Up 34.1% over the past year, the iShares Russell 1000 Growth ETF (NYSEARCA:IWF) is no stranger to strong performance. In fact, it’s a long-term winner that has outperformed the broader market over the past five and 10 years.

TipRanks Cyber Monday Sale

- Claim 60% off TipRanks Premium for data-backed insights and research tools you need to invest with confidence.

- Subscribe to TipRanks' Smart Investor Picks and see our data in action through our high-performing model portfolio - now also 60% off

I’m bullish on this popular ETF from BlackRock’s (NYSE:BLK) iShares based on its successful long-term track record, diversified portfolio of highly-rated growth stocks, and low fees. Furthermore, sell-side analysts assign IWF a Strong Buy rating, giving me additional confidence in the fund.

What Is the IWF ETF’s Strategy?

IWF launched in 2000 and has accumulated $91.5 million in assets under management (AUM) over the years, making it the 12th-largest ETF in today’s market by this measure. The major ETF also enjoys plenty of liquidity, with an average daily volume of over 1.23 million in the last three months.

According to iShares, IWF “seeks to track the investment results of an index composed of large- and mid-capitalization U.S. equities that exhibit growth characteristics.” The fund gives investors “exposure to U.S. companies whose earnings are expected to grow at an above-average rate relative to the market.”

While there’s perhaps nothing particularly complex or exotic about this simple strategy, it has been working well for the fund and its holders, as we’ll discuss in the next section.

Strong Track Record

As discussed above, IWF is up 34.1% over the past year, but this strong performance is nothing new. In fact, a large part of IWF’s appeal is that it has beaten the broader market over the past decade.

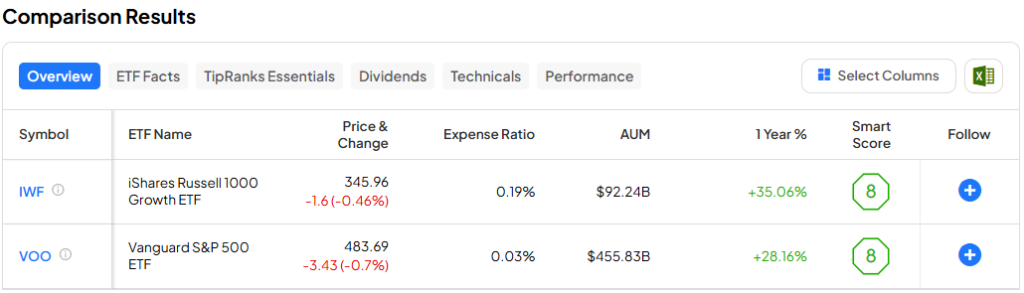

Using the Vanguard S&P 500 ETF (NYSEARCA:VOO) as a proxy for the broader market, IWF’s three-year annualized return of 8.3% (as of April 30) narrowly beats VOO’s three-year annualized return of 8.0% (as of the same date), but not by a particularly meaningful amount.

However, looking out over a longer time frame, the outperformance becomes more significant. As of April 30, IWF generated an excellent five-year annualized return of 16.3%, beating VOO’s annualized five-year return of 13.2% as of the same date.

Looking at the past decade, IWF has generated an excellent 10-year annualized return of 15.3% (as of April 30), again beating VOO’s return of 12.4% over the same time period.

It’s also useful to evaluate these returns from a cumulative perspective. Based on the same dates and parameters discussed above, If an investor had invested $100,000 in VOO 10 years ago, they would have $220,900 today, a return they’d likely be very pleased with. But if they put $100,000 into IWF a decade ago, they would have an incredible sum of $314,220 today, illustrating the big impact a difference of a few percentage points in annualized returns can make over a long enough time horizon.

Below, you can check out a comparison of IWF and VOO using TipRanks’ ETF Comparison Tool, which enables investors to compare up to 20 ETFs at a time using a wide variety of customizable factors and inputs.

Portfolio of Powerhouse Growth Stocks

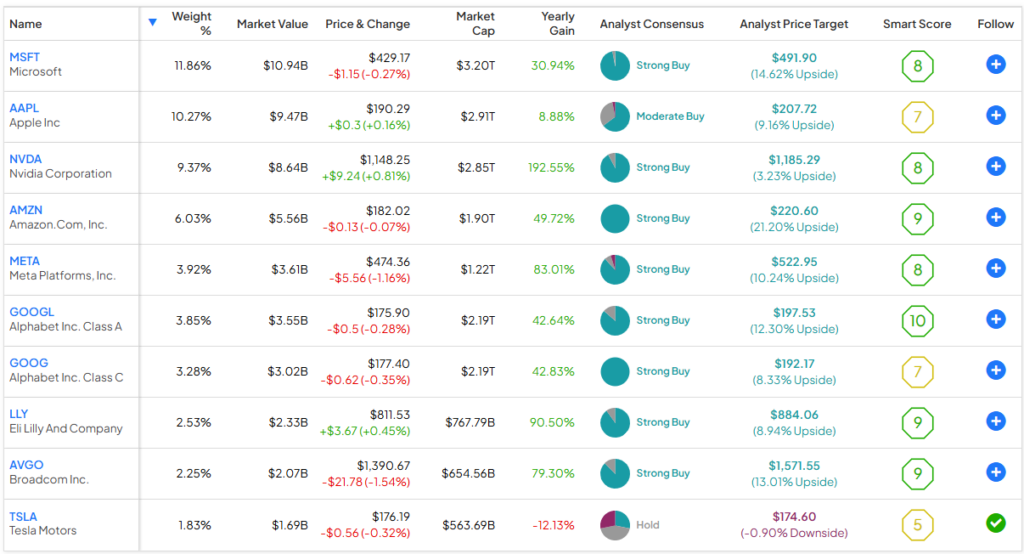

IWF holds 441 stocks, and its top 10 holdings account for 55.2% of assets. Below, you’ll find an overview of IWF’s top 10 holdings using TipRanks’ holdings tool.

