After a ho-hum 2022 in which the stock lost 3.5% on a total-return basis, Microsoft (NASDAQ:MSFT) is back with a bang in 2023, with a gain of over 41.5% year-to-date. Investor interest in artificial intelligence (AI) is surging, and few companies are better positioned to capitalize on this next wave of technological advancement than Microsoft.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Microsoft invested $1 billion in ChatGPT and Dall-E parent company OpenAI from 2019 to 2021, long before AI was the talk of the town, and doubled down with a massive $10 billion investment in OpenAI this year. Additionally, Microsoft is incorporating ChatGPT into its Bing search engine, which could help it to at least chip away at some of Alphabet’s (NASDAQ:GOOGL) (NASDAQ:GOOG) dominance in search through Google. Microsoft is also leveraging AI to improve its Azure cloud offerings.

If you are looking to gain exposure to this tech behemoth in your portfolio, one way to do so would be via ETFs. This allows investors to invest in Microsoft while also gaining exposure to other technology stocks that could benefit from similar themes and growth drivers. Because Microsoft is the second-largest company in the world, with a massive market valuation of nearly $2.5 trillion, you’ll find the stock in plenty of ETFs. However, one Microsoft ETF particularly stands out as a long-term winner, with a proven track record of performance, low management fees, and a massive stake in Microsoft — the Technology Select Sector SPDR Fund (NYSEARCA:XLK).

Big-Time Microsoft Exposure

The Technology Select Sector SPDR Fund is an ETF from State Street that invests in the technology sector of the S&P 500 (SPX), and it has a massive position in Microsoft. In fact, because Microsoft is such a large component of the S&P 500, it makes up nearly a quarter of this $46 billion ETF’s assets.

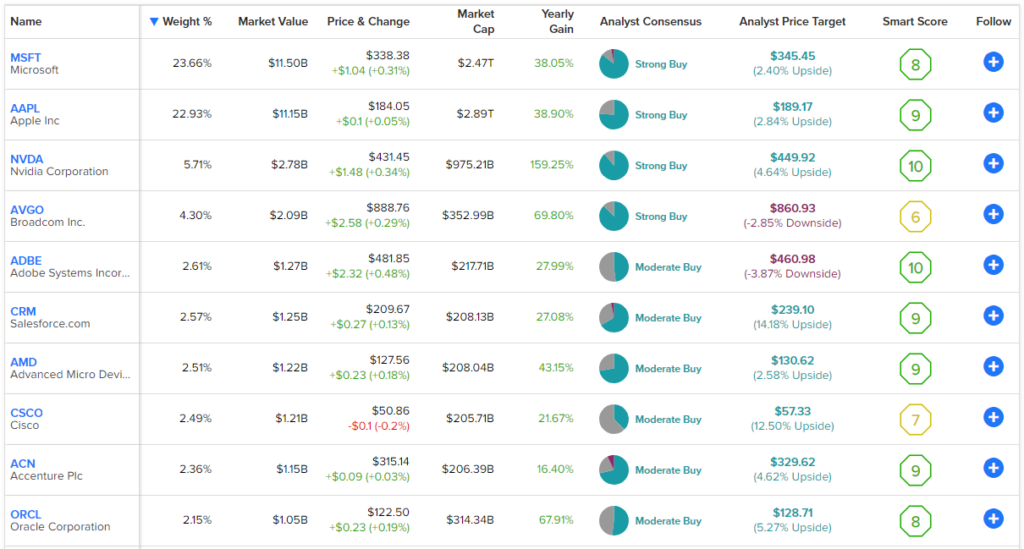

You can get an overview of the rest of XLK’s top 10 holdings using the chart below from TipRanks’ holdings tool.

As you can see, Microsoft is XLK’s largest holding with a 23.7% weighting, but the second-largest holding, Apple (NASDAQ:AAPL), isn’t far behind with a 22.9% weighting. Together, the two tech giants account for nearly 50% of assets. Altogether, XLK has 66 holdings, and its top 10 make up 71.4% of the fund.

