It’s difficult to figure out private courier FedEx (FDX), especially following the election of Donald Trump to a second term. Therefore, I am Neutral on FDX stock in terms of sentiment. However, neutrality doesn’t mean that one can’t profit from a non-committal standpoint. Thanks to options trading — specifically a strategy called the Long Iron Condor — speculators can potentially enjoy significant payouts.

First, let’s quickly discuss the broader landscape surrounding FDX stock. On the positive side, shares managed to climb back from the company’s terrible earnings results during its first fiscal quarter. Back in September, management revealed declining revenue and a reduced full-year guidance. Fortunately for the optimists, though, FDX has almost clawed back what it lost in terms of market value.

On the other hand, we can’t ignore the fundamental reasons why FedEx stumbled in the first place. As an economic bellwether, the company’s fiscal performance represents the pulse of the real economy. Further, Trump’s proposed tariffs could negatively impact the courier’s business. So, there’s every reason to believe that FDX stock can move in either direction, and that is definitely a benefit for the Long Iron Condor strategy.

Directional Uncertainty in FDX Stock May Be a Positive Development

In the open market, one generally needs to deploy a directional strategy to win. However, in the options arena, the ability to stack different transactions together creates unique opportunities. For the Long Iron Condor, the trader is focused on implied volatility (IV), specifically anticipating that IV will rise in the future. Therefore, as long as the target security either rises or falls significantly, there’s a chance for profitability.

To reiterate, the Long Iron Condor aligns with a neutral sentiment because we’re not sure whether FDX stock will ultimately move higher or lower. Rather, we’re convinced that shares will move strongly in either direction. Recently, the IV has been moving northward over the past few sessions. With the company projected to report Q2 earnings on Dec. 19, it’s possible (arguably probable) that IV will rise into the event.

Structurally, the Long Iron Condor is a combination of a Bull Call spread and a Bear Put spread. Therefore, this Condor features four strike prices. Maximum profitability is achieved when the target stock lands at or above the highest strike or falls to or below the lowest strike. Since this is a “Long” Condor, the trader begins from a cash outflow position (pays for the options).

Using Math to Pick Our Long Iron Condor

Generally, financial publication firms tend to superficially explain the process of picking the ideal Condor to what feels right to the trader. However, I would argue that there is a science to this approach. Fundamentally, if you’re too conservative, your Condor will cover a vast range of pricing possibilities, making it expensive. Even if you’re successful, you may incur an opportunity cost. Aggressive Condors will be relatively cheap but are unlikely to succeed.

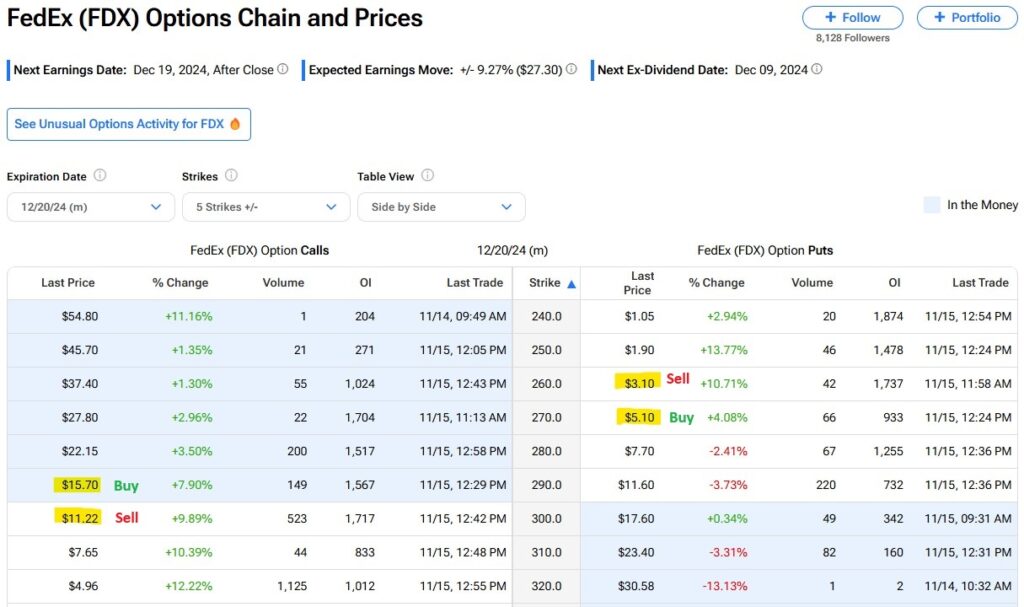

You want to find a happy medium. In other words, you want to extract as much payout (or yield) as possible while minimizing the risk. To do this, it’s important to establish a baseline trade, that is, a transaction that covers the full range of pricing possibilities that the market anticipates for a specific options chain. As an example, let’s look at the options chain expiring Dec. 20 (a day after Q2 earnings).

