Investors have been selling Australian healthcare stock Medical Developments International Limited (AU:MVP) this year, but investor sentiment seems to be shifting for MVP stock, which rose as much as 9% on Friday.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Melbourne-headquartered, Medical Developments International is a global pharmaceutical company. It manufactures pain management and respiratory medicines.

The company is behind the popular Penthrox pain relief drug. Additionally, the company makes medical and veterinary equipment. Medical Developments International reported a nearly 40% increase in its FY2022 sales.

Medical Developments International stock’s back on the radar

For much of 2022, investors have turned their back on Medical Developments International. The stock has declined about 65% year-to-date and more than 50% in the past six months. However, investors are now beginning to show some love for the Australian healthcare stock.

Friday’s surge brought MVP share price gains for the week to about 2.5%. In contrast, the S&P/ASX 200 Health Care (XHJ) index is 3.5% in the red for that period.

In August, Medical Developments International raised AU$30 million to support its expansion. The company is increasing its capacity as it pursues additional international growth opportunities. Let’s take a look at where MVP stock stands in light of TipRanks insights.

Medical Developments International insiders are buying the dip

Company insiders are buying up the stock, with TipRanks’ Insider Trading Activity showing that Insider Confidence Signal is currently Very Positive. The company’s corporate insiders, such as directors and executives, have purchased AU$3.1 million worth of shares in the past month.

Financial bloggers view Medical Developments International stock favourably

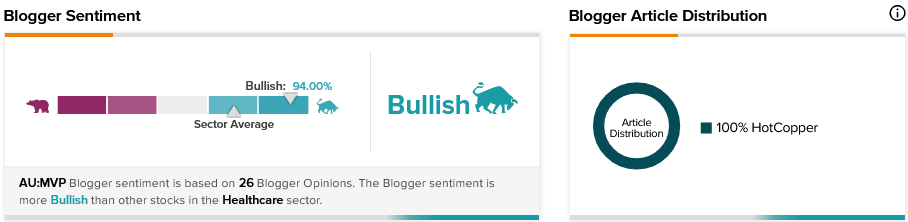

MVP stock is receiving positive mentions on financial blogs. TipRanks data shows that financial blogger opinions are 94% Bullish on MPV shares, compared to a sector average of 70%.

Medical Developments International share price prediction

According to TipRanks’ analyst rating consensus, MVP stock is a Moderate Buy. The average Medical Developments International share price prediction of AU$2.69 implies over 54% upside potential.

Moreover, MVP stock’s nine out of 10 TipRanks Smart Score rating indicates it has strong potential to outperform market expectations.

Final thoughts

The rising interest rates have investors fearing a looming economic recession. However, healthcare companies like Medical Developments International can weather a recession better than others. Medical expenses are usually among the last budget items that households cut during unfavourable economic times.