After a period of significant volatility in the Chinese technology sector, Alibaba (BABA) is once again capturing investor interest. The company’s latest quarterly report, released earlier this month, highlights strong year-over-year performance and signals meaningful progress in China’s advancement in artificial intelligence and cloud computing.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

From a long-term investment perspective, I believe Alibaba remains undervalued. Multiple avenues for potential upside exist, including stable performance in e-commerce, AI-powered cloud services, enhanced shareholder returns, and China’s evolving global positioning within the broader geopolitical landscape. While the latter remains speculative and subject to change, it is essential to consider it in the company’s long-term growth trajectory. Overall, I maintain a tentatively bullish outlook on BABA.

Solid Q4 Results Reflect a Return to Growth

Alibaba’s March quarter report posted a promising turnaround. Revenue rose 7% year-over-year, driven by stronger consumer spending and market share gains in key business lines. Notably, operating income on a comparable basis grew 93% year-over-year due to a rising top line and better cost control.

The firm reduced operating costs and share-based compensation and boosted the efficiency of its platforms. That drove adjusted EBITA 36% higher than the previous year—a definite indication that underlying profitability is gaining traction. Net income reached $1.65 billion, rising 1,203% year-over-year, albeit partly fueled by one-off investment gains. Even excluding those, non-GAAP net income grew 22%.

Cash generation was also strong, with operating cash flow up 18% year-over-year. In short, Alibaba is not only growing again—it’s turning that growth into cash and profit. That’s an instructive signal for investors seeking to ride out sustainable momentum if geopolitical headwinds don’t persist.

From Cost Center to Cloud and AI Growth Engine

Alibaba’s Cloud Computing segment is emerging as a significant growth driver, fueled in large part by the company’s strategic focus on artificial intelligence. In the fourth quarter, revenue from the Cloud Intelligence Group rose 18% year-over-year, reaching approximately $4.15 billion.

Of particular note is the consistency of Alibaba’s AI-related revenue. The company has achieved an impressive milestone of seven consecutive quarters of triple-digit revenue growth from AI-powered cloud products. CEO Eddie Wu has identified the growing demand for generative AI as a major catalyst for this momentum. This trend is also reflected in the segment’s profitability, with adjusted EBITA increasing by 69% year-over-year.

Core Commerce Is Holding Up Well

Alibaba’s core e-commerce platforms, Taobao and Tmall, continue demonstrating strong performance. In the fourth quarter, customer management revenue, comprising advertising and commission income, increased 12% year-over-year, reflecting both a rebound in consumer confidence and improved monetization efficiency.

Management has introduced initiatives focused on competitive pricing, enhanced customer service, and expanded membership benefits to further stimulate user engagement. Notably, 88VIP—Alibaba’s premium loyalty program—surpassed 50 million members in the past year, signaling growing traction among high-value consumers.

With approximately 900 million active shoppers in China, Alibaba retains an unmatched scale advantage. On the global front, its international e-commerce platforms—including Lazada, AliExpress, and Trendyol—delivered 22% revenue growth in the fourth quarter. While these operations are not yet profitable, they continue to narrow losses as they scale and mature.

Shareholder Returns and a Deep Discount

One of the most encouraging aspects of Alibaba’s fourth-quarter report was its approach to capital returns. In fiscal year 2025, the company repurchased $11.9 billion worth of shares, reducing the number of shares outstanding by over 5%. This signals a strong vote of confidence from management in Alibaba’s intrinsic value.

In addition, the company declared its first full-year cash dividend, paying $1.05 per American Depositary Share (ADS), along with a special one-time dividend of $0.95 per ADS. The combined $2.00 dividend is a notable departure from Alibaba’s historical strategy of reinvesting the bulk of its earnings, highlighting a shift toward greater shareholder returns.

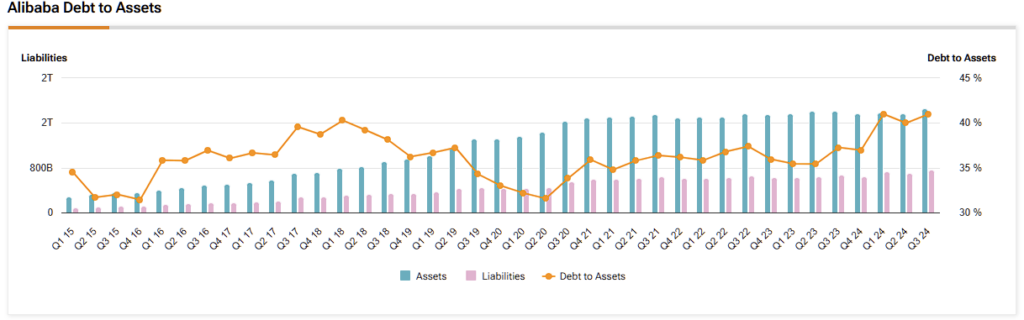

Alibaba’s balance sheet remains robust. The company ended the fiscal year with approximately $82 billion in cash and short-term investments. This provides ample flexibility to support continued investment in strategic growth initiatives while also maintaining capacity for future dividends or share repurchases.

Despite these positive indicators, Alibaba continues to trade at relatively modest valuation multiples. With FY2025 net income of roughly $17.36 billion, the company’s price-to-earnings ratio remains in the low teens—suggesting a discounted valuation by market standards.

However, this discount reflects a significant overarching risk. Geopolitical tensions pose an ongoing concern, particularly if China’s policy direction diverges from the U.S.-led international framework. Past events, such as the impact of U.S. tariffs under the Trump administration, underscore the potential for capital flight from China-focused equities. As such, maintaining limited exposure to Chinese stocks within diversified portfolios may be a prudent approach.

Is BABA a Good Buy Right Now?

On Wall Street, Alibaba has a unanimous consensus Strong Buy rating based on 13 ratings. The average BABA price target is $164.50, indicating a 35% upside potential over the next 12 months. This shows strong and broad positive sentiment that reaffirms the validity of a strategic investment.

Inflection Point Milestone Puts BABA in Contention

Alibaba’s fiscal year 2025 results—particularly its fourth-quarter performance—represent a clear inflection point. The company is regaining momentum, with renewed growth, expanding margins, and meaningful capital returns through dividends, share repurchases, and strategic spin-offs.

In my view, the market has yet to fully recognize how significantly Alibaba has evolved. It is now a more streamlined, capital-efficient, and shareholder-focused enterprise than in years past. The current valuation still leaves considerable room for re-rating, particularly if macroeconomic conditions stabilize and regulatory pressures ease.

This may represent a rare opportunity to invest in a world-class technology company at a discount, with substantial upside potential. BABA could prove to be a strategic investment in a future shaped more by global collaboration than by geopolitical conflict.