As you can see, IWF’s top holdings consist largely of the long-term winners that have driven the market higher over the past decade. This includes powerhouse growth stocks like Microsoft (NASDAQ:MSFT), Apple (NASDAQ:AAPL), Nvidia (NASDAQ:NVDA), Amazon (NASDAQ:AMZN), Meta Platforms (NASDAQ:META), and Alphabet (NASDAQ:GOOGL) (NASDAQ:GOOG).

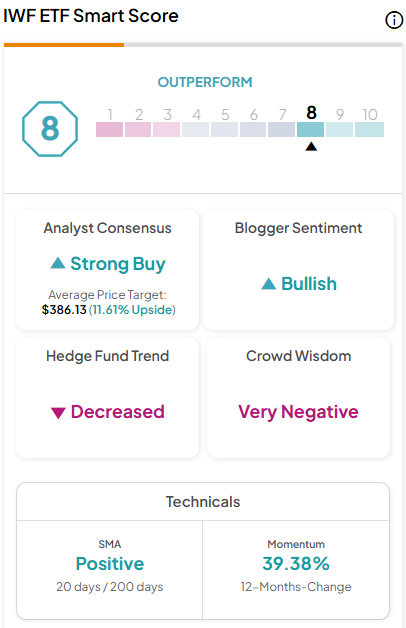

These top holdings feature a strong group of Smart Scores. The Smart Score is a proprietary quantitative stock scoring system created by TipRanks. The score is data-driven and does not involve any human intervention. Six of the eight market factors that are incorporated into the Smart Score calculation are unique to TipRanks. The system gives stocks a score from 1 to 10 based on eight key market factors, a score of 8 or above is equivalent to an Outperform rating.

An impressive seven out of IWF’s top 10 holdings have Outperform-equivalent Smart Scores of 8 or higher. IWF itself features an Outperform-equivalent ETF Smart Score of 8 out of 10.

Fair Expense Ratio. Low But Consistent Dividend

IWF charges a reasonable expense ratio of just 0.19%. This means that an investor putting $10,000 into the fund will pay just $19 in fees on an annual basis. Assuming that the fund returns 5% per year going forward and maintains its current expense ratio, this same investor will pay just $243 in fees over a 10-year time horizon.

While this 0.19% expense ratio is a bit higher than the fees investors pay for some of the largest index funds, IWF has performed well, and this expense ratio is still just one-third the average expense ratio for all ETFs (0.57%).

It should also be mentioned that IWF is a dividend payer and has made dividend payments for 22 consecutive years. While there’s something to be said for that level of consistency, the ETF’s current yield is only 0.6%, so it’s not a major part of its allure as an investment opportunity.

Is IWF Stock a Buy, According to Analysts?

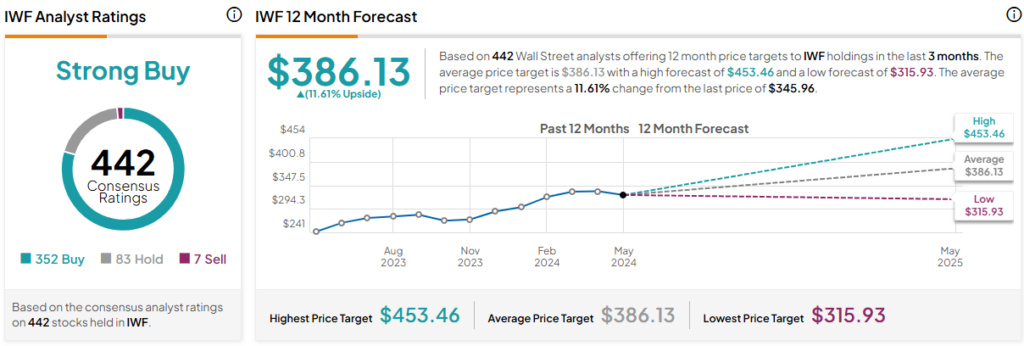

Turning to Wall Street, IWF earns a Moderate Buy consensus rating based on 352 Buys, 83 Holds, and seven Sell ratings assigned in the past three months. The average IWF stock price target of $386.13 implies 11.6% upside potential.

The Takeaway: Stay with This Long-Term Winner

You’re likely familiar with the old adage, “If it ain’t broke, don’t fix it.” This advice can apply to investing as well. While the fund isn’t necessarily employing any complex strategy or finding obscure diamonds in the rough, it has generated an impressive annualized return of 15.3% over the past decade, beating the broader market in the process.

I’m bullish on this long-term winner based on the strong track record of returns it has generated over the years, its diversified portfolio of powerhouse growth stocks, and its reasonable expense ratio. Additionally, a Strong Buy consensus rating from Wall Street analysts adds to IWF’s bull case.

While it’s always important to remember that past performance is no guarantee of future results, IWF’s track record gives me confidence that this ETF should continue to perform well for holders over the long term.