In life, bills are inevitable, and as expenses rise with economic growth, purchasing power can decline unless income keeps pace. To address this, I’ve focused on dividend growth investing, turning to stocks like NextEra Energy. Although I am not yet financially independent, buying proven businesses with cultures geared toward rewarding shareholders has helped my organic income growth exceed inflation.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The Dividend Aristocrat utility, NextEra Energy (NEE), is one such holding in my dividend growth stock portfolio that is powering my income growth. A Dividend Aristocrat is a company that has consistently increased its dividend payout for 25 consecutive years or more. As a utility company, NextEra Energy operates in the energy sector, providing essential services like electricity and natural gas, which tend to generate steady cash flow. This stability makes it a strong candidate for dividend growth investing.

After reviewing the company’s third-quarter earnings report, I remain bullish. Please allow me to unpack why.

NEE Demonstrates a Solid Showing in Q3

While NextEra Energy’s third-quarter financial results shared on October 23rd were mixed, the results were enough for me to maintain my upbeat outlook. The company’s total revenue increased by 5.5% year-over-year to $7.6 billion in the quarter, which came in $500 million less than the analyst consensus. This was largely due to temporary disruptions from Hurricanes Helene and Milton and lower fuel costs impacting how much NextEra Energy could bill customers as a regulated utility.

The company’s adjusted diluted EPS rose by 9.6% over the year-ago period to $1.03 during the third quarter. Put into perspective, that topped the analyst consensus for the quarter by $0.05. Lower fuel costs and operational efficiency helped NextEra Energy’s non-GAAP net profit margin expand by 130 basis points to 28.1% in the quarter.

NextEra Energy Leverages Florida Growth for Continued Expansion

Beyond just its recent results, another reason that I like NextEra Energy is that it has tailwinds on its side to fuel more growth. Florida’s population growth in recent decades appears poised to keep up for the foreseeable future as more Americans are drawn to the state for various reasons, including the climate and vibrant economy. It’s being projected that between 2024 and 2029, the state’s population is going to expand by approximately two million people to reach nearly 25 million.

The continued net migration into Florida is driving substantial investment from NextEra Energy into expanding and modernizing its infrastructure to accommodate a growing customer base. Over the current four year settlement agreement, its FPL subsidiary is expected to exceed $34 billion in capital investments. This can drive the high-single-digit annual rate base growth needed to push adjusted diluted EPS higher.

That’s why the analyst consensus is that NextEra Energy’s adjusted diluted EPS will rise by 7.7% in 2024 to $3.42. Another 7.9% growth in adjusted diluted EPS to $3.68 is anticipated for 2025. In 2026, adjusted diluted EPS is predicted to rise by an additional 8.4% to $3.99. For what it’s worth, these estimates are in line with NextEra Energy’s financial expectations for 6% to 8% annual growth off its 2024 adjusted diluted EPS range of $3.23 to $3.43.

NextEra Energy Is a Consistent Dividend Grower

Another facet to my bullish sentiment toward NextEra Energy is its market-beating and reliably growing dividend. The company’s 2.8% dividend yield registers at double the S&P 500 index’s (SPX) 1.3% yield. NextEra Energy’s dividend payout ratio is poised to be in the low 60% range in 2024, which supports the company’s commitment to handing out at roughly 10% annual dividend raises through at least 2026. That is arguably an excellent combination of starting income and growth potential to extend the company’s 30-year dividend growth streak.

NextEra Energy’s Balance Sheet Is Sound

NextEra Energy also has the financial means to fund its growth plans. That is because the company has access to low cost debt via its A- credit rating from S&P Global (SPGI) on a stable outlook. That allows it to invest in projects at an attractive spread with what it’s authorized to earn from regulators versus its cost of capital. NextEra Energy’s FFO/debt ratio is projected to be above 18% in 2024. For more color, this is firmly within the 13% to 23% range that S&P wants to see to maintain its corporate credit rating. Additionally, NextEra Energy’s debt-to-capital ratio of approximately 50% is further confirmation that the company is well-capitalized for a regulated utility.

NEE Stock Appears to Be Discounted

NextEra Energy’s stock looks to offer tangible value from the current share price, which is another reason I like it. The current year P/E ratio of 21.8 and forward P/E ratio of 20.2 are each below the 10-year average of 23.8. NextEra Energy’s growth prospects in the high single-digits also seem to underscore the argument that its growth remains solid. As interest rates slowly come back down, I believe this provides a clear catalyst for shares to rally back to a multiple of 23 or 24.

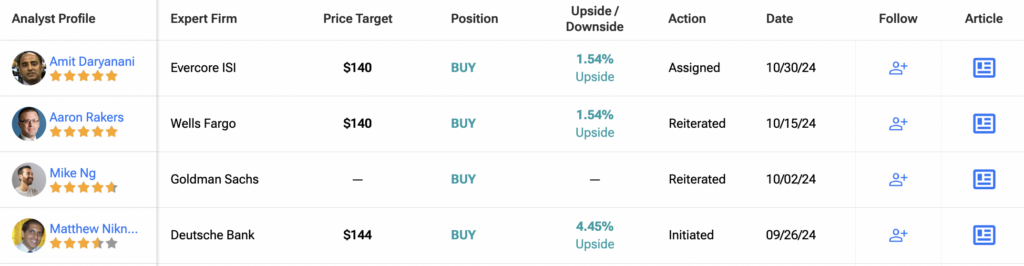

Is NextEra Energy a Buy, According to Analysts?

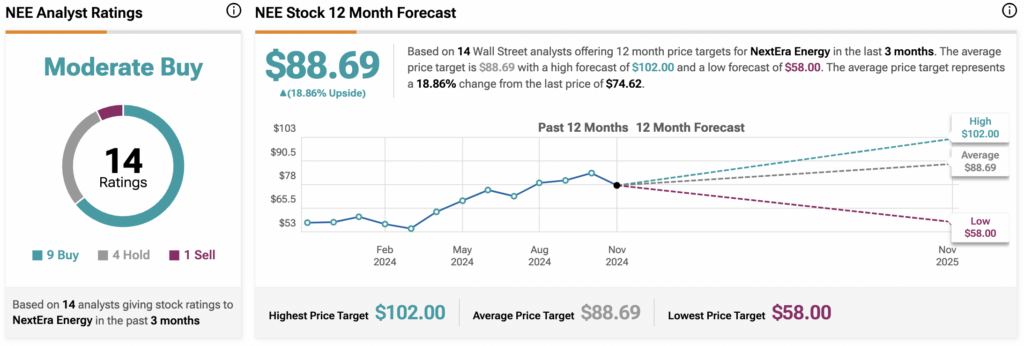

Shifting to Wall Street, analysts have a Moderate Buy rating consensus on NextEra Energy. Among 14 analysts, nine have assigned a Buy rating in the past three months, four have a Hold Rating, and one has a Sell rating. The average 12-month NEE price target of $88.69 implies an 18.9% upside potential.

Key Takeaway

NextEra Energy is a business that I’m glad to own in my portfolio. Demographic trends in Florida and capital spending plans should mean that the utility has a lengthy growth runway. NextEra Energy’s investment-grade balance sheet bolsters the company’s spending ambitions. The track record of three decades of dividend growth offers proof that it is a very shareholder-oriented company. NextEra Energy’s valuation is the final piece of the puzzle of why I’m starting coverage with a buy rating.