When corporate insiders start buying big in their own companies, investors should always take note. The reason is simple. The insiders may sell their stock due to all sorts of conditions, but they only buy for one: they believe the shares are on the way up. And they are in a position to know.

They know because they’re the movers and shakers. ‘Insider’ sometimes gets a bad flavor, but it’s really just the high-placed company officers who run the enterprises and know what’s going on, with an intimate knowledge that retail investors can’t match. We’re talking about the C-suite dwellers and the Board members – company leaders whose positions put them in a place to know.

Being human, they trade their shares on their knowledge, and the regulatory agencies require that they publish such trades. For the average investor, those published records are a potential gold mine. We can use tools, such as the Insiders’ Hot Stocks at TipRanks, to sort through the trades and find out why we should follow the insiders’ example.

So let’s do that, dip into the TipRanks data to look at two stocks that the insiders are loading up on, making buys in the million-dollar-plus range. Here are the details, and comments from the Street’s analysts.

Five Star Bancorp (FSBC)

We’ll start in the banking sector, with Five Star Bancorp. This is a holding company, like many bancorps, and operates as the holder of Five Star Bank, a community bank based in Roseville, California. The bank serves both private and commercial customers in Northern California, offering a full range of banking services for individuals, professional service providers, and small- and mid-sized business enterprises.

Five Star is a truly local banking enterprise, with 7 branch offices and 1 non-depository office in and around the Sacramento region. The bank prides itself on working closely with its customers, particularly commercial customers, to develop personalized banking plans that are in tune with local economic and business conditions.

All of this is something of a tall order for the bank, which has a market cap of $388 million, putting the company at the low end of the small-cap stock category. In a move to raise additional capital, the company announced in the last week of March a common stock offering of 3.45 million shares, with an additional 517,500 shares on option for purchase by the underwriters. The company expects to realize approximately $70 million in gross proceeds from the sale.

This gives us some context for the most recent insider buys for FSBC stock. Two members of the company’s Board of Directors, Larry Allbaugh and Robert Perry-Smith, each made substantial purchases. Allbaugh picked up 137,931 shares for $3 million, while Perry-Smith spent 1.75 million on 80,460 shares.

This bank company will report its results for 1Q24 later this month, but for now, we can look back at 4Q23 to get an idea of where it stands. The top line came to $28.62 million, down almost 7% year-over-year and missing the forecast by $0.39 million. The bottom line was better; the GAAP earnings per share came to 63 cents, 7 cents per share better than had been expected.

When we turn to the analysts, we find that D.A. Davidson’s Gary Tenner is bullish on this stock. He notes that the bank has a history of strong execution, and writes, “FSBC has been a historically strong grower, boasting a 3-yr loan CAGR of 26.8% (2020-2023). 2024 projected loan growth is in the 8% range, with a planned growth rate below the pace of deposit growth. With hires over the past year in the Bay Area, FSBC now has 10 Business Development Officers in the Bay Area alone, compared to 20 in the remainder of the franchise. With those adds, we think there is upside to the full-year loan growth outlook, although 1Q growth is likely modest given payoff activity earlier in the quarter. FSBC’s Bay Area hires have been primarily from Signature Bank; going forward the company is looking for incremental talent additions, which may come from Signature, or other institutions.”

These comments support the analyst’s Buy rating on the stock, and his $29 price target points toward a 31% share appreciation in the next 12 months. (To watch Tenner’s track record, click here)

There are only 2 recent analyst reviews on this stock, and they split to 1 Buy and Hold, each, for a Moderate Buy consensus rating. The stock is priced at $22.18 and its $28 average price target implies a 26% gain in the coming year. (See FSBC stock forecast)

OmniAb (OABI)

Now we’ll switch over to biotech, where OmniAb is working to discover new therapeutic antibodies. The company has created a proprietary line of transgenic animal platforms capable of producing fully human antibodies; that is, the animals contain genetically modified sequences from the human genome so that they can act as sources for therapeutic antibodies targeting human diseases.

