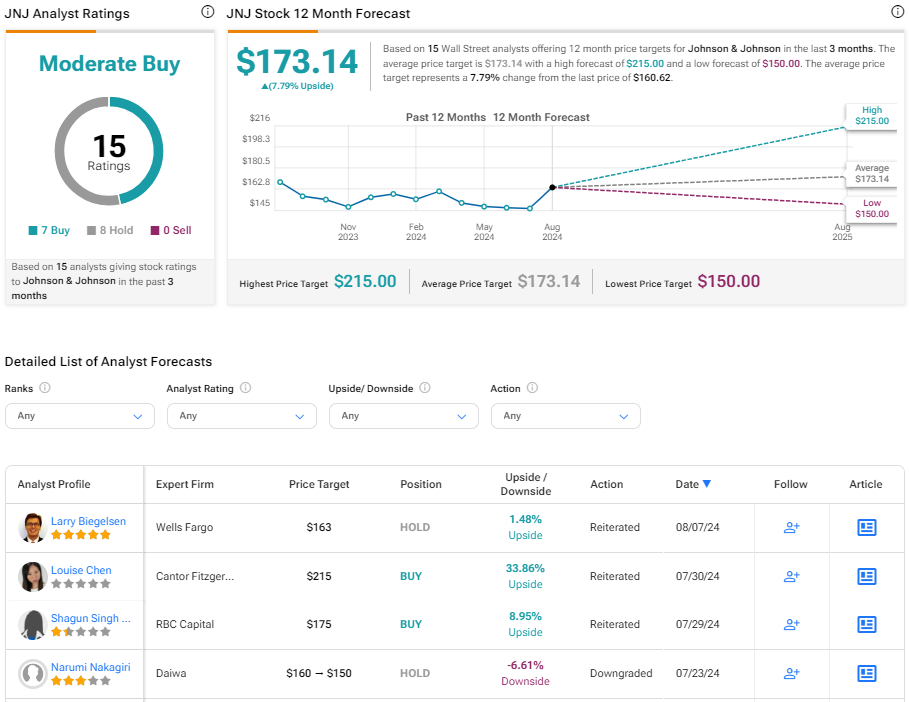

According to the latest analyst ratings, Johnson & Johnson (JNJ) stock has a consensus rating of Moderate Buy. Out of 15 analysts covering the stock, seven rate it a Buy, and eight rate it a Hold. The average 12-month price target of $173.14 implies a potential upside of around 7.79% from the current price of $158.97.

Conclusion

Johnson & Johnson looks like a solid investment opportunity right now. Although the company faces legal issues, its strong financials, diverse product lineup, and growth potential make it attractive to value and income investors.

I’m bullish on JNJ stock. Its valuation looks good, the firm has some promising new products in the pipeline, and its recent acquisitions seem smart. If you’re after a dependable Dividend King with room to grow, JNJ is worth considering this August.