While the rise of direct-to-consumer (DTC) services from traditional pay-TV operators like Comcast has given rise to the idea that more viewers could be cutting the cord on pay-TV and switching to over-the-top (OTT) services, data from Nielsen seems to suggest otherwise.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

According to Nielsen data, streaming represents just 27% of television screen time in the U.S., while linear television represents 63%.

Using the TipRanks stock comparison tool, let us look at whether Netflix, the pure-play streaming service, is facing stiff competition from other DTC services launched by The Walt Disney Company (DIS), Comcast (CMCSA) and ViacomCBS (VIAC).

While this author is bullish on Netflix, she is neutral regarding the other stocks featured in this article.

Netflix (NFLX)

It seems that users are not warming up to Netflix as rapidly as they previously had. Earlier this month, Evercore ISI analyst Vijay Jayant noted that the Monthly Active Users (MAU) data for NFLX indicated a fall of 5% year-over-year for the month of July.

The analyst also said that the app downloads for the company declined 22% year-over-year in July, on a global basis. Jayant said in a research note to investors, “While NFLX has passed the toughest y-o-y COVID-19 comparable period, we think the focus will shift to how engagement and subscriber additions perform as the world re-opens over the coming months.”

“Additionally, as we have pointed out in the prior reports, NFLX’s domestic download market share vs. other SVOD services has been challenged following the rollout of HBO Max,” the analyst added.

In contrast, according to the analyst, Disney’s DTC service, Disney+ has seen the download of its app jump 124% year-over-year in July.

In Q3, NFLX expects global paid memberships of 212.68 million, a rise of 9% year-over-year.

Netflix ended the second quarter with 209 million paid memberships, with global net additions of 1.54 million paid members. The company said in its letter to shareholders, “COVID has created some lumpiness in our membership growth (higher growth in 2020, slower growth this year), which is working its way through.” (See Netflix stock chart on TipRanks)

However, Rosenblatt Securities analyst Mark Zgutowicz didn’t seem to be buying into the pandemic “lumpiness” theory. The analyst was of the opinion that a slew of subscription video on demand (SVOD) and advertising video-on-demand (AVOD) offerings “are weighing heavier on Netflix’s sub acquisition woes vs. content and/or pandemic compares.”

The analyst noted that NFLX’s guidance of 3.5 million net additions in Q3 “does not suggest content will cure its sub acquisition woes.” Furthermore, Zgutowicz is concerned about Netflix’s competition. He noted that the array of streaming choices available “are simply enough to create pause Netflix sub starts and restarts. And while the majority of these offerings cost less than Netflix, management is prudently looking to offer more with gaming to sustain its annual pricing trajectory.”

The analyst is sidelined with a Hold rating and a price target of $450 (17.7% downside) on the stock.

Turning to the rest of the Street, consensus is that Netflix is a Moderate Buy, based on 20 Buys, 7 Holds, and 3 Sells. The average Netflix price target of $602.23 implies an approximately 10.1% upside potential from current levels.

The Walt Disney Company (DIS)

In Q3, Disney’s direct-to-consumer (DTC) services made up 25.3% of Disney’s total revenues of $17 billion, with revenues of $4.3 billion.

Disney’s CEO, Bob Chapek said, “…our direct-to-consumer business is performing very well, with a total of nearly 174 million subscriptions across Disney+, ESPN+ and Hulu at the end of the quarter, and a host of new content coming to the platforms.”

At the end of Q3, Disney+ had subscribers of 116 million, a more than 100% growth year-over-year, while Hulu subscribers stood at 42.8 million, up 21% year-over-year. However, average monthly revenue per paid subscriber at Disney fell 10% year-over-year to $4.16. (See Disney stock chart on TipRanks)

According to Wells Fargo analyst Steven Cahall, the jump in Disney+ subscribers most likely “came from Disney+hotstar, which is now nearly 40% of subs, expectations were nonetheless modest so the +12mm quarterly net adds proved yet again that Disney’s growth has fewer impediments.”

Furthermore, the analyst noted, “Disney+ subs came in ahead of expectations (again) for a pretty strong beat in what was supposed to be a wash quarter (again). The momentum of DTC seems undaunted.”

Indeed, the company’s management noted on its earnings call that the DTC “business is the company’s top priority.”

