Top cryptocurrencies, like Bitcoin (BTC-USD) and Ethereum (ETH-USD), are surging in 2023, driving crypto ETFs to massive year-to-date gains. In fact, many of 2023’s best-performing ETFs are crypto-focused ETFs. The iShares Blockchain and Technology ETF (NYSEARCA:IBLC) is one of the year’s major winners, but it’s often overlooked by investors. While it has racked up a scorching 113.4% year-to-date gain in 2023, it has just $9.2 million in assets under management (AUM).

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

IBLC is worthy of more investor attention. While cryptocurrency and the ETFs that invest in crypto-related stocks can be volatile, I’m bullish on IBLC based on its strong performance, diversified exposure to different types of crypto-related stocks, and the relatively reasonable expense ratio that it sports compared to its peers. Plus, as an added bonus, IBLC pays a dividend (albeit a small one), which is a rarity in this space.

What is the IBLC ETF’s Strategy?

According to iShares, the “iShares Blockchain and Tech ETF seeks to track the investment results of an index composed of U.S. and non-U.S. companies that are involved in the development, innovation, and utilization of blockchain and crypto technologies.”

iShares says that IBLC seeks to give investors “targeted yet diversified” exposure to the space, which it achieves through its holdings, as we’ll discuss in the next section.

IBLC’s Holdings

IBLC holds 36 different stocks, and its top 10 holdings make up 72.6% of assets. Below, you can view IBLC’s top 10 holdings using TipRanks’ holdings tool.

IBLC isn’t really diversified in the traditional sense of the word, as it doesn’t own a huge number of stocks, and its top holdings make up a large percentage of its assets.

But as a targeted bet on the growth of the cryptocurrency industry, it offers diversification by offering exposure to many different types of companies involved in the space.

While some crypto-themed ETFs focus mainly on Bitcoin miners and Coinbase Global (NASDAQ:COIN), IBLC casts a wider net.

Coinbase is still the top holding here, with a 17.7% weighting. The fund also owns quite a few Bitcoin miners like Marathon Digital (NASDAQ:MARA) and Riot Platforms (NASDAQ:RIOT), but it also owns leading semiconductor companies, like Nvidia (NASDAQ:NVDA) and Advanced Micro Devices (NASDAQ:AMD), which make the graphic processing units (GPUs) that these miners use to mine Bitcoin and other proof-of-work cryptocurrencies (along with many other uses).

IBLC also owns major fintech companies that are delving further into cryptocurrency, like Block (NYSE:SQ) and Paypal (NASDAQ:PYPL).

Paypal allows users to buy, sell, and hold cryptocurrencies like Bitcoin, Ethereum, Litecoin (LTC-USD), and Bitcoin Cash (BCH-USD) on its platform. It even recently launched its own dollar-denominated stablecoin called PayPal USD (PYUSD).

Similarly, Block’s popular CashApp allows users to buy, sell, send, and receive Bitcoin and even has a feature that allows users to automatically convert a percentage of their paychecks to Bitcoin.

There’s even room for an old school tech giant like IBM (NYSE:IBM) in this fund. While IBM likely isn’t the first stock that comes to mind when one thinks of crypto, the company offers blockchain technology solutions and services to its enterprise customers.

A Comparatively Reasonable Expense Ratio

One thing that I like about IBLC is that its expense ratio is very reasonable compared to those of its peers. In a vacuum, IBLC’s 0.47% expense ratio isn’t exactly cheap, especially compared to broad-market index funds.

But compared to its peers (other crypto ETFs), it is actually the best deal around. For example, the more popular Bitwise Crypto Industry Innovators ETF (NYSEARCA:BITQ) charges a much higher 0.85%. The interesting but costly Amplify Transformative Data Sharing ETF (NYSEARCA:BLOK) charges 0.75%, the Grayscale Future of Finance ETF (NYSEARCA:GFOF) charges 0.70%, and the First Trust Indxx Innovative Transaction & Process ETF (NASDAQ:LEGR) charges 0.65%.

The VanEck Digital Transformation ETF (NASDAQ:DAPP) charges a comparable but still slightly higher fee of 0.50%.

Let’s compare IBLC to BITQ to see what these fees mean in practice. IBLC’s 0.47% expense ratio means that an investor putting $10,000 into the fund will pay $47 in fees in year one. An investor putting $10,000 into BITQ will pay $85.

The disparity between these expense ratios becomes even more pronounced over time. Assuming that each fund returns 5% per year going forward and maintains its current expense ratio, the IBLC investor would pay $591 in fees over the course of 10 years, while the BITQ investor would pay an eye-popping $1,049 in fees. As you can see, investing in an ETF with a lower expense ratio, like IBLC, versus one with a higher expense ratio can make a meaningful difference to your portfolio over time.

Below, you can check out a comparison of IBLC and some of these peers using TipRanks’ ETF Comparison Tool, which allows investors to compare up to 20 ETFs at a time based on a variety of criteria that they can select.

In the grand scheme of things, this isn’t a “cheap” ETF. But for investors looking to gain exposure to crypto-themed stocks in ETF form, it is a comparatively cost-effective option.

Is IBLC Stock a Buy, According to Analysts?

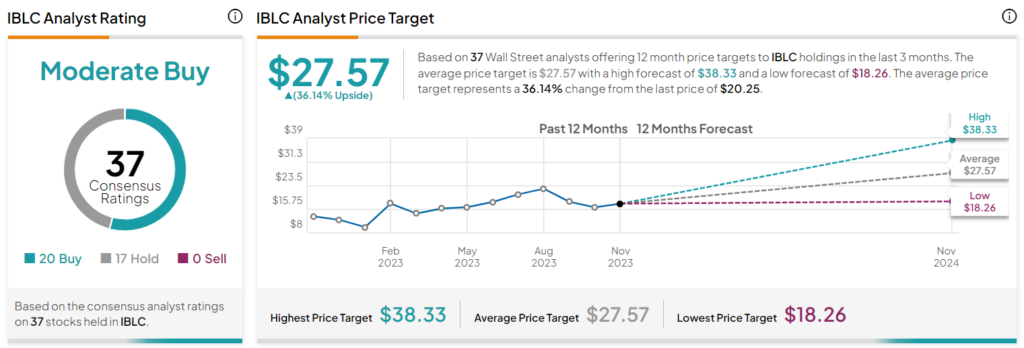

Turning to Wall Street, IBLC earns a Moderate Buy consensus rating based on 20 Buys, 17 Holds, and zero Sell ratings assigned in the past three months. The average IBLC stock price target of $27.57 implies 36.1% upside potential.

A Crypto ETF That Pays a Dividend?

IBLC further burnishes its appeal to investors by being one of the rare crypto ETFs that pays a dividend. IBLC yields 1.3%, so it’s not a huge payout, but it is still a nice added bonus for investors.

Investor Takeaway

IBLC and its peers have posted strong performances in 2023, thanks to a resurgent crypto market which has featured strong rallies by Bitcoin, Ethereum, and other top cryptocurrencies.

With just ~$9 million in AUM, IBLC seems to be the most overlooked of these ETFs. However, I’m bullish on IBLC based on the wide-reaching crypto exposure offers, its strong year-to-date performance, its relatively cost-effective expense ratio, and the fact that it pays a dividend.