In this piece, I evaluated two AI/Big Data stocks: Alphabet (GOOGL) and Meta Platforms (META). A closer look suggests bullish ratings for both, although a clear winner emerges.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Alphabet, Google’s parent company, generates revenue from online advertising, sales of apps and content on Google Play and YouTube, and fees on cloud services and other licensing revenue. Meanwhile, Meta Platforms, the parent company of Facebook, Instagram, and WhatsApp, also generates revenue from online advertising.

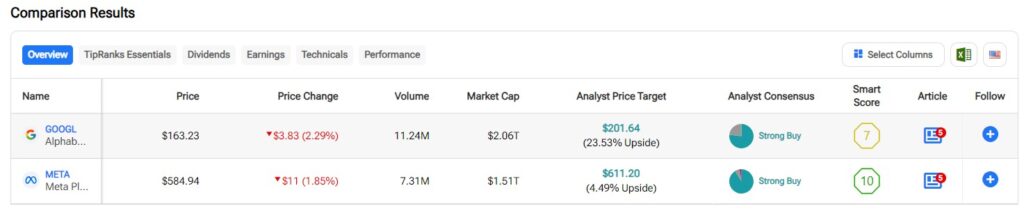

Shares of Alphabet have tumbled 12% over the last three months, bringing their year-to-date gain to 20%, which accounts for nearly all of the 21% one-year return. In contrast, Meta Platforms stock is up 12% over the last three months for a year-to-date jump of 69% and a one-year bounce of 88%.

The two companies’ equally opposite three-month performances create a setup for an interesting matchup, as outlined below.

Alphabet

At a price-to-earnings (P/E) ratio of 23.5x, there’s no ignoring the fact that Alphabet is cheap. While concerns about generative AI could threaten the technology giant, the current P/E is just too cheap to ignore, suggesting a bullish view is in order.

Notably, advertising still accounts for the lion’s share of Alphabet’s quarterly revenue, including $64.6 billion of the $84.7 billion in total revenue. Google Search alone accounted for $48.5 billion of total revenue. Thus, it’s easy to see why some might give credence to the concerns raised by a fund manager last week. However, I would suggest that his view might be a bit short-sighted, especially since Search revenue is still growing.

At the 2024 Quality-Growth Conference last week, Stephen Yiu of Blue Whale Capital explained why he’s bearish on Alphabet right now. He expects generative AI to significantly change Alphabet’s business model, although he does see some upside left in the near term.

Nonetheless, he maintains a negative view due to signs of a market share decline from Google Search, which once held a 90% share. Furthermore, Alphabet’s AI model, Gemini, has yet to meet the expectations set by competing models.

Despite Yiu’s longer-term concerns for Alphabet, this looks like a buy-the-dip opportunity. On a P/E basis, the shares have been range-bound since about April 2023. However, they’re currently at the bottom of the valuation range, suggesting another leg up could be in the offing soon.

Even if Alphabet does enter a period of struggle, as Yiu maintains, this company isn’t going anywhere anytime soon. In short, Alphabet is one of those stocks that’s good to buy and hold for the long term, although the size of the position in your portfolio might fluctuate based on valuation.

Thus, I would recommend a small position right now if you don’t already have one, potentially with plans to add a few more shares if you already have a position. After all, Alphabet has more than doubled over the past five years, rising 174%.

Additionally, should Gemini deliver positive surprises, Alphabet shares will rise further, potentially breaking out of their current range. We’re already starting to see signs of this with the integration into Google Search and the recent Gemini at Work event, which covered a range of AI use cases for enterprises.

What Is the Price Target for GOOGL Stock?

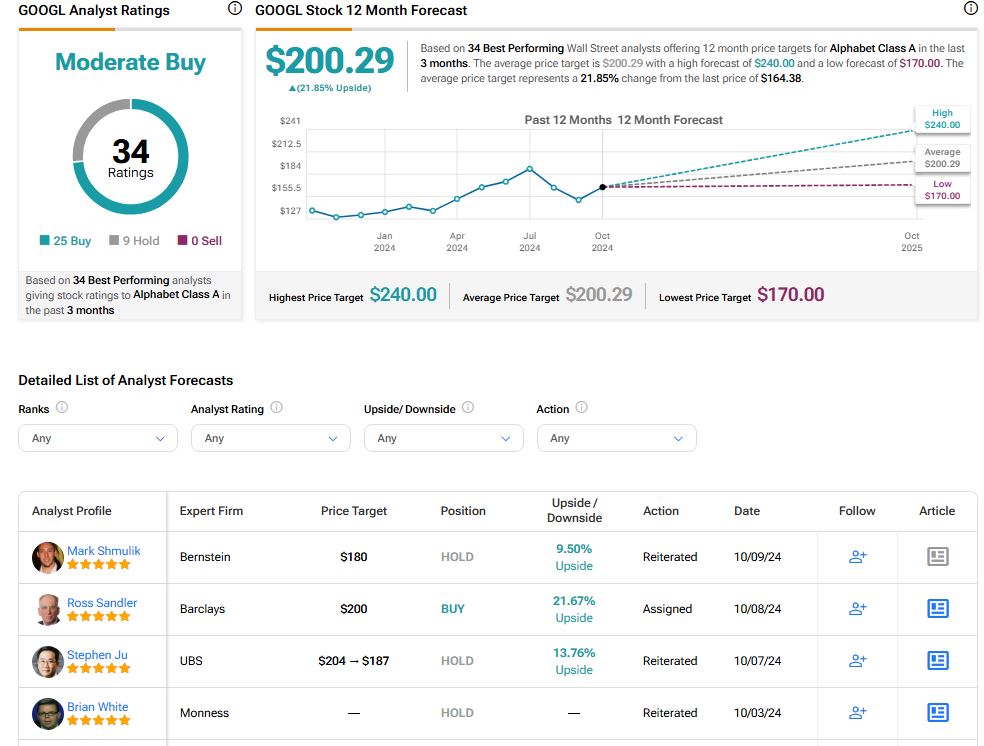

Alphabet has a Moderate Buy consensus rating based on 25 Buys, nine Holds, and zero Sell ratings assigned over the last three months. At $200.29, the average Alphabet stock price target implies upside potential of 21.85%.

