Market volatility has been picking up steam lately, driven by President Trump’s efforts to make good on a signature campaign promise – cracking down on what he sees as unfair trade practices.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

True to his unconventional style, Trump has been applying and lifting tariffs at will to pressure key trade partners like Canada, Mexico, and China into renegotiating deals on his terms. In the most recent move, the President is imposing 25% tariffs on automobile imports.

Naturally, this has injected a fresh dose of uncertainty into the markets. No one’s quite sure how the dust will settle – neither in the short term nor down the road. But one thing’s clear, investors are feeling jittery. Gold, the classic safe haven, has surged 16% this year and is now trading above $3,000 per ounce.

That shift hasn’t gone unnoticed. Jefferies analyst David Hove sees the flight to gold as a signal that gold mining stocks could be next in line for gains. He’s identified two top names he believes are well-positioned in the current environment. The upside may not be explosive, but in turbulent markets, these picks offer something just as valuable: stability, resilience, and a shot at steady returns.

We turned to the TipRanks platform to see how the rest of Wall Street feels about Hove’s picks. Let’s take a closer look at both.

Newmont Corporation (NEM)

We’ll start with Colorado-based Newmont, an American mining company that has been in business since 1921. Newmont describes itself as the world’s leading gold company and is also a major player in the production of copper, silver, zinc, and lead. Newmont’s mining asset portfolio is world-class and features important plays in North America, Latin America and the Caribbean, and Australia; together, these regions account for approximately three-quarters of the company’s operations. Newmont also has operating footprints in Papua New Guinea and the African nation of Ghana.

In February of this year, Newmont announced its mineral reserve totals as of the end of 2024. The headline figure, of course, was the company’s gold reserves, reported as 134.1 million attributable ounces. This figure was down 1.8 million ounces, or 1.3%, from the prior year. Newmont also reported solid Tier 1 reserves in copper and silver, listed as 13.5 million attributable tonnes and 530 million attributable ounces, respectively.

At the same time that the company announced its metal reserves, it also released its financial results for the fourth quarter and full year 2024. Among the key facts reported was the full-year gold production of 6.8 million attributable ounces, up 23% year-over-year. Fourth-quarter gold production came in at 1.9 million ounces, the highest quarterly result of the year. Adjusted net income for the fourth quarter came to $1.6 billion, or $1.40 per share, beating the forecast by 36 cents per share.

Also of note, Newmont reported free cash flow for 2024 of $2.9 billion, with Q4 free cash flow, at $1.6 billion, representing a quarterly record. The company has provided production guidance for 2025 of 5.9 million gold ounces.

In his coverage of Newmont for Jefferies, analyst Hove notes that the stock is discounted relative to peers—and, more importantly, that it is likely to continue delivering solid production and cash flow numbers. He writes, “NEM trades at 0.6x P/NAV at spot, a significant discount to its peer AEM of ~40%, and we expect the valuation gap to compress as NEM delivers on its guidance and FCF, driven by the ongoing optimization efforts at its asset base with duration.”

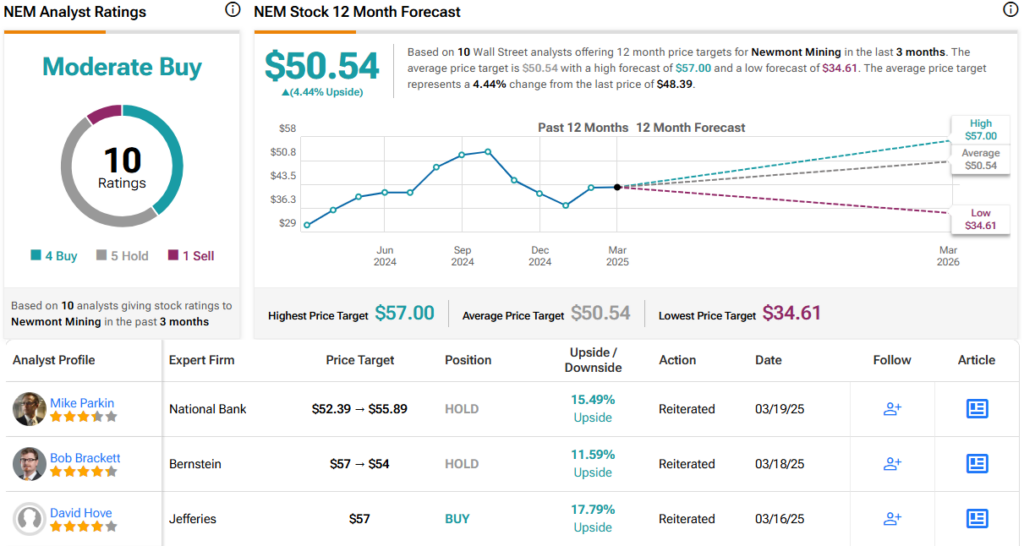

Hove goes on to put a Buy rating on Newmont’s shares, with a $57 price target that suggests a one-year upside potential of 18%. (To watch Hove’s track record, click here)

Overall, Newmont gets a Moderate Buy consensus rating, based on 10 recent analyst reviews that include 4 rated Buy, 5 rated Hold, and 1 rated Sell. The shares are currently priced at $48.39, and their $50.54 average price target implies a modest gain of 4.5% in the coming year. (See NEM stock forecast)

Royal Gold (RGLD)

Next up, also based in Colorado, is Royal Gold, a gold company with a twist. Royal operates mainly through the acquisition of stream or royalty interests in mining operations, primarily in gold but also in other metals, and derives its revenue and income from those sources. Royal’s business model includes direct investments in mining assets, provision of liquidity for miners, and funding for merger and acquisition activity in the mining industry. Through these activities, Royal derives rights to both metal streams and royalty payments.

This business model has the twin advantages of minimizing risk and maximizing reward. Royalty can hold interests in mines and their profits, while limiting its own exposure to operating risks and capital expenditures, and at the same time, the company can structure its transactions to lock in exposure to higher metal prices. Royal’s business is easily scalable and can be quickly adapted to mining operations of any size. For investors, the advantage here is the higher ratio of reward to risk – and to tapping the income from gold mines without having to risk exposure to the dangers of the mining industry.

Royal focuses its operations on gold, the traditional safe-haven precious metal, and while 76% of the company’s revenues are derived from that metal, it also has exposure to silver and copper – 12% of Royal’s top line comes from its silver interests, and 9% comes from copper. The company has operations in the Americas, Australia, Africa, and Europe.

Those operations have been generating steadily increasing revenues and earnings over the past several quarters. In its last financial report, which covered 4Q and full-year 2024, Royal reported quarterly revenue of $202.6 million. This was split between $124.8 million in stream revenue and $77.8 million in royalty revenue. The total quarterly revenue was up more than 32% year-over-year and was $16.42 million better than had been anticipated. At the bottom line, Royal realized earnings of $1.63 per share by non-GAAP measures, beating the forecast by 15 cents per share.

Checking in again with Hove and the Jefferies view, we find the analyst upbeat on the potential for growth in this stock. He writes, “We continue to forecast a compelling growth profile for RGLD, second only to WPM among its peers and expect the valuation gap to close as attributable production grows.”

For Hove, this supports a Buy rating for RGLD shares, and his price target of $178 implies that the stock will gain 10% over the next year.

Royal Gold has picked up a Moderate Buy consensus rating from the Street’s analysts, a rating that is based on 4 Buy reviews and 1 Hold and Sell, each. The stock’s $161.30 trading price and $169.83 average target price together indicate a one-year upside of 5%. (See RGLD stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue