Pharmaceutical company Moderna (MRNA) has seen its stock slump in recent months. The share price peaked at $150 in early summer before collapsing. However, I’m uncertain as to whether there’s a buying opportunity with the stock at current levels. While Moderna has an interesting pipeline of prescription drugs, it also has limited sales, making investing in the company a risky proposition. As such, I’m Neutral on MRNA stock.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

Why has MRNA Stock Slumped?

Moderna’s declining share price has been driven by a combination of factors, which make me Neutral on the stock. The primary catalyst for the current downturn has been the sharp decrease in demand for Covid-19 vaccines as the pandemic recedes. This decline has been compounded by a broader slump in vaccine demand.

The shift has led Moderna to lower its full-year sales forecast by as much as 25%, signaling weaker-than-expected performance. Additionally, the company faces increasing competition in the respiratory vaccine market from rivals such as Pfizer (PFE).

Moderna has also announced substantial cost-cutting measures, including cuts to its research and development (R&D) spending, which has raised concerns about its future growth. Investors are also wary of the company’s timeline to achieve profitability, which has been pushed out to 2028.

Is Moderna Right to Cut Costs?

Another reason I’m Neutral on MRNA stock is the company’s decision to implement significant cost-cutting measures, including a $1.1 billion reduction by 2027. This raises questions about the timing and potential consequences of such cuts. The company plans to slash its R&D expenses and has already initiated manufacturing layoffs.

While these cuts aim to address financial pressures stemming from declining Covid-19 vaccine revenues and R&D overspend, they come at a critical time for the company. The plan to drop five programs, including one vaccine designed to prevent endemic human coronaviruses, raises questions about the company’s long-term potential.

These cuts also come despite strong projections for the vaccine sector as a whole. According to forecasts, the adult vaccine market is set to grow at a 6.4% compound annual growth rate (CAGR) and reach $35.87 billion by 2032. Moderna’s choice to cut certain R&D projects could weaken its competitive position. Only time will tell if the cost-cutting strategy bears fruit, potentially giving the company a longer runway. Currently, Moderna’s net cash position is decreasing by $1.4 billion per quarter.

Moderna’s Pipeline

Although I’m personally Neutral on MRNA stock, I do acknowledge that the company’s pipeline holds promise across multiple therapeutic areas. The company’s mRNA technology continues to demonstrate potential beyond Covid-19 vaccines, and the company’s pipeline is sizable. For example, Moderna is advancing its RSV vaccine (mResvia), which has been approved for adults 60 and older in the U.S. and Europe. With a potential market of $12 billion, mResvia could become a blockbuster medication.

Moderna’s oncology program is particularly promising, with its personalized cancer vaccine showing encouraging results in trials. The company is expanding this drug to a number of cancer types, including kidney, bladder, and lung. This is an area of significant growth potential.

The expansive pipeline also includes treatments in rare diseases such as methylmalonic and propionic acidemia, which could address unmet medical needs. The company’s cytomegalovirus vaccine, currently in Phase 3 trials, targets a $2 billion to $5 billion global market.

Moderna’s Earnings and Valuation

While Moderna’s pipeline of potentially new medications is impressive, the current earnings trajectory isn’t encouraging, which is another reason I’m Neutral on this stock. The company is set to continue reporting financial losses through 2028, when it’s forecasted to register earnings per share (EPS) of $2.13 — inferring a forward price-to-earnings (P/E) ratio of 26.

The projected P/E ratio falls to 6.5 times in 2029, but it’s worth noting that there aren’t many analysts providing forecasts this far into the future. Given the company’s unusual earnings trajectory and slowdown in its Covid-19 vaccine sales, it’s not easy to compare the firm to its larger peers such as Pfizer. However, it’s worth noting that the forward price-to-sales ratio of 6.6 times represents a 78% premium to the healthcare sector.

Is MRNA Stock a Buy?

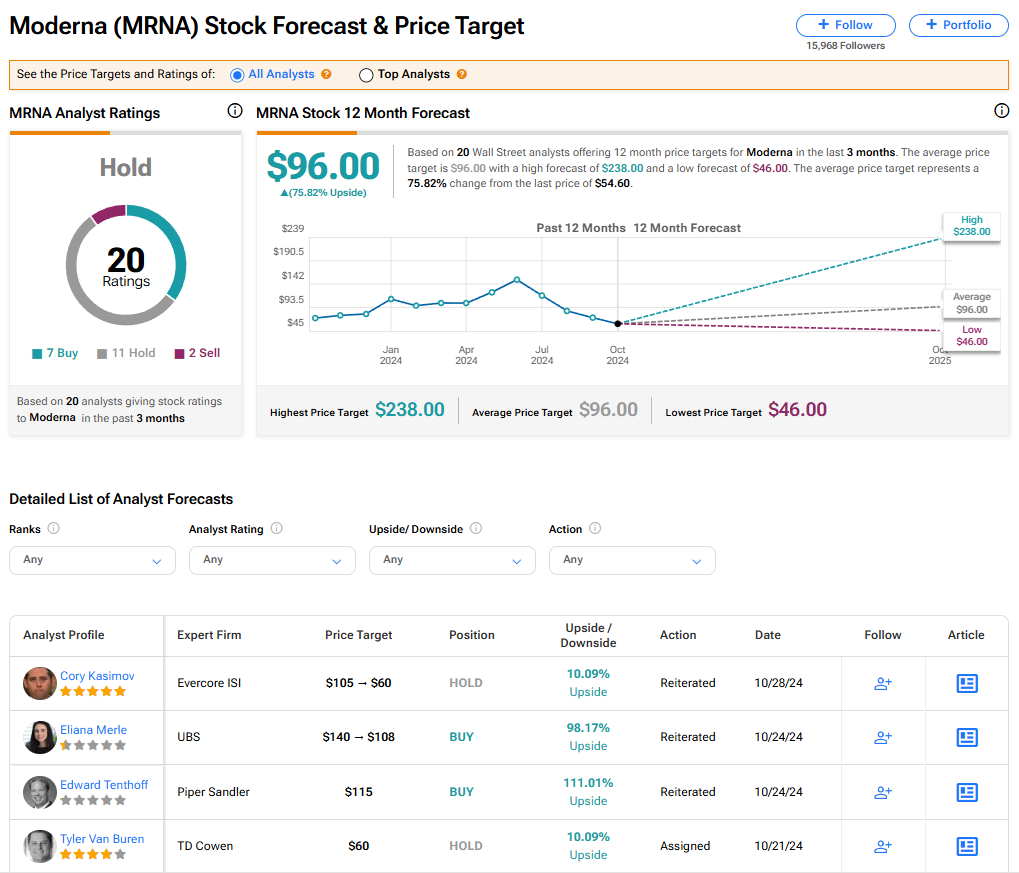

Moderna stock has a consensus Hold rating based on seven Buys, 11 Holds, and two Sells assigned by analysts in the past three months. The average MRNA stock price target of $96 implies 75.82% upside potential from current levels.

Read more analyst ratings on MRNA stock

Conclusion

Moderna might be trading at a discount to its average share price target, but it also represents something of a risk. The company offers a great deal of promise but also considerable downside potential as there is a high degree of failure in prescription drug development. While I find the current share price attractive, I’m not sure whether I want to take a chance on this security. I therefore remain Neutral on MRNA stock.