I have been recommending General Dynamics Corporation (GD) to retail value investors for nearly a decade and I am bullish on the stock today.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

GD is a Blue Ribbon Company

Five business groups comprise GD: Aerospace, Marine Systems, Combat Systems, Technologies, and Gulfstream Business Jets. Fortune ranks GD at 13 on its Blue Ribbon List of the “best of the Best” companies. Moreover, GD has rewarded investors with 24 annual consecutive increases in its dividend. The yield (FWD) is a respectable 2.4%.

GD holds about $130 billion in all backorder components at the close of the second quarter. The stock is up 38.8% over the past 12 months. (See GD stock charts on TipRanks)

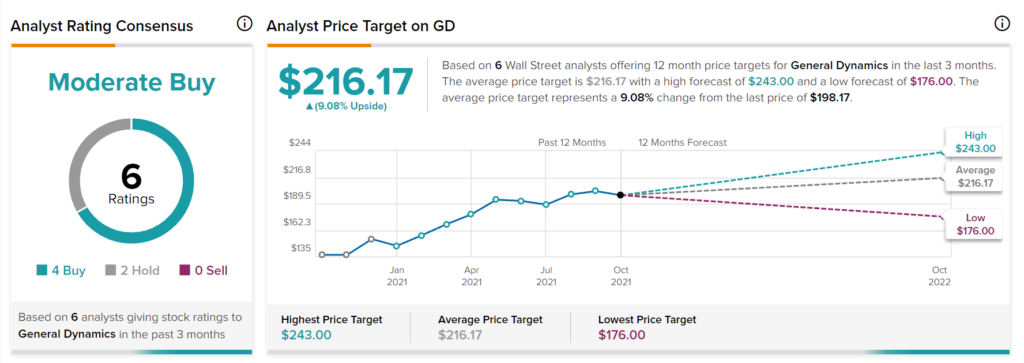

The average General Dynamics price target from six analysts is $216.17 per share, implying an upside of 9.08%. I believe that is a conservative estimate. I value the stock at around $240 per share, with all its back orders and pending military spending on weapons systems, especially for the Navy, technologies, Space Force, and Gulfstream.

Q2 ’21 net earnings were up about 18% year over year and EPS +19.7%. The company holds $4.75 billion in cash from operations and enjoys a healthy free cash flow. Also, Gulfstream order activity is rollicking as the economy emerges from the pandemic.

Expect More Defense Money for Shipbuilding

GD holds an “Outperform” TipRanks Smart Score of 9, with analysts rating GD a Moderate Buy and TipRanks Investors neutral. I think the future is brighter for the stock. Hedge fund activity is on the upswing. GD technicals are in positive territory. Insider buying is strong over the past year, especially in March, June, and September, as the share price climbed. Positive sentiment prevails, as reflected in the short interest rate of one percent.

Additionally, the Pentagon budget will get an estimated four percent boost to counter increases in China’s defense spending. Moreover, foreign policy defense experts are calling for significant upgrades to the U.S. Navy, as it is the primary conventional deterrence to China’s recent flexing of military muscle.

Also of note, America’s supply chain problems exist for the U.S. Army too. The Navy delivers everything from food, to fuel, to munitions. Also, ships are needed to keep the sea lanes open. Fortunately for GD, the company is one of the primary shipbuilders and retrofitters for the Navy at GD’s Bath Iron Works, Electric Boat, and NASSCO divisions.

Another likely source of income for GD is the U.S. Department of Defense (DOD), which hopes for a record amount of money next year. Specifically, it has requested $122 billion for technologies development in microelectronics, hypersonics, artificial intelligence (AI), and cyber security. GD can expect a large share of this money to be awarded to its tech division.

Downside Pressures on GD Stock

The risks facing GD are, first, its net debt of $11.4 billion. Yet that is down $900 million year-over-year. Equity is $15.3 billion and the debt-to-equity ratio has been rising for five years. Cash flow covers the debt, and EBIT covers interest payments. Its market cap is over $55 billion, so the company can raise cash, if needed, to cover the costs of new contracts or pay down debt.

A second risk to GD is interruptions in the supply chain. The company undertook a thorough supply chain review and started actions over the last four years. For instance, GD expects to produce 39 submarines in the next 20 years. The company used to buy from 17,000 suppliers to build submarines, while that number today is down to 5,000. GD is working to better control the quality of materials.

On the commercial side, Gulfstream is introducing newly designed jets. The division delivered its 50th G600 model to a customer. Gulfstream predicts the market has a compound annual growth (CAGR) of 7.4% through 2025. It is going to take a while for Gulfstream to reach its pre-pandemic numbers, but things are looking up.

GD Seems Worth the Price

Despite the share price of nearly $200, GD gets a Moderate Buy consensus rating from six Wall Street analysts (four Buys and two Holds). I am optimistic on GD, as its aerospace, marine, and combat systems revenue streams are up. Plus, technology revenue from encryption protection products and services is up. Giving GD even more upside is the likelihood that more money is likely be shifted into shipbuilding, as U.S. politicians cut the numbers of boots-on-the-ground with exits from Iraq and Afghanistan.

Disclosure: At the time of publication, Harold Goldmeier did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates, and should be considered for informational purposes only. TipRanks makes no warranties about the completeness, accuracy, or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment, and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. TipRanks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by TipRanks or its affiliates. Past performance is not indicative of future results, prices or performance.