Oil prices are quietly making a comeback this summer, rallying from below $70 a barrel as recently as mid-June to nearly $80 today. The iShares U.S. Oil & Gas Exploration Exploration & Production ETF (BATS:IEO) is an interesting and underrated way to gain exposure to the trend.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Last week, ETF issuer VanEck pointed out that oil prices recently hit an eight-month high and expects oil to “hold its value” based on production cuts from OPEC+, Saudi Arabia, and Russia. Similarly, asset manager BlackRock (NYSE:BLK) — the parent company of IEO’s sponsor, iShares — said that it remains “constructive on energy stocks thanks to constraints on supply and attractive valuations.”

With oil seemingly in an uptrend and stocks looking attractive, here’s why IEO could be a good way to invest in the sector.

What is IEO’s Strategy?

With just under $700 million in assets under management (AUM), IEO is a relatively small ETF from BlackRock’s iShares that launched in 2016. iShares says that IEO “gives investors exposure to U.S. companies that are engaged in the exploration, production, and distribution of oil and gas.” These exploration and production companies are also sometimes referred to as “upstream” energy companies.

This makes IEO a particularly interesting way to play an uptick in oil prices, as these exploration and production companies tend to have more leverage to both the upside and downside of oil prices than their downstream and integrated peers.

You can see this in the results, as IEO has returned 10.8% in just the past month, and 16.9% over the past three months, as oil prices have increased, outpacing the returns of the more generalized Energy Select Sector SPDR Fund (NYSEARCA:XLE), which has returned 7.6% and 10.1% over the same time frames. That being said, investors should also be aware that this can work against IEO when oil prices are declining.

IEO’s Holdings

IEO owns 50 stocks, and its top 10 holdings make up 67.7% of the fund. Below, you’ll find an overview of IEO’s top 10 holdings using TipRanks’ holdings tool.

One interesting thing about IEO is that it doesn’t own ExxonMobil (NYSE:XOM) or Chevron (NYSE:CVX), two of the mega-cap U.S. energy companies that dominate many other oil and energy ETFs. They most likely aren’t included here because while they are involved in exploration and production, they are integrated oil companies that are also involved in refining and downstream activities. Thus, they’re not pure plays on this E&P theme.

One thing I really like about IEO is that its holdings are attractively valued, even after the recent rally that they have enjoyed. IEO’s average price-to-earnings multiple stood at just 5.6 at the end of July. This is a massive discount to the S&P 500 (SPX), which currently features an average price-to-earnings ratio of about 20. This low multiple should give investors some margin of safety when investing.

Investors should note that IEO’s top holding, ConocoPhillips (NYSE:COP), has a very large 17.7% weighting in the fund. This isn’t necessarily a bad thing, as ConocoPhillips has a ‘Perfect 10’ Smart Score, but it is something investors should be aware of.

The Smart Score is a proprietary quantitative stock scoring system created by TipRanks. It gives stocks a score from 1 to 10 based on eight market key factors. A score of 8 or above is equivalent to an Outperform rating. ConocoPhillips isn’t IEO’s only top 10 holding with a Perfect 10 Smart Score. It’s joined by Pioneer Natural Resources (NYSE:PXD) and Phillips 66 (NYSE:PSX).

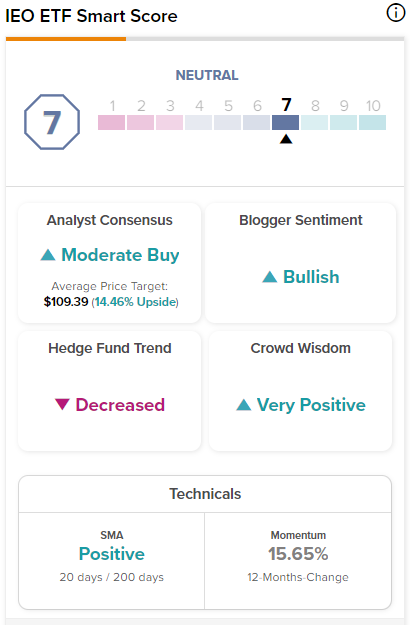

All told, an impressive seven of IEO’s top 10 holdings feature outperform-equivalent Smart Scores of 8 or better. IEO itself features an ETF Smart Score of 7 out of 10.

Is IEO Stock a Buy, According to Analysts?

Turning to Wall Street, IEO has a Moderate Buy consensus rating, as 78% of analyst ratings are Buys, 16% are Holds, and 6% are Sells. At $109.39, the average IEO stock price target implies 14.46% upside potential.

Dividend Yield and Track Record

Additionally, IEO is also a great dividend ETF, with an attractive dividend yield of 3.9%. Not only that, but IEO has a long and sturdy track record, having paid a dividend for 16 straight years. It has also increased its payout for five years in a row.

IEO’s Fees

IEO has an expense ratio of 0.4%. While this isn’t excessively expensive, it’s also not exactly a bargain either. An investor putting $10,000 into IEO would have to pay $40 in fees during year one. However, these fees compound over time, and over the course of a 10-year investment, this investor would have to pay $505 in fees.

Volatile Performance

Oil prices are known to be volatile, so it’s perhaps unsurprising that IEO’s long-term performance is a bit of a mixed bag. In recent times, its three-year annualized total return of 48.5% is nothing short of jaw-dropping, coinciding with a time period when oil surged off of the low that it fell to during the pandemic.

However, widening the lens to a longer timeframe, its performance over a longer timeframe has been much more pedestrian, with a five-year annualized return of 7.7% and a 10-year annualized return of just 4.6%.

Looking Ahead

With an attractive dividend yield, a strong group of upstream oil holdings, and a Buy rating from analysts, IEO looks like a strong choice for investors looking to gain exposure to oil and the energy sector. The main downsides are its somewhat middling expense ratio and its up-and-down long-term performance. However, if oil prices remain elevated for an extended period, IEO looks like a good ETF to consider for a buy-and-hold strategy.