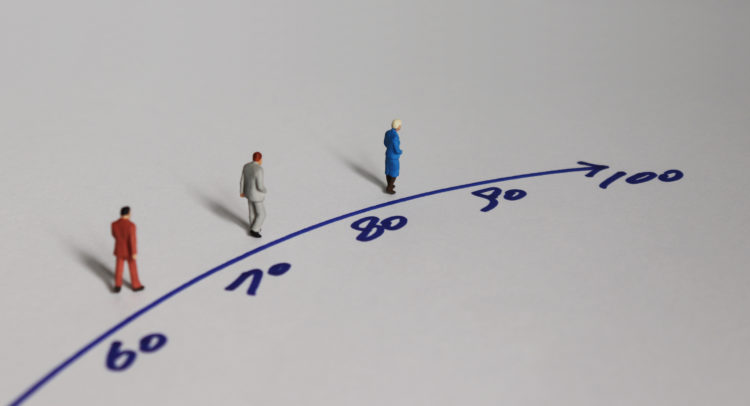

Humans have been around for quite a while. Thousands of years passed without a significant increase in human life expectancy. This started to change in the 19th and 20th centuries, with advances in the economy, society, technology, energy, medicine, and hygiene nearly doubling human life expectancy:

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

| Age | Life Expectancy |

| Pre-history (25,000 years ago) | 30-35 |

| London, early 1800s | 40 |

| Norway, 1850 | 45 |

| Norway, 1950 | 70 |

| Japan, 2019 | 84.5 |

| World average, 2019 | 72.6 |

All in all, on average, since 1840, human life expectancy has increased by three months per year. While the COVID-19 pandemic has slowed progress somewhat over the medium term, there is no reason to believe humans have reached some sort of biological limit and that there is no further room for improvement. Indeed, looking at the data from Gapminder for 2021, Japan and Singapore top the list with a life expectancy of about 85.2 years (the U.S. is at 79.1). A 25-year boost to lifespan was also one of Saxo Bank‘s outrageous predictions for 2022.

The Power of Compounding

We are all taught that starting to save early is really important to help us reach our financial goals. The same logic can be applied if we expand the investment horizon by increasing our healthspan (the number of years we live in good health), hence increasing the years we can devote a portion of our income to investments:

- If you save $5 for 40 years and earn 5% annually, you will have $604.

- If you save $5 for 45 years and earn 5% annually, you will have $798.5.

As you can see above, due to the importance of compounding the accumulated sum in the late stages of your investment lifetime, a 12.5% increase in the savings period (from 40 to 45 years) leads to a 32.2% increase in terminal value (from $604 to $798.5).

I would say 5% is a realistic long-term post-inflation return assumption. However, if you assume a 7.5% annual return, the extra five years of savings and compounding have an even greater effect of 46.1%.

Considering this data, you may incorporate a longer investment horizon in your financial planning.

Women Have an Advantage

On average, women tend to live five years longer than men. This has several implications, depending on whether you add the five years to time spent in work or time spent in retirement:

- If women work for five more years, they can attain a higher financial goal than men, thanks to their longer investment period. Alternatively, they may attain an investment goal identical to men but with a lower risk.

- If women enjoy five more years in retirement, all else equal, they have to spend an identical amount a man would spend but over five more years, meaning less spending in any given year.

Building on the above points, women should be more aggressive than men in their early investment careers thanks to their ability to recover from bear markets later on in life.

The Importance of Inflation

Over long periods of time, inflation can quickly add up. Hence, picking investments that mitigate its effect or even benefit from inflation to an extent is crucial for a successful retirement. Some good picks should include:

- Commercial or residential real estate that indexes rents to inflation.

- Farmland and timberland since they do not depreciate in time but are correlated with inflation (commodity output).

- Broad-based market indices since they capture general trends in the economy.

- Inflation-linked government bonds.

- Exposure to countries experiencing net migration and favorable demographics.

Investments to likely avoid would be:

- Perpetual fixed-rate bonds.

- Assets that depreciate quickly in time.

- Industries in terminal decline.

- Exposure to countries losing population.

Equity and Liquidity-Risk Premiums

Given an increasing investment horizon, it is important to capture as much of the equity-risk premium (investing in the higher risk portion of a company’s capital structure) and liquidity-risk premium (foregoing near-term liquidity for superior long-term investment returns) as you can.

Thus, you should consider investments in your own business, stocks, private equity, or infrastructure. Some tickers to consider for a long-term portfolio would be:

- A broad-based index such as the S&P 500 (SPY)

- Timberland stocks, such as Weyerhaeuser (NYSE:WY)

- Farmland stocks, such as Farmland Partners (NYSE:FPI)

- An ETF with exposure to Africa, such as (EZA) for South Africa or (NGE) for Nigeria

- An infrastructure fund, such as (UTF)

The Takeaway

Caught in the day-to-day market news, we sometimes overlook long-term trends. Increasing life expectancy has wide-ranging societal and economic consequences, which are almost indistinguishable over the short term. However, not incorporating a longer investment horizon in your capital allocation can undermine even the soundest financial plan.

Accounting for the cumulative effects of inflation and capturing as much of the equity and liquidity risk premiums is vital for achieving your financial goals. Women can also take advantage of their statistically longer lifespan to be more aggressive with their investments early on.