As the leader of the burgeoning EV ecosystem, Tesla (TSLA) is unsurprisingly focused on growth. And that’s the trade-off when it comes to hot technology enterprises. Most such names are obsessed with cornering the market, leaving little room for rewarding shareholders in the form of dividends. However, with a surprisingly simple options strategy, it’s possible to extract a massive 29% yield in TSLA stock over a short time period.

Fundamentally, the EV manufacturer appears stuck in a precarious situation. Yes, many Wall Street analysts are bullish on TSLA stock. However, quite a few are outright bearish on the enterprise. At the moment, most market experts have joined DBS analyst Elizabelle Pang in rating TSLA as a Hold. In particular, Tesla’s second-quarter earnings miss and a soft EV industry pose risks to the company’s top line.

Still, it’s difficult to ignore that the EV maker enjoys rich grassroots support. While the performance in the charts this year has been wildly choppy, Tesla has gained almost 19% in the trailing month. Plus, the economy may be stronger than anticipated, which adds some positivity to the mix. Overall, I believe the fundamentals balance each other out, and therefore, I’m Neutral on TSLA stock. Nevertheless, there’s a way to enjoy significant yield, which I’ll explain below.

Using Derivatives to Receive Income

Even with Tesla focused exclusively on growth, the derivatives or options market allows traders to receive income from TSLA stock. This is due to the nature of options trading. Typically, a retail trader will buy derivatives (calls for the bulls, puts for the bears). However, the other side of the transaction — the option seller or writer — receives income from underwriting the risk.

Suppose you decide to buy a flashy sports car and want to race it. Knowing the higher risks of getting involved in a car accident, you buy insurance. Effectively, you’re paying a debit for the privilege of acquiring insurance. On the other side of the transaction, the insurance company is receiving the credit to underwrite the risk that you won’t get into a serious wreck.

Ultimately, with options, you can choose to be the insurance company for TSLA stock. By doing so, you’re underwriting the risk that the EV maker’s equity value won’t plummet. It’s not really a decisively bullish sentiment, nor is it particularly bearish. Instead, such a framework could be appropriate for those who hold a Neutral view on Tesla.

Setting Up the Yield for Tesla Options

Primarily, the most common way for stakeholders of TSLA stock to generate income is to sell a cash-secured put. Basically, you show your broker that you have money to cover a sold TSLA put option. After selling it, you receive the credit or income. Now, you hope that shares move sideways or higher, resulting in the put option expiring worthless.

However, the market isn’t predictable, and the trade could move against you. If TSLA stock plunges, the put option risks becoming in the money (ITM). If that happens, you risk getting assigned shares, meaning you’re forced to buy 100 shares of TSLA. Considering that the EV manufacturer’s equity is priced around $250, a Tesla assignment represents an expensive proposition.

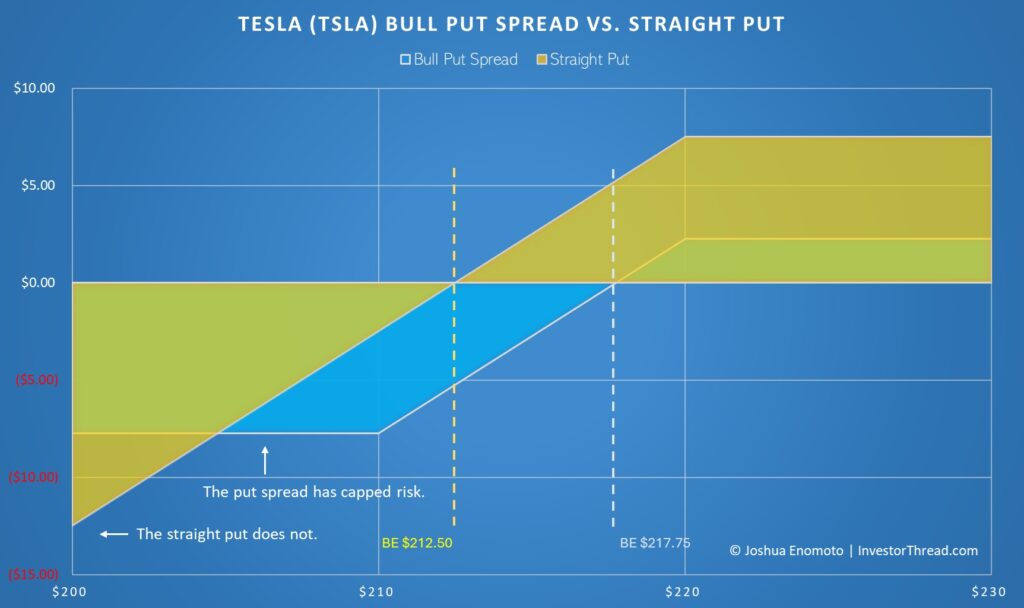

That’s where an options strategy called the bull put spread enters front and center stage. Like the straight put, you still generate income off the sale of a put. However, you simultaneously buy a put at a lower strike price. This acquisition of a long put caps off the risk posed by your short put. Your income received will be lessened by the debit paid for the long put your risk will be limited.

A Real-World Example

Let’s look at a real-world example. One possible idea to consider is to sell the $220 November 8 put at a bid of $7.50. At the same time, you buy the $210 November 8 put at an ask of $5.25. The net income received of $2.25 represents the most we can receive from this trade. Further, the maximum risk is capped at $7.75. The risk-reward ratio is 3.44-to-one or a yield of 29.03%.

Obviously, acquiring this yield necessitates that the trade goes in your favor. However, the beauty of this options strategy is the margin of safety. Notably, the breakeven for this bull put spread sits at $217.75. From Friday’s closing price of $250.08, TSLA stock may drop 12.9% before an investor begins losing money. If you merely rate TSLA as a Hold, this is an attractive proposition.

In many ways, it’s also superior to the sold put iteration. Yes, by selling the put straight, you would receive $7.50 in income, not just $2.25. However, if the trade goes sour, you’d be forced to buy back $22,000 worth of TSLA stock ($220 strike multiplied by 100 shares). That actually works out to a yield of only 3.41% since you’re putting so much at risk for such a small reward.

Is Tesla Stock a Buy?

Turning to Wall Street, TSLA stock has a Hold consensus rating based on 12 Buys, 16 Holds, and seven Sells. The average TSLA price target is $210.91, implying 14% downside risk.

The Takeaway: TSLA Stock Can Be a Yield Monster

While EV manufacturer Tesla features some positives, the negatives — including an earnings miss and a soft automotive ecosystem — give me a Neutral view on TSLA stock. Nevertheless, neutrality can be profitable via an income-generating strategy called the bull put spread. By selling and buying puts of the same expiration date, traders can extract a risk-controlled yield. As long as Tesla doesn’t crumble, the bull put can be a powerful weapon in a trader’s arsenal.