Intel (INTC) has found itself in a world of trouble in 2024 after years of innovation failures left it significantly lagging behind its peers. A lot has happened in recent months, and there are many more developments possible before the end of the year. Interestingly, analysts still see the business recovering to the extent that the stock becomes quite affordable compared to peers in upcoming years. Despite this, I’m concerned the company will struggle to catch up, and as such, I’m neutral on INTC.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

What Happened at Intel?

Intel remains a global chip giant, with operations in both the design and manufacturing of chipsets. However, the decline from its once-dominant position in the semiconductor industry is evident, and can be attributed to a variety of factors that have unfolded over the past decade. Those pressures continue, and so I have a neutral rating on the stock.

The company’s struggle to maintain its technological edge began around 2015 when it simply stopped innovating as quickly as its peers. As the innovation cycles failed to deliver material improvements and other companies transitioned to smaller, more efficient chip manufacturing processes, Intel continued making profits as it produced its less advanced chips en masse.

This lack of innovation eventually caught up with Intel. The company’s reliance on its x86 architecture also left it vulnerable as the industry shifted towards more energy-efficient ARM-based (ARM) designs, particularly in mobile and emerging artificial intelligence (AI) applications. Intel’s weaknesses were laid bare during the pandemic as supply chain disruptions and increased demand for computing power highlighted the company’s manufacturing limitations.

Intel’s Catch-Up Strategy

In response to falling behind, Intel brought in CEO Pat Gelsinger in 2021 to spearhead a turnaround strategy, which included massive investments in new fabrication facilities and a renewed focus on technological leadership.

Gelsinger kicked things off by announcing his ambitious “five nodes in four years” strategy, with the aim of rebounding as quickly as possible. However, the road to recovery has been challenging, with Intel facing intense competition and a tough climb to regain customer confidence in its ability to deliver cutting-edge products on schedule.

To date, there’s very little evidence of Intel catching up. The company’s struggles are particularly evident in the Data Center business, where it lags behind competitors AMD (AMD) and Nvidia (NVDA). Intel’s Q2’24 results produced a 1% year-over-year revenue decline; a sharp contrast to its peers.

Does Intel’s Future Include Divestments or a Buyout?

To address its financial issues, Intel has implemented a $10 billion cost reduction program and recently converted its foundry business into a subsidiary. This restructuring aims to drive greater transparency, cost savings, and growth, but it hasn’t led me to adopt a bullish view of Intel stock yet.

The stock gained on this announcement in September, and then further by a deal with Amazon (AMZN) Web Services to co-invest in a custom AI semiconductor. The company also received $3 billion of U.S. government funding to make chips for the military.

Moreover, recent reports have suggested that a potential $5 billion investment from Apollo Global Management (APO) could be on the cards, and there have also been reports of discussions with Qualcomm (QCOM) about a possible partial or full acquisition.

While the $5 billion investment may sound lofty, some analysts have suggested that it would amount to little more than a drop in the ocean given the capital needed in the sector. That may be especially true for Intel, given its technological lag versus peers like TSMC.

Intel Seems Cheaper than Nvidia & AMD

Despite all these issues, reports, and turbulence, Intel appears cheaper than its peers Nvidia and AMD. While INTC stock trades at 91x forward earnings, according to analysts EPS will improve significantly in the coming years. Resultantly, the estimated forward price-to-earnings (P/E) ratio falls to 20.3x for the year ending December 2025 and to 12.6x in 2026.

By comparison, Nvidia is trading at 43x forward earnings, and 30.9x earnings for the year ending January 2026. This figure falls to 26.3x for the year to January 2027 and 24.3x for 2028. AMD’s valuation metrics are also higher, with the stock trading at 31x forward earnings for the year ending December 2025, and 21.8x forward earnings for the year ending December 2026. That suggests Intel is actually significantly cheaper than its peers, albeit without taking account of cash positions.

Is Intel Stock a Buy According to Analysts?

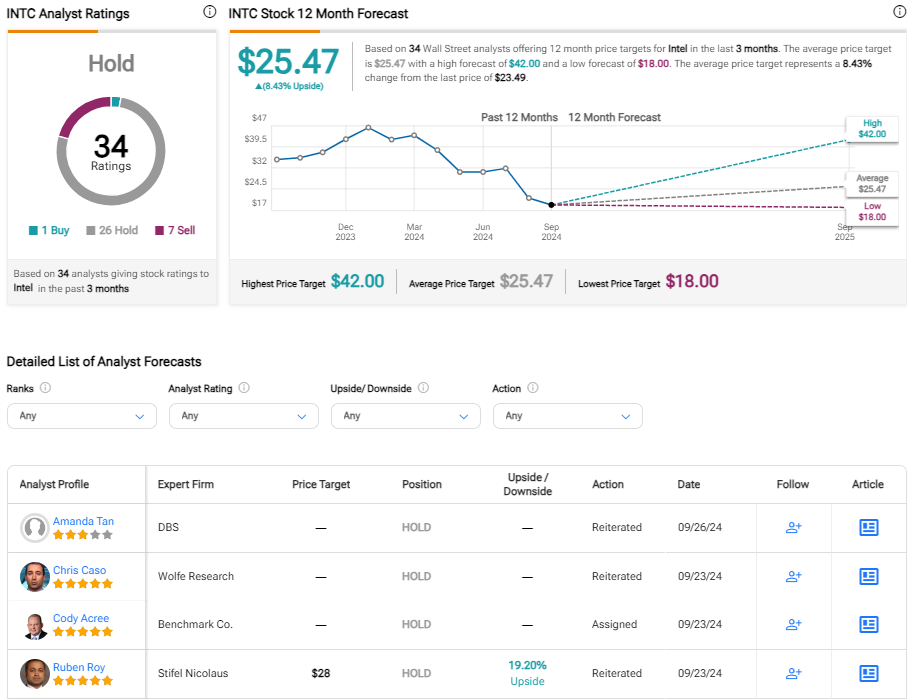

On TipRanks, INTC comes in as a Hold based on one Buy, 26 Holds, and seven Sell ratings assigned by analysts in the past three months. The average Intel stock price target is $25.47, implying almost 10% potential upside.

The Bottom Line on Intel Stock

Intel’s recent rally on acquisition rumors has the stock trading within 10% of its share price target. It’s interesting to see that most analysts are neutral despite consensus forecasts that predict a strong recovery in earnings and very competitive forward valuation multiples. I believe the ongoing concerns about Intel’s industry relevancy compound existing concerns. It remains uncertain how much support the business might require to effectively compete with TSMC from a foundry perspective. I have a neutral view of INTC stock.