Many investors dream of owning real estate and living off passive income. However, it’s not always a walk in the park. Whether it’s mowing the lawn in the summer, shoveling snow in the winter, or installing a new boiler after an emergency, I can tell you from experience that it’s not always glamorous. However, you can indirectly own real estate by investing in REITs, specifically REIT ETFs. These allow you to gain exposure to real estate and the passive income it provides without the headaches and calls in the middle of the night.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

What is a REIT ETF?

REIT stands for Real Estate Investment Trust. Industry association Nareit defines REITs as “companies that own or finance income-producing real estate across a range of property sectors. These real estate companies have to meet a number of requirements to qualify as REITs. Most REITs trade on major stock exchanges, and they offer a number of benefits to investors.” REITs must also meet other certain requirements, such as distributing at least 90% of their taxable income to shareholders through dividends.

One important thing to remember about REITs is that while we most often think of real estate investments pertaining to things like housing, apartment buildings, and offices, they can also include anything from telecom towers and data centers to farmland and timberland. Even niche types of real estate like golf courses, casinos, and water parks can be part of a REIT.

Investing in REITs gives you, as an investor, exposure to real estate and the passive income that it produces — many REITs are known for having above-average dividends. Owning REITs can also be seen as a hedge against inflation, as hard assets like real estate tend to appreciate in value during times of inflation. They also expose you to a sector that is less correlated with the rest of the broader stock market.

A REIT ETF is simply an ETF that invests in numerous REITs, allowing investors to diversify their investment across a broad swath of REITs. Here are three you can buy right now to become a real estate investor in a truly passive sense.

Vanguard Real Estate ETF (VNQ)

With over $30 billion in assets under management, the Vanguard Real Estate ETF is the 800-pound gorilla in the REIT ETF space. With a low expense ratio of just 0.12% and a sizable dividend yield of 4.3%, it’s easy to see its appeal.

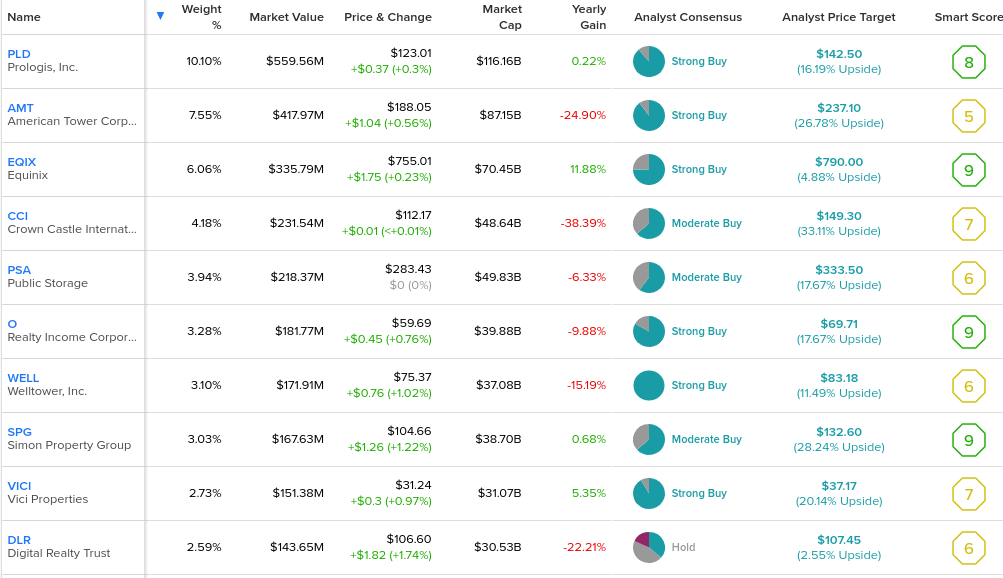

VNQ also offers investors significant diversification. It holds 165 positions, and its top ten holdings make up just under 50% of its assets. Below is an overview of VNQ’s top ten holdings using TipRanks’ holdings tool.