OmniAb has been creating human antibodies in this manner since 2012, and the company’s repertoire has broadened to include other technologies such as antigen design. The common theme is the company’s commitment to remaining at the forefront of therapeutic antibody discovery, and the firm currently has 7 active transgenic animal lines capable of producing these antibodies. OmniAb also has multiple partnership programs with various biopharmaceutical companies, a situation that allows OmniAb to know what therapies are in demand – and to optimize its own discovery programs to best meet current needs.

On the financial side, Q4 revenue came in at $4.8 million, missing the estimates by $2.66 million and amounting to a big drop from the $35.3 million recorded in the same period of 2022. The company put the big drop down to a $25.0 million milestone payment recognized in the previous year, which was associated with the initial commercial transaction of Tecvayli (teclistamab) in the U.S. Additionally, there was a reduction in service revenue due to the conclusion of discovery activities related to specific ion channel programs. The bottom line was a net loss, of 14 cents per share by non-GAAP measures – but beat the forecast by a penny.

Looking at the insiders, we find that company President and CEO Matthew Foehr recently made a big purchase. In late March, he bought 225,000 shares for $1.167 million. Foehr now holds almost $17 million in company stock.

Foehr is not the only bull here. Analyst Matt Hewitt, of Craig-Hallum, has also staked out an upbeat stance on OABI shares, seeing the stock as an affordable entry into the long-term opportunity afforded by antibody technology. He says of the company, “Over the long-term, we believe OABI offers investors the ability to participate in the rapid growth of antibody-based therapies while at the same time protect them from the always present clinical risk, i.e. ‘coin flip situations’ associated with investing in this sector… We believe the current share price does not reflect the opportunity OmniAb can offer investors with a diversified shots on goal model in an attractive market.”

Hewitt goes on to reiterate his Buy rating here, and his $10 price target points toward a potential one-year upside of 89%. (To watch Hewitt’s track record, click here)

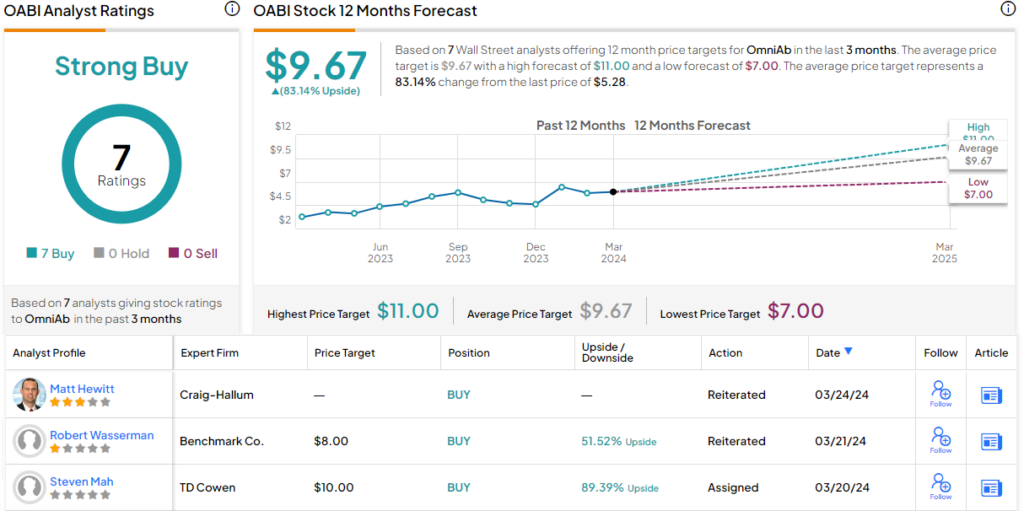

This stock’s Strong Buy consensus rating is unanimous, based on 7 recent positive reviews. The shares have a trading price of $5.28 and the $9.67 average price target suggests the stock will gain 83% on the one-year horizon. (See OABI stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.