More than 60% of the S&P-listed companies have reported earnings, and the results are well above expectations. It’s safe to say that 2024 ended with a bang. What lies ahead is more of a mystery, however, as President Trump has chosen to take a wrecking ball to the expectations of Washington’s policy wonks.

Will it turn out for the better or worse? We just don’t know yet. But the strong earnings season has set a solid floor, even as forecasters continue to set a low bar.

Covering the situation from Goldman Sachs, chief US equity strategist David Kostin sums up what’s going on:

“Against an uncertain macro backdrop, micro data revealed another strong earnings season. With 61% of S&P 500 companies accounting for 72% of market cap having reported, S&P 500 aggregate 4Q profits grew by 12% year/year compared with consensus estimates of 8% growth at the start of earnings season. The median S&P 500 company grew EPS by a healthy 7% compared with a 6% expectation at the start of reporting season. Solid sales growth and margin expansion both contributed to S&P 500 bottom-line growth… However, 2025 EPS forecasts appear to have recently inflected lower, with negative revisions to most sectors.”

With that backdrop in mind, Goldman’s stock analysts have singled out two stocks they believe could be potential gainers in the coming year. We tapped into the TipRanks platform to see the broader Wall Street view on each of them, and to find out why you should follow the Goldman lead. Let’s dive in.

Albertsons Companies (ACI)

The first company we’ll look at, Albertsons, is one of the largest grocery store chains operating in the US market. There are various yardsticks to rank the nation’s grocers – by market cap, Albertsons’, valued at $12.1 billion, ranks just 14th, but by number of outlets, with nearly 2,300, the company ranks at number 5. In addition to its retail locations, Albertsons has 19 manufacturing plants and 22 distribution centers and employs approximately 285,000 people. The company generated almost $80 billion in total revenue during the 12-month period ending in November of last year.

Albertsons operates through a lineup of grocery brands. The company’s eponymous chain is well-known west of the Rockies, while other brands include Jewel-Osco, Safeway, and Kings Food Markets. The company also has several ‘house brand’ labels for food products, including Signature Select, Open Nature, and Value Corner. The company was founded in 1939 and is based in Boise, Idaho.

Elevated inflation during the past several years has had an impact on the grocery industry – the price of eggs was a talking point issue during last year’s election campaign. Meanwhile, in its latest quarterly earnings report, Albertsons showed somewhat mixed results. That report covered fiscal 3Q24 (November quarter), and in it, the company had a top-line result of $18.77 billion. This was up a modest 1.2% year-over-year, and it came in just under the forecast, missing by $80 million. At the bottom line, Albertson’s reported a non-GAAP EPS of 71 cents based on an adjusted net income of $420 million. The EPS figure was 6 cents per share better than had been expected.

We should note here that the company did have sufficient confidence to raise its quarterly common share dividend – declaring on January 8 this year a payment of 15 cents per share. This translates to a bump of 25% in the dividend payment. The annualized payment of 60 cents per share gives a forward yield of 2.8%.

For Goldman analyst Leah Jordan, the key here is valuation. Jordan sees Albertsons as a sound value for investors, especially when compared to a peer competitor such as Kroger. The analyst writes, “We view ACI’s risk/reward set-up as attractive given its valuation. Specifically, ACI currently trades at wider discounts to KR vs its historical average. Additionally, adjusting for differences in pension and leases, ACI’s valuation looks attractive relative to KR. Our estimates incorporate annual disclosures as of FYE23, while the company indicated it has received outside funding since then, which suggests the valuation could look more compelling. We believe some investors are still mindful of ACI’s under-funded pension, although the company views these as contingent liabilities and not necessarily obligations, noting any future contribution would be based on collective bargaining. Ultimately, we anticipate improving trends throughout the year, which should support a re-rating in the stock, off of depressed levels.”

These comments support Jordan’s Buy rating on ACI, while her price target, set at $26, implies a one-year upside potential of 22.5%. (To watch Jordan’s track record, click here)

Overall, ACI shares have a Moderate Buy consensus rating from the Street, based on 11 recent analyst reviews that include 7 to Buy and 4 to Hold. The shares are priced at $21.21, and their $22.91 average price target suggests that a gain of 8% is in the offing for the stock. (See ACI stock forecast)

NXP Semiconductors (NXPI)

Next on our list is the Dutch semiconductor chip company NXP. This firm was founded in 2006 as a spin-off from Philips and today is a $54 billion independent operator working in both the design and production of silicon semiconductor chips. The company is known for its contributions to the automotive, IoT, and industrial sectors. NXP’s product lines include a wide range of processors and microcontrollers, RFID and NFC chips, sensors, security and authentication systems, power management chips, and wireless connectivity technologies.

