If there’s one area of the market that billionaire Microsoft (NASDAQ:MSFT) founder Bill Gates knows inside and out, it’s the technology sector. So, it caught my eye when Gates added a new tech ETF to the Trust’s portfolio, according to the 13F filings that just came out. According to the filing, the Bill and Melinda Gates Foundation Trust purchased the iShares U.S. Technology ETF (NYSEARCA:IYW) during the third quarter.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

I’m bullish on IYW based on its compelling track record of long-term performance and its comprehensive portfolio of top U.S. tech companies.

Bill Gates, The Investor

Bill Gates is best known as the founder of Microsoft. He is also one of the richest people in the world. Bloomberg estimates that Gates has a net worth of over $130 billion.

What’s less known is the fact that Gates is also an avid investor through the Bill and Melinda Gates Foundation Trust, which has a portfolio value of approximately $38 billion.

Gates has a close relationship with Warren Buffett, who is widely acknowledged as one of the greatest investors of all time, if not the greatest, so Gates has learned from the best. Warren Buffett is a trustee for the Foundation, and the two frequently play “bridge” (a card game) together to stay sharp. Furthermore, about 20% of the Bill and Melinda Gates Foundation’s portfolio is invested in Buffett’s Berkshire Hathaway (NYSE:BRK.B).

Thanks to 13F filings, we get a snapshot of what investors like Gates are doing with their portfolios once a quarter. Institutional investors with over $100 million in assets under management must file a 13F within 45 days of the end of the previous quarter. Many investors look forward to the release of these 13Fs, as they provide some insight into what moves the “smart money” is making.

In its most recent 13F, we can see that Gates added a bevy of new tech stocks to the portfolio, including Apple (NASDAQ:AAPL), Amazon (NASDAQ:AMZN), and Adobe (NASDAQ:ADBE), as well as the iShares U.S. Technology ETF. To be clear, this isn’t a huge position for Gates. According to the filing, he owns about $6 million worth.

But its inclusion is notable, nevertheless, as it is one of the few ETFs Gates owns, and he clearly has his finger on the pulse of the tech sector. Therefore, let’s take a closer look at this tech-oriented ETF that caught Gates’ eye.

What is the IYW ETF’s Strategy?

iShares says that IYW “seeks to track the investment results of an index composed of U.S. equities in the technology sector.” It gives investors “exposure to U.S. electronics, computer software and hardware, and informational technology companies.”

The fund was launched in 2000 and now has $12.6 billion in assets under management.

IYW’s Portfolio

IYW’s portfolio is a comprehensive collection of the U.S.’s top technology companies. Altogether, the ETF owns 134 stocks, and its top 10 holdings make up 64.2% of the fund. Below, you can check out an overview of IYW’s top 10 holdings using TipRanks’ holdings tool.

The list of holdings reads like a roll call of the U.S.’s best and brightest tech companies. Apple is the fund’s largest holding, followed by Microsoft, which Gates should know well. Other top holdings unsurprisingly include additional FAANG names like Meta Platforms (NASDAQ:META) and Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL), as well as leading semiconductor names like Nvidia (NASDAQ:NVDA), Advanced Micro Devices (NASDAQ:AMD), and Broadcom (NASDAQ:AVGO).

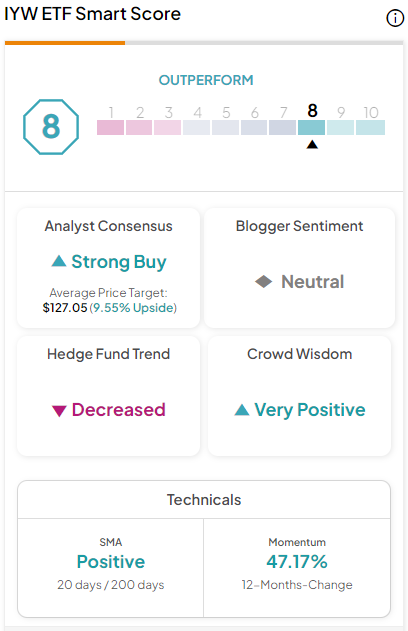

Collectively, IYW’s top holdings feature an impressive collection of Smart Scores. The Smart Score is a proprietary quantitative stock scoring system created by TipRanks. It gives stocks a score from 1 to 10 based on eight market key factors. A score of 8 or above is equivalent to an Outperform rating. Impressively, each and every one of IYW’s top 10 holdings features an Outperform-equivalent Smart Score of 8 or above.

Alphabet, Nvidia, Meta Platforms, and Advanced Micro Devices, and Broadcom all boast ‘Perfect 10’ Smart Scores. IYW itself features an Outperform-equivalent ETF Smart Score of 8.

Long-Term Excellence

In addition to this strong portfolio, IYW has been a great performer for a long time. IYW is up an incredible 49.5% over the past year as tech stocks have surged. Over the past three years, it has returned a very respectable 12.8% on an annualized basis (as of October 31).

Looking further out, IYW’s returns are excellent. Over the past five years, it has provided investors with an annualized return of 19.2%, and over the past decade, it has returned 18.6% on an annualized basis.

Looking at it another way, on a cumulative basis, an investor who put $10,000 into IYW 10 years ago would have nearly $46,000 today.

Expense Ratio

IYW’s expense ratio of 0.40% isn’t great, but it’s not exorbitant either. An investor putting $10,000 into the fund would pay $40 in fees during year one. Assuming that the expense ratio remains at 0.40% and that the fund returns 5% per year going forward, this investor would pay $505 in fees over the course of a 10-year investment in the fund.

On the one hand, there are plenty of tech-centric ETFs, such as the various ARK ETFs, that charge much more than this. But on the other hand, there are other large tech ETFs, such as the Invesco QQQ Trust (NASDAQ:QQQ) and the Technology Select Sector SPDR Fund (NYSEARCA:XLK), with cheaper expense ratios.

Is IYW Stock a Buy, According to Analysts?

Turning to Wall Street, IYW earns a Moderate Buy consensus rating based on 112 Buys, 23 Holds, and zero Sell ratings assigned in the past three months. The average IYW stock price target of $126.16 implies 9.55% upside potential.

Gates Could be on to Something

We don’t know exactly why Gates added IYW to his portfolio during the past quarter. However, the ETF’s highly-rated portfolio of top U.S. technology stocks and its stellar long-term track record are good reasons to consider investing in it.

Gates certainly has a good overview of what is going on in the U.S. tech sector, and he clearly feels that there is still plenty of opportunity in these types of stocks. This ETF is a convenient and effective way to invest in all of them. The only downside of IYW is that its expense ratio is a bit higher than some of its peers. Nevertheless, with the type of long-term performance it has put up, it’s unlikely that many investors are complaining about the 0.40% expense ratio.