Being an AI infrastructure provider has paid off in a big way for IREN (NASDAQ:IREN) over the past year. You only need to look at the share price chart for the evidence – the stock is up a blistering 645% during the period.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

While AI hype has certainly helped the bitcoin miner-turned data center operator’s case, Roth analyst Darren Aftahi thinks the company’s latest deal brings a “level of credibility we believe investors were looking for.”

The company has signed its first major AI Cloud contract with Microsoft, a five-year, 200MW (CITL) deal valued at approximately $9.7 billion. As part of the agreement, Microsoft will provide a 20% revenue prepayment, which will be credited back during years three to five, totaling about $1.94 billion. This deal is anticipated to generate IREN roughly $1.94 billion in average annual AI Cloud revenue, with project-level EBITDA margins around 85% – though Aftahi points out that GPU depreciation makes the EBITDA figure somewhat misleading.

To support the deal, IREN will construct four Horizon Tier 3 HPC data centers at its Childress, Texas site, each consisting of 75 MW gross/50 MW CITL buildings, which will come online in phases through 2026. CapEx will come in at roughly $15 million per MW, up from the previously stated $7 million per MW for the raw shells. The increase reflects $2 million per MW for accelerated build schedules, $3 million per MW for server fit-out, and $2-3 million per MW in additional construction costs, bringing total infrastructure CapEx to around $3 billion. IREN will collaborate with Dell, which will supply GPU/server racks for the project, valued at ~$5.8 billion.

With this deal, IREN now has visibility – though Aftahi thinks not all GPUs are yet contracted – into roughly $2.5 billion in AI Cloud–related ARR (annual recurring revenue) by the end of 2026. Based on IREN’s control over power and GPU assets, the analyst reckons EBIT margins on the AIC (AI Cloud) business to be in the low 30% range, compared with long-term Neocloud targets of 20–30%.

IREN’s recent announcements indicate a stronger focus on an AIC/Neocloud model, while still retaining the flexibility to later repurpose that infrastructure for HPC colocation. As such, Aftahi considers the Microsoft AIC deal is unsurprising. “Moreover,” the analyst went on to add, “we believe a hyperscale name like MSFT is likely the best ‘brand validator’ for IREN’s AIC business in a high-credit worthy tenant, with IREN able to utilize these cash flows from the contract for potential asset backed loans or raising incremental capital to fund the build out (and beyond).”

Looking at Childress and IREN’s general business, AIC now appears to be “taking a front seat.” The remaining 450 MW at Childress is being designed for conversion to liquid-cooled GPU racks, and IREN’s sites in British Columbia (~160 MW gross, with ~50 MW already converting) are following a similar path. Childress was specifically designed with the option to transform former Bitcoin mining halls into HPC facilities, requiring only incremental infrastructure upgrades.

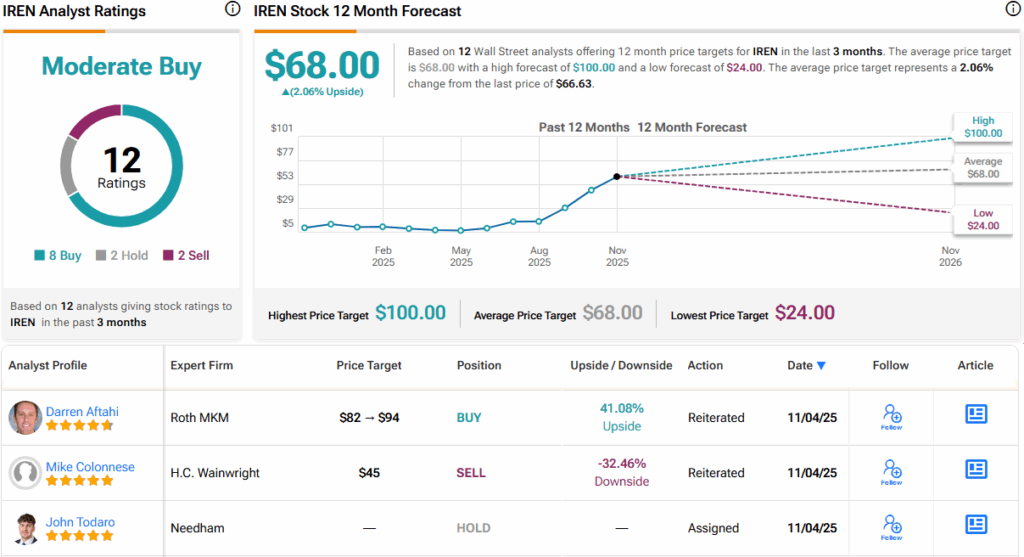

The deal merits a new price target from Aftahi, which goes from $82 to $94, suggesting the stock will gain another 41% in the year ahead. Aftahi’s rating stays a Buy. (To watch Aftahi’s track record, click here)

7 other analysts are also bullish on IREN’s prospects, while an additional 2 Holds and Sells, each, add up to a Moderate Buy consensus rating. However, going by the $68 average target, the shares will stay rangebound for the time being. (See IREN stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.