NXP takes a two-sided approach to the chip industry, working for both tech and people. That is, the company aims to create technologies that solve customers’ issues. Following this approach, NXP has built up operations in more than 30 countries and last year generated over $12.6 billion in total revenues. That said, this figure was down 5% year-over-year. The company has faced recent headwinds, including a slowdown in its automotive and industrial business segments. These sectors are in the midst of correcting and updating inventory, which cuts into NXP’s current sales.

At the same time, NXP remains profitable and has maintained its quarterly dividend payments. In the last reported quarter, 4Q24, the company’s revenue figure of $3.11 billion was $10 million over the forecast—despite a 9% year-over-year decline. Bottom-line earnings also beat the forecast; the non-GAAP EPS of $3.18 was 5 cents per share better than expected.

Goldman’s Toshiya Hari, an analyst who ranks in the top 1% of Street stock experts, acknowledges NXP’s headwinds but remains bullish on the stock.

In his latest note following Q4 earnings, the 5-star analyst doubled down on his optimism: “While we are cognizant of the challenging operating environment in Automotive and Industrial (specifically, the ongoing inventory correction at NXP’s customers/partners), we reiterate our Buy rating on NXP… We believe this quarter will mark the last cut in consensus EPS and that Street estimates will stabilize in 2Q25 before reverting higher in 2H25/1H26. Longer-term, we consider NXP to be well-positioned in what is a secularly growing Automotive semiconductor market (note NXP’s exposure to ADAS and leadership positions in processors/MCUs, radar, connectivity and electrification) with material runway to expand margins, grow FCF and allocate capital to shareholders.”

That Buy rating comes with a price target of $260 to indicate room for a 24% upside potential in the next 12 months. (To watch Hari’s track record, click here)

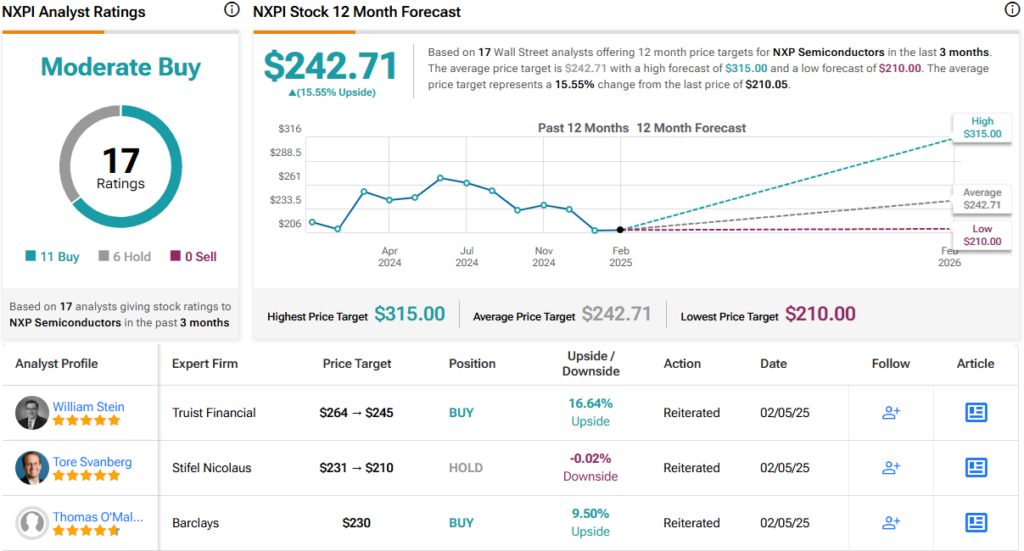

This stock’s Moderate Buy consensus rating is derived from 17 recent reviews, with a breakdown of 11 Buys and 6 Holds. The shares are currently trading for $210.05, and their $242.71 average price target suggests a gain of 15.5% on the one-year timeline. (See NXPI stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.