Beyond these two dominant technology names, Nvidia (NASDAQ:NVDA) is XLK’s third-largest holding. Nvidia’s semiconductors are crucial for powering generative AI applications like ChatGPT and Dall-E. Nvidia is joined by other leading semiconductor names like Broadcom (NASDAQ:AVGO) and Advanced Micro Devices (NASDAQ:AMD) in the top 10.

Beyond these stocks, you’ll also find enterprise software names like Salesforce (NYSE:CRM), Adobe (NASDAQ:ADBE), and Oracle (NYSE:ORCL) that harbor their own AI ambitions. Salesforce will be holding an “AI Day” on June 12th and is working on a spate of new products to bolster its core CRM offering. Adobe is incorporating generative AI into its offerings with its Firefly product, which has rejuvenated the stock and propelled it to its highest level in over a year. Meanwhile, Oracle is a legacy tech name like Microsoft, but that doesn’t mean it can’t learn new tricks. Oracle is investing in AI startup Cohere (which Salesforce and Nvidia have also invested in) and will integrate its tools into its products.

When it comes to Smart Scores, it’s hard to beat XLK’s top 10 stocks. The Smart Score is TipRanks’ proprietary quantitative stock scoring system. It gives stocks a score from 1 to 10 based on eight key market factors. The score is data-driven and does not involve any human intervention. A Smart Score of 8 or above is equivalent to an Outperform rating. As you can see in the chart, eight of XLK’s top 10 holdings feature Smart Scores of 8 or above. XLK itself has an ETF Smart Score of 8.

Investor-Friendly Expense Ratio

Another reason XLK is attractive is its low expense ratio of just 0.1%. This means that an investor allocating $10,000 to XLK would pay just $10 in fees in year one, and this beats many of the other ETFs you will find in the market today.

Reliable Track Record

Lastly, XLK is a long-term winner that has built a stellar performance track record over the years. The ETF is up 34.7% year-to-date, but it’s not just a flash in the pan. As of the end of May, over a three-year time frame, XLK has a total annualized return of 19.9%. This return is even more impressive when you remember that it’s taking last year’s bear market into account. Over a five-year time frame, XLK has returned 20% annually, and over the past 10 years, it has returned 19.6% annually.

Is XLK Stock a Buy, According to Analysts?

XLK enjoys a favorable view from Wall Street analysts, who collectively assign it a Moderate Buy rating. The average XLK stock price target of $176.64 represents upside potential of just 2.8% from here.

Of the 946 analyst ratings on the ETF, 63.6% are Buys, 31.9% are Holds, and just 4.4% are Sells.

The Takeaway — An ETF for Microsoft Lovers

There are other major tech ETFs out there with large positions in Microsoft. For example, the Invesco QQQ Trust (NASDAQ:QQQ) has a 12.9% position in the stock. QQQ is an excellent ETF, and while this is a large Microsoft position, it’s far below XLK’s 23.7% weighting. Furthermore, QQQ’s expense ratio of 0.2% is very reasonable, but it’s above XLK’s 0.1% expense ratio.

The Vanguard Information Technology ETF (NYSEARCA:VGT) is another top tech ETF. It has a sizable 19.3% position in Microsoft, but this is still slightly behind XLK’s. Nonetheless, VGT’s 0.1% expense ratio is equivalent to that of XLK’s. In reality, all three of these are great ETFs, but XLK is the top choice for ETF investors looking for large Microsoft exposure.

It’s also hard to beat XLK’s total returns over time, and based on this track record, its low expense ratio, and 23.7% weighting towards Microsoft, this is a great ETF for investors who want to gain exposure to Microsoft while also being diversified into other stocks.

Looking for a trading platform? Check out TipRanks' Best Online Brokers guide, and find the ideal broker for your trades.

Report an Issue