Accounting software maker Intuit (NASDAQ:INTU) impressed investors and analysts by beating Fiscal Q1 earnings and revenue estimates. Despite macroeconomic headwinds, a robust start to Fiscal 2024, combined with Intuit’s forecast to finish the year stronger, has Wall Street very optimistic about the company’s future. The stock is up 47% YTD compared to the S&P 500’s (SPX) gain of 20%. With the demand for digitalizing and streamlining tax processes rising, I remain bullish on Intuit.

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

A Strong Start to Fiscal 2024

Intuit began as a personal finance software company and has since evolved into a leader in providing innovative financial management and tax solutions.

Intuit’s portfolio includes well-known financial tools such as QuickBooks, TurboTax, Credit Karma, and Mint, all of which aim to simplify financial tasks for consumers and small businesses. Furthermore, Intuit has already incorporated artificial intelligence (AI) into all of its flagship products, which is fueling demand.

This resilient demand drove an outstanding first-quarter performance in Fiscal 2024. Intuit’s revenue of $2.98 billion beat the consensus estimate of $2.88 billion while also surging 15% year-over-year. Meanwhile, adjusted earnings per share (EPS) grew a massive 49% year-over-year to $2.47 in the quarter. EPS also surpassed the consensus estimate of $1.98.

The company operates through four segments. According to management, the Small Business & Self-Employed segment saw a revenue surge of 18%, and the Consumer Group segment revenue increased by 25%, both of which drove Q1’s top-line growth.

Meanwhile, macroeconomic headwinds affecting personal loans, auto insurance, home loans, and auto loans resulted in a 5% decrease in Credit Karma segment revenue from the prior-year quarter. On the other hand, a “strong finish to the tax extension season” aided the ProTax segment’s 24% revenue increase to $42 million in the quarter.

Discussing the results, CEO Sasan Goodarzi stated, “With data and AI core to our strategy, we’re accelerating innovation across our global financial technology platform to power the prosperity of consumers and small businesses.”

Management believes that its generative AI-powered financial assistant, Intuit Assist, launched in September, reflects Intuit’s commitment and “years of investment in data and AI” and will be a big winner this tax season.

Bold Dividend Hikes Signal Growing Dividends in the Future

Intuit remains committed to returning value to its shareholders in the form of dividends and share repurchases. In Fiscal Q3 2023, Intuit announced a bold quarterly dividend hike of 15% year-over-year to $0.78. The company made another noticeable hike of 15% year-over-year to its quarterly dividend to $0.90 per share in Fiscal Q4 2023. Furthermore, it repurchased $603 million worth of its shares in Q1.

The company offers a dividend yield of 0.57%, which is lower than the sector average of 1.02%. While the yield isn’t particularly appealing to investors, the payout ratio of 21.2% indicates that there is more room for dividend hikes as earnings continue to climb. Also, it’s not just about a company’s dividend yield. Consistency in dividend payments and hikes reveals more about a dividend stock.

A Rosy Outlook

Driven by the outstanding quarter, management is confident of meeting its earlier target for Fiscal 2024. Revenue is expected to increase by 11% to 12% to land in the range of $15.89 billion to $16.10 billion. Additionally, EPS could be in the $16.17 to $16.47 range, implying a 12% to 14% year-over-year increase.

According to William Blair analyst Matthew Pfau, Intuit’s Fiscal 2024 guidance is conservative, leaving room for favorable modifications once the macroeconomic headwinds dissipate. Impressed with the Q1 results, the analyst maintained his Buy rating on INTU stock.

Meanwhile, analysts forecast revenue growth of 11.7% to $16.05 billion, with EPS of $16.40 for Fiscal 2024 (ending July 2024).

Is INTU Stock a Buy, According to Analysts?

After its Q1 results, Wells Fargo (NYSE:WFC) analyst Michael Turrin gave a Buy rating to INTU with a price target of $615. The analyst believes that Intuit reiterating its Fiscal 2024 guidance reflects the company’s confidence in maintaining a steady growth trajectory in the face of macroeconomic headwinds.

Furthermore, Turin is optimistic that the upcoming tax season and the company’s generative AI efforts will be bigger catalysts for its near-term success.

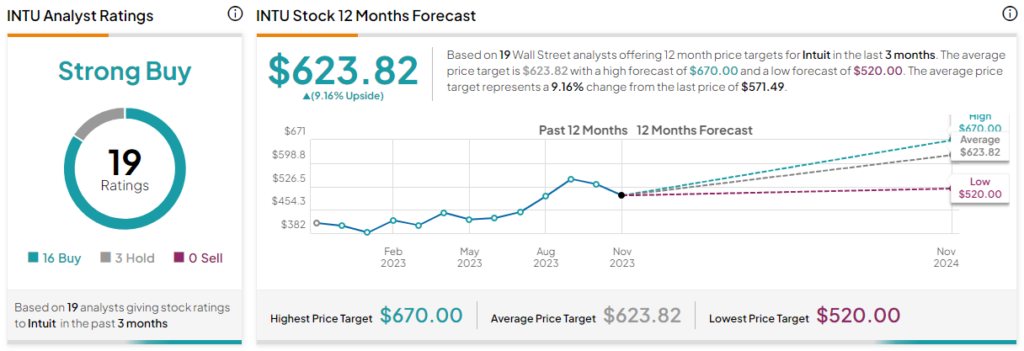

Overall, Wall Street maintains a bullish stance on Intuit stock, rating it a Strong Buy. Out of the 19 analysts covering the stock, 16 rate it a Buy, while three rate it a Hold. There are no sell ratings. The average analyst INTU target price is $623.82, which is 9.2% above current levels.

Priced at 30.1 times forward 2025 projected earnings, Intuit’s valuation appears to be somewhat justified, given the revenue and earnings growth projected from its AI-integrated products. Analysts predict 14.6% and 12.5% year-over-year growth in earnings and revenue in Fiscal 2025.

The Bottom Line on Intuit

AI presents a myriad of opportunities for Intuit, and the company’s commitment to harnessing the full potential of AI to strengthen its platform gives me hope for a fruitful future. Intuit’s stable revenue and earnings growth trajectory, management’s confidence in maintaining this trajectory with financial cost discipline, and bold dividend hikes all make for a compelling long-term investment case for Intuit.