The blockchain technology and crypto-themed Global X Blockchain ETF (NASDAQ:BKCH) has taken advantage of a red-hot crypto market to soar to a scintillating gain of 188.3% year-to-date. BKCH points out that the value of the crypto market could grow by over 10x to $1.4 trillion by the end of the decade, so we could still be in the early innings of the growth of crypto and blockchain technology.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

But while the crypto market is indeed exciting, there are several risk factors that investors should give consideration to before rushing into BKCH to join the party.

What Does the BKCH ETF Do?

BKCH is a relatively small ETF from Global X (with $107.3 million in assets under management) that invests in companies that are involved in cryptocurrency and blockchain technology.

One nice thing about BKCH is that it is one of the rare crypto-themed ETFs that pays a dividend, although it currently yields just 0.6%.

Concentrated Holdings

With just 25 holdings, BKCH is not particularly diversified. Additionally, BKCH’s top 10 holdings make up 75.8% of assets, making it even less diversified. Below, you’ll find an overview of BKCH’s top 10 holdings using TipRanks’ holdings tool.

Top holding Coinbase Global (NASDAQ:COIN) has a large weighting of 13.5%, while Bitcoin (BTC-USD) miners Marathon Digital (NASDAQ:MARA), Riot Platforms (NASDAQ:RIOT), and Hut 8 Mining (NASDAQ:HUT) all have double-digit weightings as well, making this a very concentrated fund with large exposure to a few names.

In fact, a whopping nine of BKCH’s top 10 holdings are Bitcoin miners. This can be great when the price of Bitcoin is surging, but it leaves investors exposed to plenty of volatility and risk to the downside when Bitcoin is slumping.

BKCH touts the fact that “this theme is bigger than cryptocurrency” because of the promise of blockchain technology itself, but it’s hard to see that in the way that the fund is configured.

After the deluge of miners, the stock does own some companies that participate in blockchain technology and the crypto industry in other ways. For example, Nvidia (NASDAQ:NVDA) supplies the GPUs (graphic processing units) that the Bitcoin miners mentioned above utilize to process transactions and secure the Bitcoin network.

Block (NYSE:SQ) has made Bitcoin accessible to millions of investors by enabling them to buy, sell and hold it directly in its popular CashApp payment service. However, NVDA and SQ have smaller weightings of 2% and 1.5%, respectively, that pale in comparison to the weightings of the Bitcoin miners listed above.

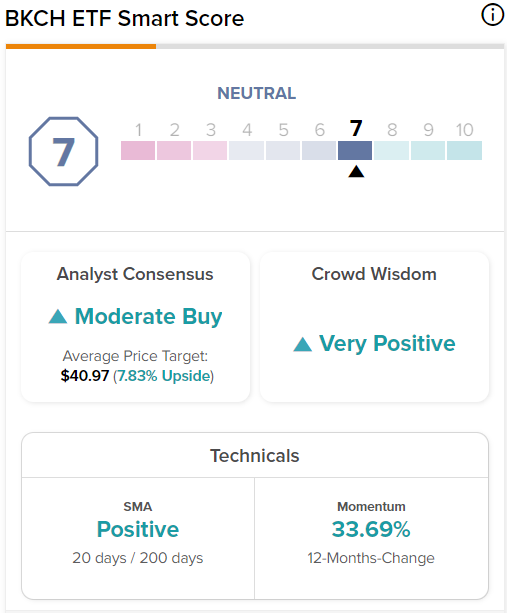

In fairness to BKCH, while I’m concerned about its heavy concentration in Bitcoin miners, TipRanks’ Smart Score system views its holdings favorably. The Smart Score is a proprietary quantitative stock scoring system created by TipRanks. It gives stocks a score from 1 to 10 based on eight market key factors. A score of 8 or above is equivalent to an Outperform rating, and an impressive eight out of BKCH’s top 10 holdings boast outperform-equivalent Smart Scores of 8 or better.

So, while I have some concerns about the fund’s heavy concentration in a cohort of very similar companies, the Smart Score views these companies favorably on an individual level. As a whole, BKCH has a Neutral Smart Score of 7, although this is at the higher end of Neutral.

As you’ll see below, sell-side analysts also have a relatively favorable view of BKCH.

Is BKCH Stock a Buy, According to Analysts?

Turning to Wall Street, BKCH has a Moderate Buy consensus rating, as 72.13% of analyst ratings are Buys, 21.86% are Holds, and 6.01% are Sells. At $40.97, the average BKCH stock price target implies 6.4% upside potential.

BKCH’s Fees

At 0.5%, BKCH’s expense ratio isn’t great. In the broader landscape of all ETFs, it is expensive compared to the many index funds that now feature expense ratios of 0.1% or lower. However, in the smaller world of crypto ETFs, its expense ratio is actually more cost-effective than those of many of its competitors. Its fees are equivalent to those of the VanEck Digital Transformation ETF (NASDAQ:DAPP), and they are cheaper than those of other names in the space, like the Amplify Transformational Data Sharing ETF (NYSEARCA:BLOK) and the Bitwise Crypto Industry Innovators ETF (NYSEARCA:BITQ), which charge fairly exorbitant fees of 0.75% and 0.85%, respectively.

Ultimately, BKCH’s expense ratio means that an investor putting $10,000 into the ETF today will pay $50 in fees in year one. Over time, these fees would compound. Assuming the 0.50% expense ratio remains in place and that the fund returns 5% per annum, this same BKCH investor would pay $628 in fees over the course of 10 years, which is a fairly steep price to pay.

An Underwhelming Track Record

Launched in December of 2021, BKCH hasn’t been around for long enough to compile much of a performance track record, but unfortunately for its investors, it has lost 43.6% on a total-return basis since inception, which isn’t much to write home about.

It should be noted that the fund launched at the height of exuberance surrounding the crypto bull market in late 2021 and early 2022 before the entire crypto market headed much lower over the course of the year. This has obviously impacted BKCH’s results, but it has to be said that this is still a pretty disappointing performance at the end of the day.

The Takeaway

Overall, BKCH has some good things going for it, including the strong Smart Scores for its holdings and its relatively bullish rating from analysts. Ultimately, though, the fund’s underwhelming track record, high fees, lack of diversification, and heavy concentration toward Coinbase and the Bitcoin miners it owns make it a pass for me.

Investors who are intrigued by this ETF’s theme could, for example, buy Coinbase and one or two of the larger Bitcoin miners like Marathon Digital or Riot Platforms and achieve similar exposure without the fee. Conversely, an investor could also simply buy Bitcoin and perhaps Ethereum (ETH-USD) and gain exposure to the underlying assets that will ultimately drive this entire space in one direction or another.