See more GOOGL analyst ratings

Meta Platforms

At a P/E of 30x, Meta Platforms is trading at a premium to Alphabet, and it’s on the rise after hitting bottom at around 25.5x in early August. Meta has been rangebound for about a year or so on a P/E basis and is approaching the middle of that range. Nonetheless, a long-term bullish view looks appropriate.

Meta Platforms is less diversified than Alphabet, capturing 98% of its revenue from advertising in the second quarter. This could prevent a problem in the event that digital advertising goes south, though that looks doubtful.

Yiu also commented on Meta Platforms, picking it as his top Magnificent Seven stock aside from NVIDIA (NVDA). He believes that Meta has greater access to personal information than Alphabet, thanks to the interactions occurring across its various platforms. He noted that this provides more personal information about individuals than just searching for things on Google.

Further, Yiu mentioned that he believes ads on Meta Platforms will become more personalized through generative AI, which he expects to have a greater impact on Meta than on Alphabet. He argues that personal interactions are more likely to drive immediate purchase decisions compared to Google searches. Additionally, Meta CEO Mark Zuckerberg supported Yiu’s remarks, stating that AI will allow Meta to offer even more tailored advertisements.

I would agree with Yiu on these points, but I don’t think Meta will enjoy greater benefits from AI than Alphabet, especially over the long term. Notably, Meta’s ad revenue growth rate reached 22% in the second quarter, double that of Google’s growth rate. However, it’s important to consider that Alphabet’s growth rate was based on a much larger scale versus Meta’s total revenue of $39.1 billion for Q2.

What Is the Price Target for META Stock?

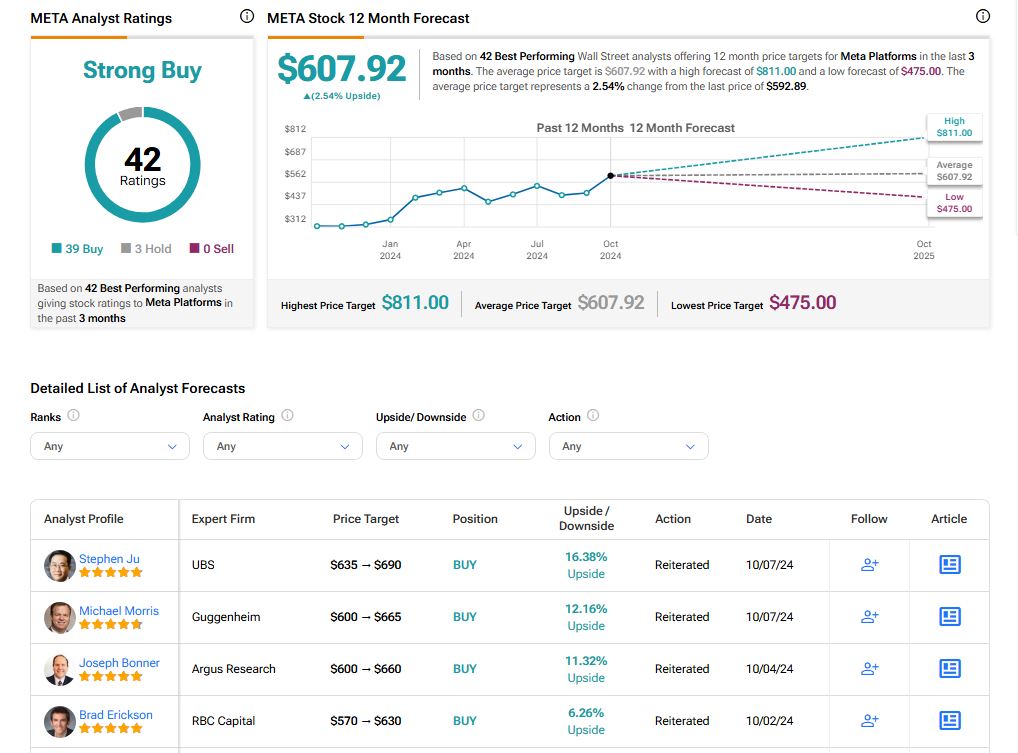

Meta Platforms has a Strong Buy consensus rating based on 39 Buys, three Holds, and zero Sell rating assigned over the last three months. At $607.92, the average Meta Platforms stock price target implies downside potential of 2.54%.

Conclusion: Bullish on GOOGL and META

Although both Alphabet and Meta Platforms receive bullish ratings, Alphabet is the clear winner here. Google Cloud revenues continued to rise sequentially, surpassing $10 billion in quarterly revenue for the first time in the second quarter. The Cloud division accounts for Alphabet’s AI revenue, which is critical because AI is already starting to cover for the drop in ad revenue.

On the other hand, Meta Platforms is trading at a premium to Alphabet, and it’s verging on overbought territory with a Relative Strength Index of 69.4. Ultimately, I expect Alphabet and Meta to both capture significant AI revenues.

However, Alphabet takes the crown this time around due to valuation and the fact that it was able to put an actual number on AI-related revenue, while Meta just talked about AI making a difference in its revenue growth.