VNQ offers investors exposure to many different types of real estate — Telecom tower REITs make up the fund’s largest weighting at 14.3%, followed closely by industrial REITs at 13.3% and retail REITs at 12.6%. You’ll also find health care REITs (8.1% weighting), data center REITs (7.6% weighting), self-storage spaces (7.4% weighting), multi-family residential REITs (9.2% weighting), and even timber REITs (2.5% weighting).

Analysts view VNQ as a Moderate Buy, and the average analyst price target of $94.90 represents an upside of 16.11% from current levels.

With low fees, a dividend yield north of 4%, and this diversified portfolio of over 165 REITs that give you instant access to the broad spectrum of U.S. real estate, it’s easy to see why VNQ is a leading REIT ETF.

Schwab U.S. REIT ETF (SCHH)

With $5.6 billion in assets under management, the Schwab U.S. REIT ETF is another mainstay in the REIT ETF space, although it is still much smaller than VNQ. While VNQ is a low-cost ETF with a 0.12% expense ratio, SCHH features an even more favorable expense ratio, which is a minuscule 0.07%.

Like VNQ, SCHH offers plenty of diversification with 126 holdings. Its top ten holdings make up 46.6% of the fund. Below, you can take a closer look at SCHH’s top ten positions.

As you can see, there is plenty of overlap between the two funds. In fact, VNQ and SCHH share nine of the same top ten holdings. The key difference is that VNQ’s top holding is Vanguard’s own VRTPX mutual fund, which SCHH does not own (with data center REIT Digital Realty Trust (NYSE:DLR) taking its place in the top ten).

SCHH features a 3.1% dividend yield, which isn’t as high as VNQ’s, but still comes in at nearly twice the average yield for the S&P 500. SCHH also has a solid track record in this department, having paid out a dividend to its holders for 12 straight years since its inception in 2011.

The Schwab U.S. REIT ETF is viewed positively by analysts, who assign it a Moderate Buy rating. Furthermore, its average analyst price target of $22.61 implies 18.13% upside potential.

SCHH is another strong choice for investors interested in REIT ETFs, although it has a lower dividend yield than VNQ (albeit still attractive) but a lower expense ratio.

iShares Cohen & Steers REIT ETF (BATS:ICF)

The iShares Cohen & Steers REIT ETF is another major REIT ETF with $2.2 billion in assets under management. However, this means it is smaller than VNQ and SCHH.

You will immediately notice that it has a lower dividend yield than the preceding two ETFs, with a current yield of 2.8%. It also has a considerably higher expense ratio, at 0.32%.

However, dig a bit deeper, and you’ll find that despite this, ICF is about on par with these peers in terms of total performance. As of the close of the most recent quarter, ICF’s total return over the past three years was 9.1%. This was lower than VNQ’s total return and higher than ICF’s. Over the same time frame, VNQ posted a total return of 9.9%, while SCHH returned 8.6%.

Broadening the scope of the comparison to five years, ICF returned 6.2%, slightly outperforming VNQ’s total return of 5.8% and besting SCHH’s 3.1%.

You can compare ETFs like VNQ, SCHH, ICF, and others based on various factors using TipRanks’ ETF comparison tool.

ICF is a more concentrated fund than VNQ or SCHH, with 30 holdings. Furthermore, its top ten holdings make up 61% of assets. Below, you’ll find a snapshot of ICF’s top ten holdings.

ICF’s top ten holdings are the same ten stocks in SCHH’s top ten holdings, and it also shares nine of its top ten holdings with VNQ.

Analysts view ICF as a Moderate Buy, and the average analyst price target of $64.12 indicates a potential upside of 18.24% from ICF’s current price.

Closing Thoughts: Why My Top Pick is VNQ

REIT ETFs are a great way to become a real estate investor without dealing with the nuisances of being a landlord. They provide investors with passive income through dividends and provide some defense against inflation. All three of these REIT ETFs are solid choices for investors looking to achieve this. As you can see, there isn’t a massive difference between these ETFs. Still, of the three, my top choice would be VNQ based on its immense diversification across stocks and real estate subsectors, low fee, superior dividend yield, and performance track record.