Indonesia Energy (INDO) is an oil and gas exploration and production company based in Indonesia. I am bullish on the stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

All eyes are on the U.S. inflation numbers now, as well as inflation data around the world. However, the Consumer Price Index is heavily influenced by the recent rise in energy prices.

As long as fuel costs are high, inflation will probably also remain elevated. This makes it difficult to invest in certain market sectors, where high prices can weigh on corporate profits.

On the other hand, there are market segments that will benefit from high energy prices.

With that in mind, let’s get into the basics of Indonesia Energy and see what makes this international business worthwhile for today’s investors.

Small but Focused

Indonesia Energy completed its IPO in December 2019. The company specializes in advancing low-cost energy assets, particularly for oil and gas, in the country of Indonesia.

The company’s two main assets are known as the Kruh Block, which is already in production, and the Citarum Block, which is in the appraisal and development phase. Suffice it to say that while the Citarum Block is certainly promising, Indonesia Energy’s crown jewel is the Kruh Block asset.

Indonesia Energy describes the Kruh Block as a stable, cash-flow-generating asset that’s owned and controlled until 2030. This asset yielded 175 BOPD (barrels of oil per day) on average in 2021.

Here’s the real kicker, though. For the Kruh Block, the average production cost in 2021 was just $24.51 per barrel of oil. Therefore, even when oil was trading closer to $50 per barrel last year, Indonesia Energy was getting it out of the ground at a very low cost.

Of course, the WTI (West Texas Intermediate) crude oil price is significantly higher this year than it was last year. Not long ago, it reached an eye-popping $130 per barrel.

As we discussed earlier, this has had a dramatic effect on the inflation rate, and it’s not great news for most consumers. Yet, elevated oil prices can benefit energy companies, and particularly ones that can get oil out of the ground at a low cost.

Indonesia Energy fits this description perfectly. If the company can achieve a higher production rate this year for the Kruh Block, the profit potential could be huge.

Why Indonesia?

Even if you’re aware of Indonesia Energy’s profit potential, you might not be comfortable investing in a business that’s so far away. Why invest in an Indonesian energy company when there are investable oil and gas drillers closer to home?

That’s a fair question, and there are valid reasons to consider targeting Indonesia for energy-market wealth in 2022. You might be know it, but Indonesia is the largest economy in southeast Asia, and is the fourth most highly populated nation with more than 262 million inhabitants.

Moreover, Indonesia is the 16th largest global economy, plus a member of the G20 group of nations.

Indonesia Energy is situated in a nation that’s known for being rich in natural resources, including oil and natural gas. Furthermore, the demand for energy in Indonesia is expected to grow quickly. From 2016 to 2050, the nation’s total energy demand growth is predicted to be 5.3% per year.

It’s also encouraging to know that the government of Indonesia is friendly to the energy market. Reportedly, Indonesia’s government has initiated incentive plans in order to attract investors for the development of new oil and gas blocks — and oil majors are investing billions of dollars into this resource-rich country.

Wall Street’s Take

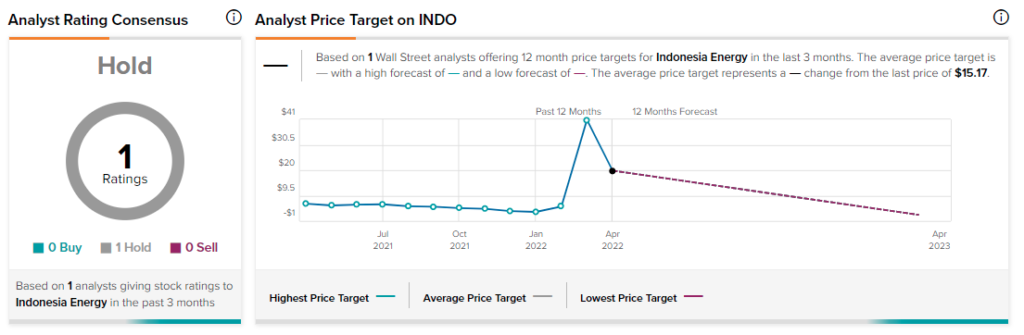

According to TipRanks’ consensus rating, INDO is a Hold, based on one Hold rating.

Right Time, Right Price

You’ve probably heard of the expression “right time, right place.” Indonesia is definitely operating at the right time because the prices and oil and natural gas are elevated this year.

Also, we’ve touched upon Indonesia Energy being in the right place to conduct oil and gas drilling operations. Clearly, Indonesia is an ideal place to pursue a low-cost energy business.

So, Indonesia Energy is at the right place at the right time. What about the “right price,” though? Does INDO stock have upside potential at its current price point?

The answer is definitely yes. The Indonesia Energy share price has been as high as $86.99, but recently came down to $15 and change. This represents a prime opportunity to buy a stake in a low-cost driller at a low price.

Just bear in mind that macroeconomic factors, and especially the prices of oil and natural gas, will have an impact in INDO stock.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure