Hikma Pharmaceuticals (GB:HIK) shares started a downward trend after it reported its interim results for 2022 on August 4 – but the stock might offer a decent option for longer-term investors.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

The company’s revenues were flat at $1.2 billion, as revenue growth in injectables and branded medicines segments was offset by a decline in generics segment. The company downgraded its guidance for generics for the full year.

Shareholders reacted adversely, and the stock has lost 30% of its value since then. Overall, the stock has been trading down by 46% in the last year.

Looking more closely at the numbers, the performance doesn’t feel so bad, and the recent fall has led to a buying opportunity for the shares.

What does Hikma Pharmaceuticals make?

Hikma manufactures and sells a vast range of generic, branded, and specialty medicines for global customers. The company has a product portfolio of around 670 medicines and 32 manufacturing plants.

Product categories include oncology, pain management, antibiotics, respiratory, cardiovascular, and many more.

The company operates through three business segments: branded, injectables, and generics. Some of its products are amoxicillin, prednisone, Robaxin, argatroban, amoclan and Suprax.

The road ahead

The company’s generics segment revenue saw a decline of 18% due to the tough competitive conditions in the market, especially in the U.S. The performance was also hit by some product delays, which are now expected in 2023.

The company expects its generics revenue to be in the range of $650 million to $675 million for the full year 2022, instead of $710-750 million as announced earlier.

The company is positive about the new launches, including Ryaltris and Xyrem, which will bring the generics business back to growth in 2023.

Hikma is also focused on its injectable segment, which is a high-margin business. This segment saw its operating profit go up by 12% and the operating margin grew to 38.8%. The company further expanded its European market by launching its injectable business in France. Moreover, it is further investing in MENA to produce injectables locally in the region.

Hikma Pharmaceuticals dividends

The company announced an interim dividend of 19 cents per share, up from 18 cents last year. The company’s dividend yield is 3.03%, higher than the sector average of 1.57%.

Time and again, the company has proven its intentions of growing shareholder returns. Even though the yield is not the highest in the sector, it is stable and supported by profits.

Is Hikma Pharmaceuticals a buy?

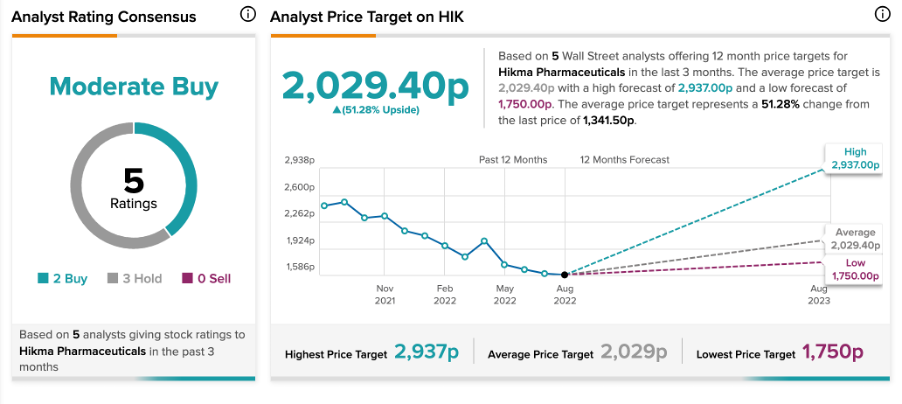

According to TipRanks’ analyst rating consensus, Hikma is a Moderate Buy. It has a total of five ratings, including two Buy and three Hold recommendations.

The HIK target price is 2,029.4p, which represents a 51.1% change in the price from the current level. The price has a high and a low forecast of 2,937p and 1,750p, respectively.

Conclusion

Despite its recent woes, the company’s strategy of product expansion will lead to more growth opportunities. A diverse portfolio, when combined with its dividend track record, makes it an attractive opportunity for investors.