The tech-heavy Nasdaq 100’s (NDX) strong start to the year (up 21% year-to-date) has been led by the AI tech high flyers. Unless you’re overconcentrated in the leading semiconductor firms, though, your portfolio is probably falling well shy of the Nasdaq 100. Indeed, it’s tough to beat the market. In any case, there’s no need to chase semiconductor stocks after a euphoric surge — not while there are Strong-Buy-rated, modestly-priced software stocks that have the means to heat up.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Thus, let’s use TipRanks’ Comparison Tool to gauge three Strong Buy-rated software names—INTU, SNPS, MDB—that may still be overlooked.

Intuit (NASDAQ:INTU)

It did not take very long for shares of financial software firm Intuit to recover from its rapid correction in May. Over the past month alone, INTU stock has gained more than 14% as investors piled back into a name that may have the opportunity to raise prices by offering more value. Indeed, bookkeeping and accounting seem like a job fit for artificial intelligence (AI). And as Intuit refines its AI arsenal, it’s hard to be anything less than bullish.

Last month, Intuit acquired some technologies and assets from insurance technology company Zendrive. Indeed, Intuit is perhaps best known for its QuickBooks and Turbotax software, not insurance. However, what you may not know is that Credit Karma (owned by Intuit) has gotten into the auto insurance business via Karma Drive.

With Zendrive’s tech and talent aboard, perhaps Karma Drive has what it takes to take its insurance foray to the next level as it embraces value from telematics and data analytics. Come for the credit score, stay for the great quote on a credit card, loans, and, now, car insurance. Investors seem to have viewed the Zendrive deal positively, with shares now flirting with 52-week highs again.

As Intuit becomes more of a data- and AI-driven company confident enough to expand into new markets (like insurance) as opposed to a mere financial software developer, perhaps the 60.3 times trailing price-to-earnings (P/E) multiple is warranted.

What Is the Price Target of INTU Stock?

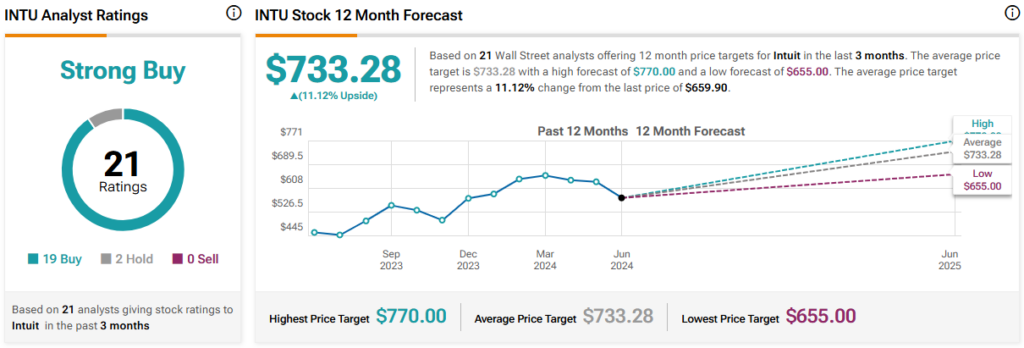

INTU stock is a Strong Buy, according to analysts, with 19 Buys and two Holds assigned in the past three months. The average INTU stock price target of $733.28 implies 11.1% upside potential.

Synopsys (NASDAQ:SNPS)

Shares of chip design software maker Synopsys are closing in on new highs again after a 20% surge since their April 2024 lows. All it took was a strong second-quarter earnings beat for the bulls to return to a name that stands to benefit greatly from the AI-driven semiconductor surge. Despite the loftier multiple, I’m inclined to stay bullish on SNPS stock, given that its growth prospects seem to have gotten a whole lot better following its latest acquisition.

Looking ahead, Synopsys aims to close its $35 billion acquisition of engineering simulation software developer Ansys in the first half of next year. This move will bolster the firm’s silicon-to-system design solution and help Synopsys become a more influential enabler of emerging technological innovations. Indeed, having simulations and chip designs under the same hood could help firms cut back on costs and risks involved with tackling complex, forward-thinking engineering projects.

The deal isn’t a sure thing, though, not after Chinese anti-trust authorities look into the implications of a Synopsys-Ansys deal. Shares of Ansys (NASDAQ:ANSS) have fallen around 10% since the deal was announced back in December 2023 due to uncertainties about whether the deal will fall through.

Either way, Synopsys is already playing chess while others are playing checkers. With an impressive Synopsys.ai suite of tools and analytics solutions that harness the full power of data, perhaps the hefty 65.8 times trailing P/E (way more than the Infrastructure Software industry average of 42.2 times) is worth paying up for.

What Is the Price Target of SNPS Stock?

SNPS stock is a Strong Buy, according to analysts, with 10 Buys assigned in the past three months. The average SNPS stock price target of $651.70 implies 7.7% upside potential.

MongoDB (NASDAQ:MDB)

Shares of database software firm MongoDB have been under serious pressure this year, now down 47% from 52-week highs and off around 35% year-to-date. In any case, some big-name analysts see value in the name after the latest plunge. Despite the tough quarters and lower guidance contributing to MDB stock’s slide, I remain bullish on MDB stock.

MongoDB isn’t the only enterprise software firm sagging lower, even as the Nasdaq 100 surges to new heights. However, it may be one of the first to make up for lost time as industry conditions normalize.

Last week, analysts over at Citi (NYSE:C) praised MDB stock as one of their top two picks in the enterprise software scene. Citi highlighted multiple catalysts that could help MongoDB and other ailing enterprise software firms rise out of its funk. Most notably, Citi views recovering IT spending, lower rates, and seasonal factors as reasons to get behind MDB stock right here.

Indeed, corporate budget cuts from 2022 have weighed heavily. More recently, perhaps enterprises are prioritizing AI hardware spending over software spending. Still, once the hardware is in place, it may be time to start spending on software again to make use of those shiny, new AI accelerators.

Specifically, MongoDB’s AI Applications Program (MAAP) stands out as an intriguing generative AI-enabling platform for the enterprise. With the backing of big names in AI, like Anthropic, and some of the Magnificent Seven public cloud giants, perhaps investors are underestimating the firm’s ability to benefit from the catalysts Citi outlined.

What Is the Price Target of MDB Stock?

MDB stock is a Strong Buy, according to analysts, with 20 Buys and four Holds assigned in the past three months. The average MDB stock price target of $335.95 implies 26.8% upside potential.

Conclusion

AI-enabling software companies may be standing in the shadows of semiconductor firms right now. Only time will tell if the euphoric gains will shift into the software space in the second half of the year. Regardless, Wall Street’s enthusiasm for each stock is tough to ignore. Of the three names, Wall Street sees the most upside potential (26.8%) in MDB stock.