Semiconductor giant Intel (NASDAQ:INTC) is currently undergoing a restructuring plan that holds considerable implications for the long term. When reflecting on past events, it is worth noting that its competitor, Nvidia (NASDAQ:NVDA), has seen its stock more than triple in value since I emphasized its plans for new chip production in November 2022. This begs the question: can Intel stock potentially yield similar high returns for investors? In my opinion, Intel is poised to benefit from the AI boom in the long run. While the benefits may take some time to materialize, they are expected to deliver significant value to investors over a long-term investment horizon.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Importantly, the stock is currently trading at much lower levels compared to its all-time high of $69.29 seen in early 2020. Further, I believe the current stock price offers an attractive entry point for long-term investors.

AI Opportunity and Related CapEx to Act as Long-Term Tailwinds

The global artificial intelligence chip market is expected to grow at a CAGR of 29% between 2023 and 2030, according to Next Move Strategy Consulting. Digging deeper, the market size is expected to grow by over 10 times to around $300 billion by 2030 versus $29 billion in 2022. This presents a huge growth opportunity for all the AI chip makers like Intel.

Intel intends to position itself for future growth and maintain its competitive edge by changing its business model and investing in fields like artificial intelligence, cloud computing, and advanced manufacturing. As the AI landscape continues to expand and evolve, Intel is making increased capital expenditures (CapEx) to support strategic growth toward AI development and implementation.

NVDA, one of Intel’s top competitors, has gained almost 200% year-to-date, riding high on the AI growth prospects. However, Intel has gained only 26% year-to-date. While NVDA is undoubtedly the dominant player in the AI chip-making industry, competitors like Intel are also bracing up and can get a share of the AI growth in the coming years.

Interestingly, while NVDA chips have a huge competitive edge when it comes to performance, Intel chips will offer cheaper alternatives to clients. The better value proposition may help Intel win newer clients as the AI industry continues to grow globally. Further, NVDA’s chips alone will not be able to fulfill the upsurge in demand for AI chips in the coming years. Consequently, peers like Intel will fill in the supply gap and should remain one of the important players in the AI chip-making industry.

Intel is Undergoing a Paradigm Shift

To gain an edge over its peers, Intel is undergoing multiple restructuring initiatives like increased spending to support strategic growth, disciplined expense management, and PC inventory correction, among others. Intel recently held an investor webinar where it laid out the details of creating a new internal foundry model. This fundamental shift is expected to enhance production efficiency and also lead to cost savings. Moreover, it will also open its products to external customers and chip designers, thereby further driving revenue growth.

Under the new operating model, Intel’s internal product business units will have a foundry-style relationship with the company’s manufacturing group working in an “arm’s-length fashion.” Starting Q1 2024, the company will also provide standalone profit and loss statements for its Manufacturing groups that will include Manufacturing, Technology Development, and Intel Foundry Services.

Importantly, Intel reiterated its long-term goal of becoming the second-largest external foundry by 2030. The new model is clearly an accelerated step in that direction. With the expected ramp-up of releasing five nodes over the next four years, revenues from the internal foundry are expected to reach $20 billion by 2024.

The company said that the transition to the foundry model will play a significant role in achieving its targeted cost savings of over $8 billion to $10 billion by 2025. With the resulting optimization of its cost structure, the company will be likely able to achieve its long-term target non-GAAP gross margin of 60% and operating margin of 40%.

For reference, Intel achieved a non-GAAP gross margin of 38.4% and a negative operating margin of 2.4% in the most recently reported first-quarter results. Therefore, Intel has a long path to tread to reach its margin goals.

If the shift to the foundry model is successfully executed, it could be a game changer for Intel and help it meet its lofty goals. However, it should be noted that the volume ramp-up is not expected anytime soon and could be visible after Fiscal Year 2025. Investors will likely get more clarity after the upcoming second-quarter earnings report scheduled to be released on July 27.

Is Intel Stock a Buy, According to Analysts?

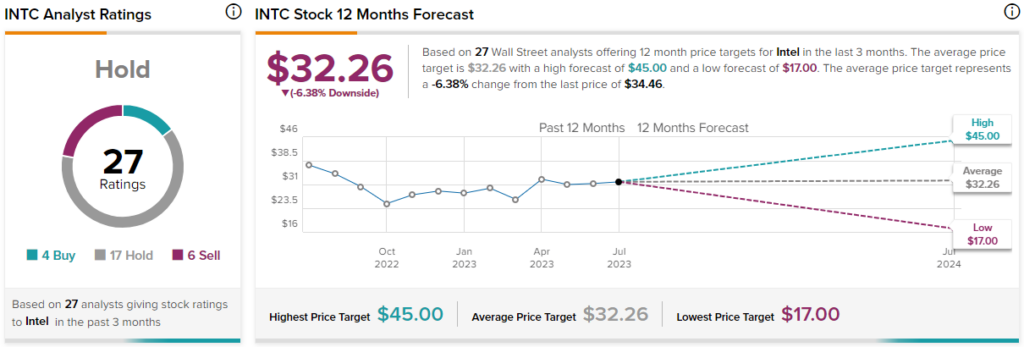

As per TipRanks, analysts are cautious about Intel stock and have a Hold consensus rating, which is based on four Buys, 17 Holds, and six Sells assigned in the past three months. Intel stock’s average price forecast of $32.26 implies 6.4% downside potential.

Conclusion: Consider Buying Intel for Long-Term

The AI boom is here to stay, and Intel is diligently taking every necessary step to capitalize on its robust growth potential. The company is currently undergoing a substantial business transformation, implementing an integrated device manufacturer (IDM) 2.0 strategy and adopting a new internal foundry model. These strategic moves are paving the way for a noteworthy expansion of Intel’s manufacturing capabilities.

Although the results of this scale expansion may not be immediately apparent, Intel is poised to reap the benefits of its multiple initiatives and the long-term potential of AI. Consequently, I maintain a bullish stance on the stock, viewing it through a long-term lens.