Tech stocks have taken the market by storm in 2023 as investor excitement about AI soars, and semiconductors are increasingly in the spotlight. However, with this renewed focus on tech comes an increasing focus on technology as a geopolitical and national security issue. Tech independence is important to the U.S., and this is a theme that the iShares U.S. Tech Independence Focused ETF (BATS:IETC) seeks to capitalize on.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

For context, U.S. politicians have discussed banning the sale of certain semiconductors and other technologically sensitive products to China, and there is also plenty of discussion about how reliant U.S. tech companies are on China (and other countries) for key components and parts of their supply chain. Case in point, China has restricted the export of certain metals that are important to the manufacture of semiconductors.

In America’s polarized political landscape, tech independence is one of the few issues that seems to have support on both sides of the political divide. Last year, the CHIPS Act, which was designed to boost investments in the U.S. semiconductor industry and increase the country’s capacity to fabricate semiconductors domestically, passed with relatively strong bipartisan support. With all of this in mind, let’s check out the IETC ETF.

What is the IETC ETF’s Strategy?

IETC launched in 2018 and it is still a relatively small, undercovered ETF, with just $153 million in assets under management. As discussed above, IETC plays on the growing focus on tech as a geopolitical issue by giving investors “exposure to U.S. companies with a focus on U.S. tech independence,” according to iShares.

It also seeks to “capture the evolving landscape of technology-focused companies through BlackRock’s (NYSE:BLK) proprietary data” and to place a “thematic focus on companies which could benefit from more resilient value chains.”

As we saw during the COVID pandemic, when lockdowns around the world and other logistical bottlenecks wreaked havoc on the supply chains of many companies, the fragility of the modern world’s complex and interconnected economy and supply chains is a key factor that companies must navigate over the long term. Companies with strong control over their entire supply chain, or more domestic supply chains, stand to benefit from the increased focus on these issues.

IETC’s Holdings

So what does a portfolio of stocks with a strong focus on U.S. tech independence look like in practice?

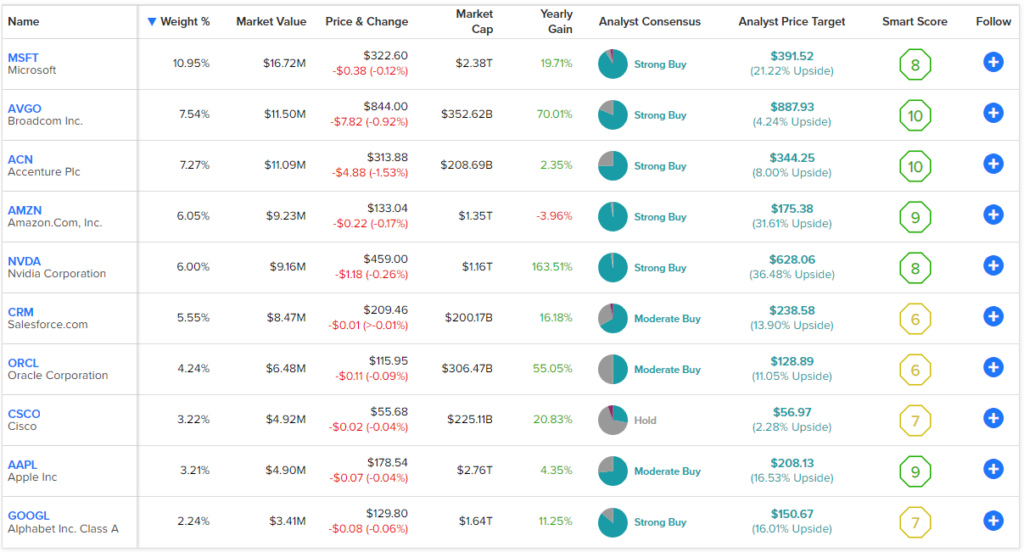

IETC holds 172 stocks, and its top 10 holdings account for 56.3% of the fund. Below, you’ll find an overview of IETC’s top 10 holdings using TipRanks’ holdings tool.

IETC’s top holdings likely look fairly familiar if you’ve looked at other large-cap tech ETFs, but there is one notable difference — Apple (NASDAQ:AAPL), which dominates many tech funds as the top position, is notable in that it only has a small weighting here. This is likely because much of Apple’s supply chain is reliant on other countries. Instead, Microsoft (NASDAQ:MSFT) takes top billing in IETC with a 10.95% weighting.

The rest of IETC’s holdings include semiconductor companies like Broadcom (NASDAQ:AVGO), Nvidia (NASDAQ:NVDA), Advanced Micro Devices (NASDAQ:AMD), and Intel (NYSE:INTC), tech mega caps like Amazon (NASDAQ:AMZN), Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) and Meta Platforms (NASDAQ:META), and SaaS leaders like Salesforce (NYSE:CRM), Adobe (NASDAQ:ADBE), and ServiceNow (NYSE:NOW).

