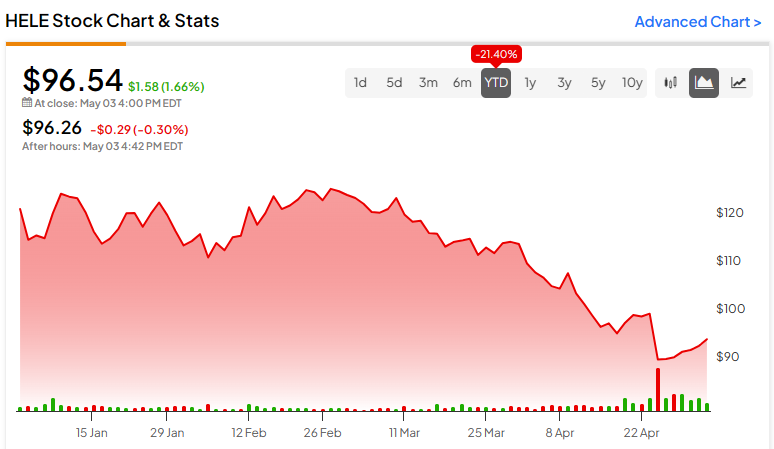

Helen of Troy Limited (NASDAQ:HELE) may be named after a beautiful Greek mythology figure, but its recent stock performance has been anything but beautiful. On April 24, shares of the consumer products maker fell to a 12-month low of $87.50 after the company’s Fiscal Q4-2024 earnings release. Wall Street analysts were quick to predict that the mid-cap will rebound by over 40%.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Headquartered in El Paso, Texas, Helen of Troy owns a diversified portfolio of popular consumer brands in the beauty, wellness, home, and outdoor categories. The company’s products are sold globally through supermarkets, drugstores, home improvement retailers, and other channels. Braun, PUR, and Vicks are among its most recognized brands.

Last month’s sell-off was somewhat surprising because it came after Helen of Troy announced better-than-expected financials for the three months ended February 29, 2024. Revenue of $489.2 million was flat compared to the prior year period but ahead of the $476.9 million consensus estimate. Growth in the Home & Outdoor business was offset by a sales decline in the Beauty & Wellness segment.

Helen of Troy also outperformed profit expectations. Fiscal fourth-quarter earnings per share (EPS) rose 22% to $2.45, the best growth in more than two years. Despite the strong finish to Fiscal 2024, the market reacted negatively because of concerns about further Beauty & Wellness weakness in Fiscal 2025.

While I can understand the rationale for selling a stock whose larger business is struggling, I am bullish on Helen of Troy. Falling sales of hair and personal care items, as well as fans, heaters, and air purifiers, reflect challenges faced by the broader beauty and wellness market more so than the company itself. As the economic pressures impacting consumer spending — inflation and high interest rates — improve, Helen of Troy’s brand strength is likely to restore the Beauty & Wellness unit to growth.

Wall Street’s mostly bullish response to Helen of Troy’s fourth-quarter update suggests that the post-earnings sell-off was overdone. Let’s see what analysts are saying.

Helen of Troy Stock Looks Undervalued

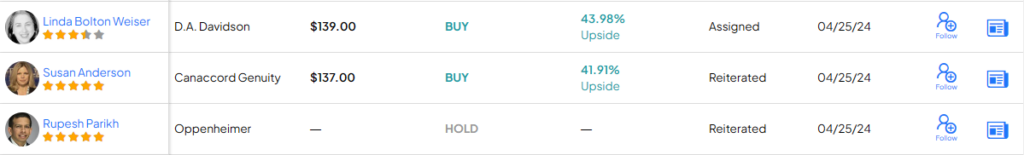

Five-star Canaccord Genuity (OTC:CCORF) analyst Susan Anderson reiterated a Buy rating on Helen of Troy after the stock dipped to a new 52-week low. The analyst gave HELE a $137.00 price target that implies 1) a run back toward the 52-week high of $143.68 and 2) more than 40% upside from current levels. Anderson’s opinion is one worth noting because she ranks within the top 5% of Wall Street research analysts.

Investment firm D.A. Davidson also expressed bullish sentiment on Helen of Troy following the double beat. Linda Bolton Weiser noted that management’s 5% to 7% sales decline guidance for Fiscal 2025 first-quarter sales is based on a “lack of flu season reorders and systems-related disruption.”

She said, however, that after this headwind clears, organic sales growth is expected to turn positive in the second quarter amid retail distribution gains. Although the analyst lowered her price target from $151.00 to $139.00, she said a 9x P/E ratio makes Helen of Troy stock “worth a look for value investors.”

Project Pegasus Could Send Profits Flying

Management also provided an update on the company’s Pegasus restructuring plan, which is designed to expand operating margins through cost reduction and efficiency gains. It lowered its one-time restructuring charge estimate to $50-55 million, which is expected to be applied in Fiscal 2025.

Helen of Troy also revised the timing for its estimated $75-85 million of pre-tax operating profit improvements. After approximately 25% of this goal was achieved in Fiscal 2024, it now sees 35%, 25%, and 15% of the savings being recognized over the next three fiscal years, respectively.

A reduced restructuring charge and continued cost savings point to solid progress with Project Pegasus. It could also be a source of outperformance, with management projecting a wide adjusted EPS growth range of -2.4% to 3.3% in Fiscal 2025.

What Is the Consensus Price Target for HELE Stock?

Helen of Troy is actively followed by a handful of research firms, just three of which have offered an opinion over the last three months. HELE stock comes in as a Moderate Buy based on two Buys and one Hold rating assigned in the past three months. Meanwhile, the average HELE stock price target comes in at $138.00, which implies 43% upside potential over the next 12 months.

The Bottom Line on HELE Stock

Helen of Troy stock was hit hard by a conservative Fiscal 2025 outlook that reflects declining Beauty & Wellness product sales in a tough discretionary spending environment. Low expectations and a low valuation could drive significant upside, though, especially if macroeconomic conditions improve and Project Pegasus continues to boost profit margins.