Politics are increasingly creeping into all areas of American life, and for better or worse, investing is not immune to this phenomenon. We recently covered the growing number of ETFs that allow people to invest in companies that they believe are aligned with their viewpoints. These ETFs do this by screening for companies that donate money to political candidates or causes.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Now, Subversive ETFs has unveiled an interesting new twist on political ETFs with two brand new ETFS, one for each opposing side of the aisle — the Unusual Whales Subversive Republican Trading ETF (BATS:KRUZ) and the Unusual Whales Subversive Democratic Trading ETF (BATS:NANC). How do they work, and could they be worthy of a place in your portfolio?

How Do These ETFs Invest Like Political Insiders?

As one might guess, the Democratic version of this ETF’s ticker is a reference to Democratic congresswoman and former Speaker of the House Nancy Pelosi, while the Republican ying to NANC’s yang is named for Ted Cruz, the high-profile Republican Senator from Texas and former presidential candidate.

While a number of ETFs allow investors to invest in stocks that they feel like match up with their political preferences, these two new ETFs take a whole new approach. Instead of merely tracking which companies make donations to politicians, NANC and KRUZ utilize data provided by Unusual Whales, an options and equity data platform, to track what stocks members of Congress are buying and selling, using this information to invest alongside them. KRUZ invests in equities bought or sold by Republican members of Congress, while NANC does the same thing with Democratic members of Congress.

If you’ve spent any time on the financial side of Twitter (often called “FinTwit”) in recent years, you’ve likely seen plenty of accounts discussing the transactions made by Nancy Pelosi and her husband, Paul, and users joking (or perhaps only half joking), that Pelosi is a better investor than Warren Buffett based on her timely buys and sells before major news comes to light about some of these stocks.

While the ability of politicians to enrich themselves based on inside knowledge and influence they derive from positions as lawmakers is an unseemly part of U.S. politics (the U.S. is the only democracy in the world that allows officeholders to invest like this), I give Unusual Whales and Subversive ETFs credit for using data to level the playing field and at least letting everyday Americans invest like these political insiders.

They are able to do this because, thanks to the STOCK Act, members of Congress and their spouses must disclose what stocks they buy and sell.

How Are Politicians Investing?

Now that we know how they work, let’s take a look at what NANC and KRUZ look like in practice. These ETFs are actually incredibly diversified, which stands to reason, as they are representing the transactions of hundreds of Congressmen and Congresswomen.

NANC holds a massive 741 positions, and its top 10 holdings make up 47.4% of the fund. Below, you’ll find an overview of NANC’s top 10 holdings using TipRanks’ holdings tool.

As you can see above, NANC skews heavily towards mega-cap tech stocks like Microsoft (NASDAQ:MSFT) and Apple (NASDAQ:AAPL), so holding it would give investors exposure that isn’t all that different from investing in massive tech ETFs like the Invesco QQQ Trust (NASDAQ:QQQ) or the Technology Select Sector SPDR Fund (NYSEARCA:XLK).

You’ll also notice that NANC’s top holdings collectively boast some pretty impressive Smart Scores, with eight of its top 10 scoring 8 or above. The Smart Score is a proprietary quantitative stock scoring system created by TipRanks. It gives stocks a score from 1 to 10 based on eight market key factors. The score is data-driven and does not involve any human intervention.

Meanwhile, KRUZ holds 486 positions, and its top 10 holdings make up a fairly minuscule 16.5% of assets. Check out the table below for an overview of KRUZ’s top holdings.

KRUZ clearly isn’t as tech-centric as NANC, and it skews more towards what you might call ‘old economy stocks’ like energy companies and tobacco giant Philip Morris International (NYSE:PM). But there’s a little bit of everything, with Netflix (NASDAQ:NFLX) representing the tech sector and healthcare companies also having a presence. Seven out of KRUZ’s top 10 positions feature Smart Scores of 8 or above.

NANC has an ETF Smart Score of 8, edging out KRUZ, which scores a 7.

One thing to make note of is that just because these two ETFs represent different sides of the aisle, that doesn’t mean there isn’t overlap in their positions. Politicians from both parties have bought stocks like Amazon (NASDAQ:AMZN), Home Depot (NYSE:HD), and Ford (NYSE:F), just to name a few, so you’ll find these and plenty more in both ETFs.

Are Analysts Bullish on NANC and KRUZ Shares?

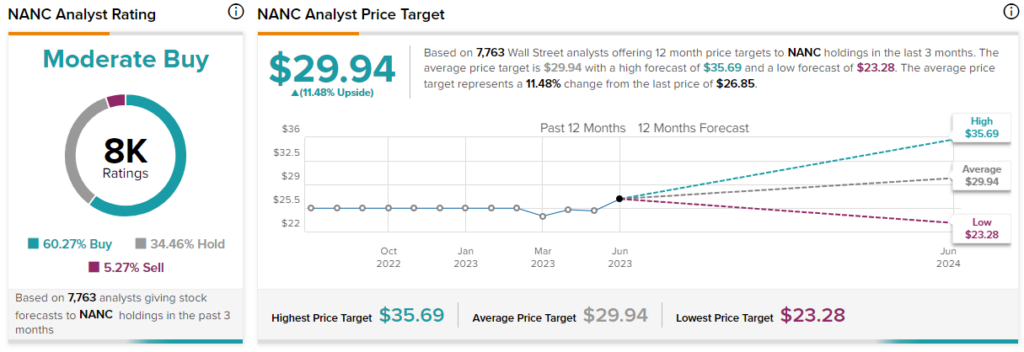

Analysts view NANC in a positive light. It has a Moderate Buy rating, and the average NANC stock price target of $29.94 implies upside potential of 11.5% from the ETF’s current price.

The analyst community views KRUZ relatively similarly, giving it the same Moderate Buy consensus rating. Further, the average KRUZ stock price target of $28.52 implies 15.2% upside potential.

Investor Takeaway

This is an interesting concept for an investment vehicle, and I also give Subversive ETFs and Unusual Whales credit for seeking to level the playing field between politicians and everyday Americans, at least in the investing sphere.

It’s feasible that this strategy of following the investing decisions of Congressmen and congresswomen could be a fruitful one, but these ETFS just launched in February of 2023, so for now, they don’t have much of a track record to judge them on, and time will tell how effective this strategy is.

These are still relatively tiny ETFs in the investing landscape — KRUZ currently has just $4.9 million in assets under management, while NANC has $6.7 million.

One additional downside to be aware of is that both of these ETFs charge relatively high fees — KRUZ and NANC both have expenses ratios of 0.75%, meaning that if you were to invest $10,000 into one of them today, you would pay $75 in fees in year one. For these reasons, I am watching KRUZ and NANC as an interested observer rather than buying one or the other.

One additional idea is that if I were interested in investing in NANC, I would consider simply investing in the aforementioned ETFs like QQQ or XLK, as they give you much of the same exposure to the large-cap tech stocks that make up NANC’s top holdings and offer lower fees and a much longer track record of performance.