Older tech companies like IBM (NYSE:IBM) and Oracle (NYSE:ORCL) that are in the process of reinventing themselves with offerings in cloud, AI, and big data are also present. Lastly, another interesting aspect of IETC is that it also includes several companies that we don’t necessarily think of as tech companies but possess critically important technology, like aircraft manufacturer Boeing (NYSE:BA), communications equipment maker Motorola Solutions (NYSE:MSI), and defense contractor Lockheed Martin (NYSE:LMT), among others.

Solid Long-Term Performance

IETC launched in 2018, so it hasn’t been around for a long time, but it has now been around for long enough that we can begin to get an idea of its performance track record, and the early results are promising.

As of the end of July, IETC had a one-year total return of 21.4%. Over the past three years, the fund had a very respectable annualized total return of 12.7%. Zooming out to five years, IETC posted an excellent annualized total return of 17.7%.

How do these results stack up against the broader market? Using the same parameters, the Vanguard S&P 500 ETF (NYSEARCA:VOO) returned 12.9% over the past year, 13.7% on an annualized three-year basis, and 12.2% annualized on a five-year basis. As you can see, IETC has outperformed the broader market over the past year and on a five-year basis but has slightly underperformed it on a three-year basis, which is a pretty good overall performance.

These results are also largely on par with those of the tech-centered Invesco QQQ Trust (NASDAQ:QQQ), which is a good ETF to compare IETC to, given that they both focus on the same industry and because QQQ is widely used as a proxy for talking about the tech sector as a whole.

Using the same parameters from above, QQQ had a one-year total return of 22.5%, a three-year annualized total return of 13.7%, and a five-year total return of 17.6%. As you can see, on a five-year basis, the results of IETC and QQQ are nearly identical.

Reasonable Fees

Another nice thing about IETC is that while its expense ratio of 0.18% isn’t necessarily the cheapest out there (especially in comparison to broad market index funds), it is actually relatively inexpensive compared to many of the more specialized and sector-specific ETFs on the market.

For example, its expense ratio is slightly cheaper than that of QQQ, which charges 0.2%, but it’s more expensive than that of another tech-focused ETF, the Technology Select Sector SPDR Fund (NYSEARCA:XLK), which charges 0.10%. However, overall, this is a relatively reasonable fee, especially for a smaller, sector-specific ETF.

Ultimately, the fund’s expense ratio of 0.18% means that an investor allocating $10,000 to IETC will pay $18 in fees during their first year of investing in it and $230 over the course of 10 years.

Is IETC Stock a Buy, According to Analysts?

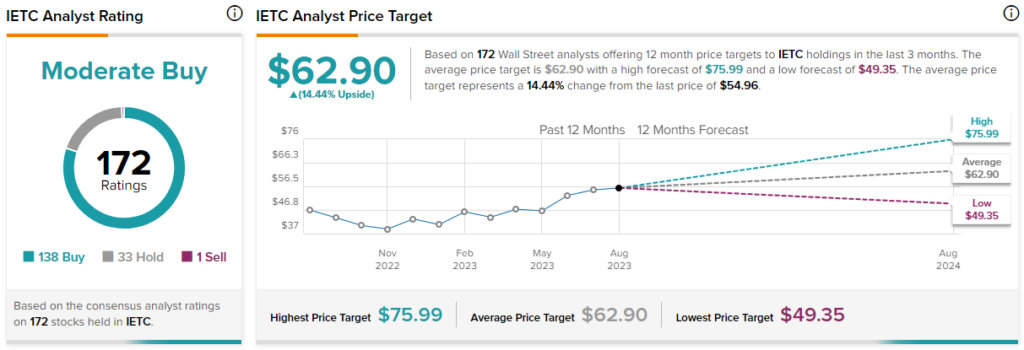

Turning to Wall Street, IETC earns a Moderate Buy consensus rating based on 138 Buys, 33 Holds, and one Sell rating assigned in the past three months. The average IETC stock price target of $62.90 implies 14.4% upside potential.

A Beneficiary of Long-Term Trends

In conclusion, this year’s exciting advances in technology have propelled tech stocks while also bringing renewed attention to the sector as one that is vital to national security and geopolitical posturing. As technologies like artificial intelligence and quantum computing continue to advance, the focus on this theme seems likely to increase in intensity as time goes on, especially as it seems to have become an important issue to U.S. politicians on both sides.

IETC looks like a good way to play this theme, with strong exposure to these geopolitically-important tech companies (as well as high-tech manufacturers, defense contractors, and others), a strong long-term performance, and a reasonable expense ratio.