You don’t need to be a gamer to invest in the growing gaming market. This is a massive market with a long growth runway ahead of it. PC Magazine finds that two-thirds of people under the age of 18 play video games. Because gaming is popular with younger consumers, it looks well-positioned to grow over the long term as these consumers attain higher incomes.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Thanks to the advent of mobile gaming, video games are now reaching a wider audience than ever before. For instance, Comscore finds that nearly three-quarters of mobile-only gamers are female.

The COVID-19 pandemic was also a significant driver for demand. According to The NPD Group, the average time spent gaming increased by 16.9% between 2019 and 2020 as people sought new forms of entertainment while confined to their homes. Meanwhile, Insider Intelligence finds that over half of the U.S. population are digital gamers.

New revenue drivers like advertising and Esports are emerging within gaming. Insider Intelligence forecasts that U.S. mobile gaming ad revenue will grow 10% this year to $6.28 billion. It should then grow at an 8%-10% CAGR over the next several years. The firm predicts that Esports advertising revenue will grow at a similar rate.

And this isn’t just a U.S. story — Statista forecasts the global video game market to grow from just under $200 billion last year to nearly $270 billion by 2025.

If you aren’t a gaming enthusiast, it can be challenging to keep track of which companies have hot titles coming out. Adding to the complexity of investing in the sector, game launches can be hit or miss. This is why using gaming ETFs is a great way to invest in the sector. Here are three gaming ETFs that you can add to your portfolio to tap into this long-term global growth story.

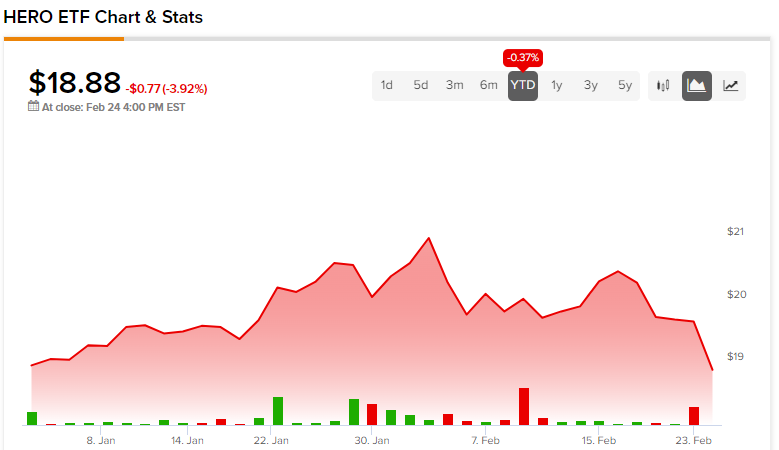

Global X Video Games & Esports ETF (HERO)

The Global X Video Games & Esports ETF is Global X’s offering in the gaming space. HERO is a smaller ETF with about $164 million in AUM.

HERO ETF’s holdings include 51 gaming and Esports stocks, and its top 10 holdings make up 54.2% of the fund. The top 10 holdings consist of major gaming developers and publishers like Take-Two Interactive (NASDAQ:TTWO), Activision Blizzard (NASDAQ:ATVI), and Electronic Arts (NASDAQ:EA).

Take-Two’s portfolio includes blockbuster series like Grand Theft Auto and Red Dead Redemption, as well as the popular NBA 2K games. Activision Blizzard is home to a comprehensive array of titles from all corners of the gaming spectrum, including Call of Duty, World of Warcraft, Starcraft, Guitar Hero, and the Candy Crush series of mobile games. Electronic Arts is known for its popular sports titles like the Madden NFL series and FIFA, plus its portfolio also includes franchises like Medal of Honor, Apex Legends, and Battlefield.

Top holding Roblox (NYSE:RBLX) is a play on the metaverse that has gained popularity with younger gamers. Meanwhile, Unity Software (NYSE:U), a top 10 holding, provides software solutions that developers use to create their games.