First, we’ll conduct a stochastic analysis, multiplying the share price with the option chain’s average IV and the time decay adjustment. Doing this exercise nets us a unit price of $34.44, meaning that FDX stock is anticipated to either rise to $328.90 or fall to $260.02. A good baseline trade is the 260.00P | 270.00P || 290.00C | 300.00C Condor, which risks $648 for the chance to gain $352 or a payout of just over 54%.

Other Compelling Condors to Consider

To be sure, while a 54% payout is nothing to scoff at — especially for a relatively boring entity like FDX stock — it’s also a limited reward for the money at stake. Plus, if the velocity of FedEx shares happens to be much more robust, we would have absorbed an opportunity cost for paying for protection that we didn’t need. After all, a capped call strike of $300 is put to waste if FDX ends up at $330.

To thin our condor’s coverage and thereby see a bigger payout, we could move up to the 270.00P | 280.00P || 310.00C | 320.00C condor. This trade puts $529 at risk in the hope of gaining $471 or a payout of 89%. Both the upper and lower max profitability thresholds are within reason based on the aforementioned stochastic calculations. Further, the breakeven prices to the upside and downside are $315.29 and $274.71, respectively.

For the real speculator, the 260.00P | 270.00P || 310.00C | 320.00C is available. This puts $469 at risk for the chance to gain $531; in other words, a 113% payout opportunity. The breakeven thresholds for this trade are $314.69 on the upside and $265.31 on the downside. Personally, I don’t like the idea of going more aggressive than this condor because you would be stretching credulity.

Wall Street’s Take on FedEx

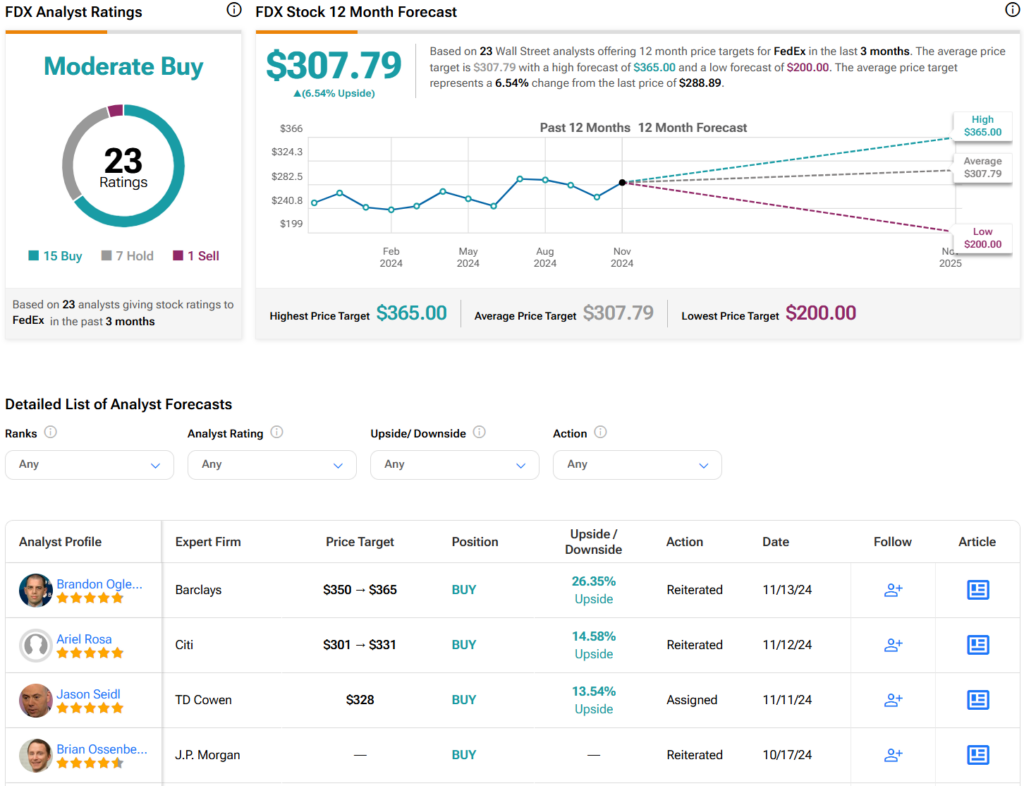

Turning to Wall Street, FDX stock has a Moderate Buy consensus rating based on 15 Buys, seven Holds, and one Sell rating. The average FDX price target is $307.79, implying 6.54% upside potential.

The Takeaway: Use Rising Volatility in FDX Stock to Your Advantage

Ultimately, the Long Iron Condor strategy offers a creative way to navigate FedEx’s uncertain outlook. By capitalizing on implied volatility and structuring a balanced trade, investors can potentially profit from significant moves in either direction. The key lies in striking the right balance between risk and reward, tailoring the condor to align with the projected price action of FDX stock, and your personal risk tolerance.

As always, it’s essential to approach options trading with discipline and an eye toward probabilities. While the opportunity for profit is compelling, the inherent risks require careful consideration. For those willing to dive into the intricacies of the Long Iron Condor, FedEx’s upcoming earnings report could present a well-timed occasion to put this strategy to the test.