By arguably most measures, gaming juggernaut Flutter Entertainment (FLUT)—perhaps best known for its market-leading U.S. brand FanDuel—represents a risky venture. As exciting as sports betting is, the underlying economy suffers from significant challenges. That’s not great for consumer sentiment, which could easily weigh on this Wall St. darling with a unanimous buy rating from 20 different analysts. Nevertheless, nuanced data points suggest that the contrarian argument could win out. Therefore, I am bullish on Flutter.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Solid Fundamentals Build the Case for FLUT Stock

To be blunt, investors have no shortage of concerns to consider, from the Trump administration’s tariffs and subsequent trade wars to the blistering surge in gold prices. Essentially, this framework implies that consumers are reducing their discretionary spending. Such a backdrop naturally bodes poorly for enterprises like Flutter.

Nevertheless, management is issuing a different narrative: “Historically, our business has been very strong in the face of challenges from a consumer economics perspective, so we’ve always been quite defensive from that perspective,” Flutter CEO Peter Jackson told Reuters in an interview. “We’re a growth business. I think that even in the face of these sorts of macro and global challenges, the business will continue progressing,” Jackson emphasized.

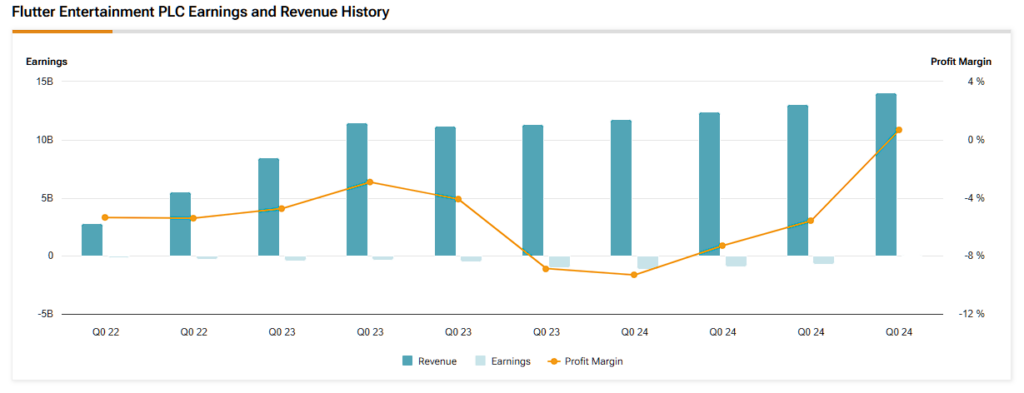

Of course, as the head executive of a major publicly traded company, one would expect a positive framing of the underlying business. However, the difference between Jackson’s conviction and the typical corporate cheerleading is the data. Profit margins are climbing.

It’s generally known that gambling expenditures enjoy growth during economic expansions but stagnate during recessions. Interestingly, though, an April 2024 report by The City University of New York revealed that despite Americans feeling glum about the economy, their gambling behaviors belie their beliefs.

Per the research, “[c]onsumer sentiment reached a record low in July 2022, and while it has improved somewhat since then, it is still nowhere near its pre-pandemic level. Yet gambling has surged. Spending on sports betting went up almost 50% since last year, and spending in casinos and on lottery tickets went up nearly 10%.”

The underlying economy may actually be stronger than it appears. Until the willingness to spend on discretionary pleasures like gambling noticeably fades, FLUT stock may be an opportunity when it encounters volatility. Apparently, management isn’t seeing gambling trends diminish — quite the opposite.

Keep in mind that FLUT stock currently trades at 2.93x its trailing 12-month (TTM) sales. One year ago, this metric was slightly higher at 2.96x. With experts pounding the table, this could be a discount hiding in plain sight.

Two Ways to Approach Flutter Entertainment

For speculative traders who prefer simplicity over complexity, the current price level of FLUT stock may represent an attractive entry point. From a technical perspective, the bulls will surely attempt to drive the price toward the prior high of nearly $300. Fundamentally, the gambling market has proven surprisingly resilient. Therefore, it wouldn’t be out of the question for Flutter stock to rise.

For those who want to dial in their speculation, they may turn to options trading. One factor that isn’t discussed as often as it should be is that FLUT stock commands an upward bias. Using pricing data from January 2019, a long position held for any given eight-week period has a nearly 60% chance of being profitable. Further, assuming the positive scenario, the median return over these eight weeks is 11.67%.

The next available options chain for FLUT stock expires on April 17, about three weeks away. Based on prior market trends, it’s not unreasonable to assume that FLUT could hit $240 by expiration. This would roughly align the equity with its 20-day exponential moving average. Those who want to place this wager may consider the 230/240 bull call spread.

The above transaction involves buying the $230 call and simultaneously selling the $240 call, both for the same April 17 expiration date. In this trade, the proceeds from the short call partially offset the debit paid for the long call. Should FLUT stock hit the short strike price at expiration, the maximum payout is nearly 82%.

Traders seeking even greater payouts may consider the 240/250 bull call spread expiring May 16. The mechanics are identical to the aforementioned trade, except that FLUT must reach $250 or above at expiration. Still, if this event materializes, the maximum payout is nearly 144%.

Is FLUT a Good Stock to Buy?

On Wall Street, FLUT stock carries a unanimous Strong Buy consensus rating based on 20 Buy, zero Hold, and zero Sell ratings over the past three months. FLUT’s average price target of $320.71 per share implies almost 48% upside potential over the next twelve months.

FLUT Stock Offers a Surprising Contrarian Opportunity

At first glance, given broader economic headwinds, Flutter Entertainment would appear to be a dubious wager. However, fundamental data demonstrates that sentiment is surprisingly robust, at least as far as the gaming industry is concerned. Because of this dynamic, the recent fallout in FLUT stock could represent a buying opportunity, both from long-term investment and short-term trading perspectives.