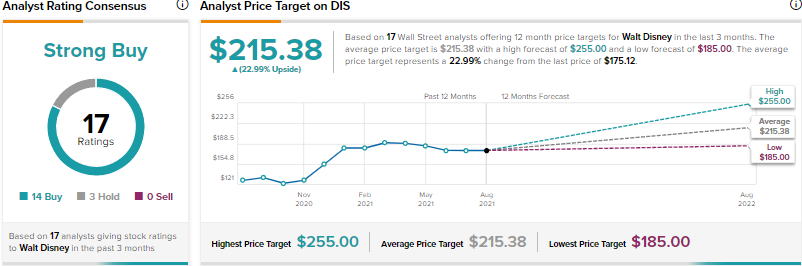

Positively impressed with Disney’s performance, Cahall reiterated a Buy rating on Disney following the Q3 results, but raised the price target from $209 to $216 (23.3% upside) on the stock.

Turning to the rest of the Street, analysts are bullish on the stock, with 14 Buys and 3 Holds. The average Disney price target of $215.38 implies 23% upside potential from current levels.

Comcast (CMCSA)

In Q2, Comcast reported revenues of $28.55 billion, up 20.4% year-over-year. The company’s streaming service, Peacock, contributed $122 million in revenues to Comcast’s NBCUniversal’s Media segment, and this segment reported an adjusted EBITDA loss of $363 million related to Peacock.

As of July 29, the company stated on its earnings call that Peacock had “54 million sign-ups and over 20 million monthly active accounts.” (See Comcast stock chart on TipRanks)

According to Raymond James analyst Frank G. Louthan, the Tokyo Summer Olympics could alone bring in “~10M incremental “paying subs” onto Peacock, altogether amounting to ~$222M worth of Peacock-generated revenue during 3Q21… and we are raising our 3Q21 NBCU media estimate, accordingly.” That’s because Peacock featured five new channels which were dedicated to the Olympics, which included live coverage and Olympic-related features.

Following the Q2 results, the analyst reiterated a Buy and a price target of $65 (9.4% upside) on the stock.

Last week, the company partnered with ViacomCBS (VIAC) for the launch of SkyShowtime, a new SVOD service, in over 20 territories in Europe. The companies will jointly control and equally invest in the partnership, which will be structured as a joint venture. Comcast’s expansion into Europe could sharply improve its revenues.

Turning to the rest of the Street, consensus is that Comcast is a Moderate Buy, based on 12 Buys, 2 Holds, and 1 Sell. The average Comcast price target of $66.64 implies an approximately 12.2% upside potential from current levels.

ViacomCBS (VIAC)

Streaming has also fueled the rise in revenues for ViacomCBS in Q2. The company posted revenues of $6.56 billion, up 8% year-over-year, while global streaming revenue jumped 92% year-over-year to $983 million.

Furthermore, the company added 6.5 million streaming subscribers globally in Q2 to reach 42 million subscribers. VIAC’s streaming subscription revenues rose 82% year-over-year to $481 million in Q2. (See ViacomCBS stock chart on TipRanks)

Following the Q2 results, Goldman Sachs analyst Brett Feldman was pleasantly surprised to see that “VIAC is showing much more durable momentum with its flagship streaming service (Paramount+) than we had expected.”

The analyst pointed out that the company’s streaming service generated more net additions in Q2 “than its launch quarter in 1Q (6.0mn), it did this during a period when most other streaming services showed material deceleration.”

Analyst Feldman ascribed upside potential to the streaming subscriber and revenue estimates, on the basis of VIAC’s “upcoming market launches, robust slate of content and new distribution agreement with Sky.”

Reflecting his upbeat approach to the stock, the analyst reiterated a Buy and a price target of $75 (88.8% upside) on the stock.

Turning to the rest of the Street, consensus is that ViacomCBS is a Strong Buy, based on 6 Buys and 2 Holds. The average ViacomCBS price target of $62.75 implies an approximately 58% upside potential from current levels.

Bottom Line

On its earnings call, NFLX’s management acknowledged the competition it is facing from other OTT services, but said that it is concentrating on adding more value to its service. It is doing this by making a foray into gaming, as indicated by the recruitment of Mike Verdu as VP of game development last month.

The company has also established a foothold in the e-commerce space by launching its first owned-and-operated online retail outlet, Netflix.shop, to sell products directly to consumers.

While Netflix is facing the heat from its competitors, it also seems that the company is trying to add more value to its service through video gaming and its online retail outlet, and in that way extending its original programming franchises. With those strategic moves, Netflix stands a good chance of beating its competition.

Disclosure: Shrilekha Pethe held no position in any of the stocks mentioned in this article at the time of publication.

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities.