Striking the right balance between gaining exposure to the growth offered by top tech stocks and gaining income through dividend stocks can be a challenge for many investors. With a portfolio full of top tech stocks and a massive 9% dividend yield, the JPMorgan Nasdaq Equity Premium Income ETF (NASDAQ:JEPQ) enables investors to achieve both of these aims through one ETF.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

I’m bullish on this popular dividend ETF from JPMorgan Chase & Co. (NYSE:JPM) based on its portfolio of highly-rated tech and growth stocks, monthly dividend payout, and above-average dividend yield. However, no investment opportunity is without risks, so there are also some caveats that we’ll discuss within this article.

What Is the JEPQ ETF’s Strategy?

Fund sponsor JPMorgan explained, “JPMorgan Nasdaq Equity Premium Income ETF seeks to deliver monthly distributable income and Nasdaq 100 exposure with less volatility.”

Essentially, this is an actively-managed fund that invests in the stocks of the Nasdaq 100 Index (NDX) and sells covered calls to produce monthly income for its holders. The ETF only launched in May 2022, but thanks to its high 9% yield and blue-chip sponsor, it has already grown to $11.6 billion in assets under management (AUM), making it one of the market’s largest actively-managed ETFs.

JEPQ is an appealing option for income investors or for growth investors looking to add some yield to their portfolios. It pays a monthly distribution, and it generates this income by owning some dividend stocks and, as mentioned earlier, selling covered calls to generate additional income.

Not only does JEPQ pay investors monthly, but its 9% yield is extremely appealing because it’s significantly higher than the average yields offered by U.S. equities (1.4%), U.S. 10-year treasury bonds (3.9%), global REITs (4.3%), and even U.S. high-yield bonds (7.6%).

This is a great ETF for earning significant monthly income. However, there’s no such thing as a “free lunch,” and anything that sounds this good usually comes with some type of tradeoff.

The tradeoff for this high monthly payout is that an ETF like JEPQ inevitably leaves some potential total return on the table as selling covered calls caps some of the upside from the price appreciation of its holdings because if the price of the underlying stock rises beyond the strike price of the option, JEPQ investors won’t benefit from the additional gains.

You can see this for yourself. For example, JEPQ owns most of the same mega-cap tech stocks that dominate the Nasdaq. JEPQ posted a very nice total return of 36.2% in 2023, while the Invesco QQQ Trust (NASDAQ:QQQ), which is meant to track the Nasdaq 100, generated a much higher 54.9% simply by holding the Nasdaq’s top stocks.

As you can see, an investor in JEPQ actually trailed the total return of the Nasdaq by a significant margin, even when accounting for the significant dividend income they received from JEPQ.

As long as investors understand this tradeoff and are comfortable with potentially forgoing higher total returns in exchange for a steady stream of monthly income, then JEPQ is worth a spot in a balanced portfolio.

It should also be noted that according to its prospectus, JEPQ can invest up to 20% of its assets into equity-linked notes (ELNs). According to the prospectus, these are “derivative instruments that are specifically designed to combine the economic characteristics of the S&P 500 Index (SPX) and written call options in a single note form and are not traded on an exchange.” As you’ll see in the holdings section below, these ELNs currently make up 14.6% of JEPQ’s portfolio.

One additional note for potential investors to be aware of is that JEPQ’s payouts can vary from month to month and aren’t set in stone, but they are usually within a similar range. For example, looking at the ETF’s dividend history on TipRanks, JEPQ paid a dividend of $0.39 in January. The payout fell to $0.34 in February but rebounded to $0.38 in March.

Experience Counts

Another appealing aspect of JEPQ is that while this is a complex, active strategy, it has an experienced team running it. Lead portfolio manager Hamilton Reiner has over 30 years of experience investing in equities and equity derivatives (and 37 years in the investment industry), and he is joined by two other seasoned managers.

Note that Reiner is the same portfolio manager who runs the JPMorgan Equity Premium Income ETF (NYSEARCA:JEPI), a similar ETF that yields 7.6% and is extremely popular with dividend investors.

JEPQ’s Top Holdings

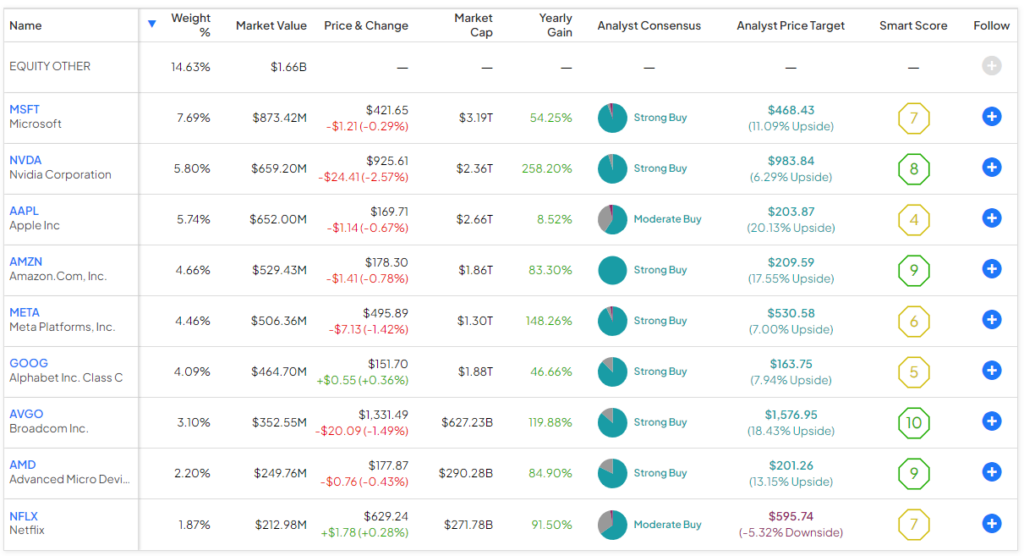

JEPQ holds 88 positions, and its top 10 holdings account for 53.9% of the fund. Below is an overview of JEPQ’s top 10 holdings using TipRanks’ holdings tool.

As you can see, unlike many dividend ETFs that achieve high yields by investing in high-yield stocks with little to no growth, JEPQ gives investors exposure to the mega-cap tech powerhouses like Microsoft (NASDAQ:MSFT), Nvidia (NASDAQ:NVDA), Amazon (NASDAQ:AMZN), Meta Platforms (NASDAQ:META), and Broadcom (NASDAQ:AVGO) that are leading the stock market higher.

Beyond tech stocks, JEPQ also holds positions in other prominent Nasdaq stocks, like Pepsi (NASDAQ:PEP), Costco (NASDAQ:COST), and Mondelez (NASDAQ:MDLZ), which are all dividend payers.

Note that, as discussed above, the ELNs are currently JEPQ’s largest position at 14.6%, and the fund can invest up to 20% of its assets in these instruments.

What Is JEPQ’s Expense Ratio?

JEPQ features an expense ratio of 0.35%. This means that an investor in the fund will pay $35 in fees on a $10,000 investment annually. While this isn’t as cheap as some of the broad-market index funds out there, it seems reasonable enough for an active ETF with a fairly complex strategy. It’s also significantly cheaper than the average expense ratio for all ETFs, which is 0.57%.

Is JEPQ Stock a Buy, According to Analysts?

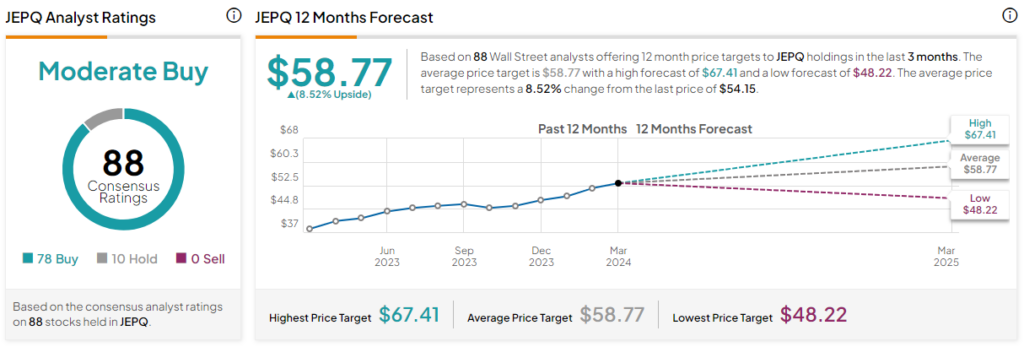

Turning to Wall Street, JEPQ earns a Moderate Buy consensus rating based on 78 Buys, 10 Holds, and zero Sell ratings assigned in the past three months. The average JEPQ stock price target of $58.77 implies 8.5% upside potential.

A Steady Stream of Dividend Income

For investors who are alright with potentially leaving some upside on the table in terms of capital appreciation in a bull market, JEPQ is a great way to add substantial monthly income to a portfolio.

I also like the fact that JEPQ gives investors this 9% yield while giving them exposure to compelling tech and growth stocks rather than no- or low-growth stocks like many high-yield ETFs. I’m bullish on JEPQ based on its strong portfolio of top tech stocks, its 9% dividend yield, and its monthly payout schedule.