HERO also provides significant international exposure, with investments in Japanese gaming stalwarts Nintendo (OTC:NTDOY) and Capcom (OTC:CCOEY), China’s Netease (NASDAQ:NTES) and Bilibili (NASDAQ:BILI), and Poland’s CD Projekt SA (OTC:OTGLF), the company behind Cyberpunk 2077.

HERO enjoyed a phenomenal 2020, gaining 91% during the pandemic. The past two years haven’t been as good for HERO holders, as the ETF lost 7.9% and 33.5% in 2021 and 2022, respectively. However, HERO is about flat on the year so far, so a trend change may be underway.

HERO has an expense ratio of 0.5% and has a small dividend yield of 0.27%.

VanEck Video Gaming & Esports ETF (ESPO)

The VanEck Video Gaming & Esports ETF is VanEck’s product in this space. ESPO is similar to HERO but is more concentrated, with 27 holdings. ESPO’s top 10 holdings make up 62.2% of the fund.

As with HERO, you’ll find names like Take-Two Interactive, Activision Blizzard, Roblox, Netease, Nintendo, and Unity Software within ESPO’s top holdings. However, one major difference is that rather than focusing on just pure-play gaming companies, it also invests in the semiconductor stocks that power the gaming industry, like Nvidia (NASDAQ:NVDA) and Advanced Micro Devices (NASDAQ:AMD). These companies can be thought of as pick-and-shovel plays on the growth of the sector as a whole.

You’ll also find some of China’s internet giants, like Tencent (OTC:TCEHY) and Sea Limited (NYSE:SE) in this fund. While these juggernauts are involved in a wide range of businesses, Sea Limited is home to gaming studio Garena, which is known for the popular mobile gaming franchise Freefire. Simultaneously, Tencent derives a significant amount of its revenue from its video game segment and is home to popular titles like League of Legends.

Like HERO, ESPO posted an impressive gain in 2022, gaining 84.3% for the year before cooling down in 2021 and 2022 with losses of 1.9% and 34.4%, respectively. Now, ESPO is up 6.9% year to date, primarily driven by its large positions in Nvidia and AMD, which are off to strong starts in 2023.

ESPO has an expense ratio of 0.56% and a dividend yield of 0.8%.

Roundhill Video Games ETF (NERD)

Roundhill’s NERD ETF has a catchy ticker and a pure-play focus on gaming. This is a very small ETF with just $26.5 million in AUM.

NERD holds 39 stocks, and its top 10 holdings make up 57.7% of the fund. There is a lot of overlap between NERD and the other two names included here, with names like Nintendo, Electronic Arts, Roblox, Take-Two, and Unity populating the top 10. One thing to note about NERD is that the top holding, Nintendo, makes up a massive 16.2% of holdings.

The Roundhill Video Games ETF has roughly followed the same trajectory as HERO, with a monster 89.9% gain in 2020 followed by losses of 16.9% and 43.5% in 2021 and 2022, respectively. The ETF is up 1.15% year to date.

NERD has an expense ratio of 0.5%. Like the other two ETFs on this list, NERD pays a small dividend and currently yields 0.67%.

Looking Ahead

Gaming looks like a market that has a long runway for growth worldwide in the years to come, and these ETFs offer an effective way for investors to tap into this growth. I like the idea of investing in the gaming market using ETFs because it removes some of the need for specialist knowledge and removes the risk of investing in a single gaming company which can rise or fall dramatically based on the reception of an individual title.

HERO and NERD both offer exposure to pure-play gaming names, while ESPO brings in semiconductor giants like Nvidia and AMD, which are the powerhouse of the space. ESPO also brings in some of China’s internet giants like Sea Limited and Tencent, which the other two funds don’t own.

Nonetheless, all three look like solid ways for investors to gain exposure to the gaming market, and ESPO is my pick of the three thanks to its additional exposure to semiconductors, which can be thought of as the picks and shovels of the industry and have driven a strong gain for ESPO this year.