Oil prices paused their recent climb this week as tensions between Israel and Iran appear to be easing, and crucially, the Strait of Hormuz remains operational. However, given that both parties have already violated the terms of the U.S.-led ceasefire, it would be premature to assume that lasting stability will be achieved in the region.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

With the Middle East remaining a potential flashpoint, investors may want to stay prepared for renewed volatility in energy markets. In this context, established energy leaders such as ExxonMobil (XOM), Chevron (CVX), and ConocoPhillips (COP) offer a strategic way to maintain exposure to potential upside in oil prices amid geopolitical uncertainty.

These three energy giants could be the key to navigating volatility while gaining exposure to a potential oil price shock that would significantly boost earnings and revenues, despite its detrimental impact on international trade and consumer prices.

ExxonMobil (NYSE:XOM) | A Heavyweight with Global Reach

For many income-focused investors, ExxonMobil is a core holding. Its massive daily output of around 4 million barrels makes it one of the most reliable names in energy. Furthermore, its diversified portfolio, ranging from upstream exploration in places like Guyana to downstream refining, means it is not just banking on crude prices remaining high.

Recent moves, such as its $59.5 billion acquisition of Pioneer Natural Resources last year, have also significantly increased its Permian Basin output, positioning it to produce low-cost shale oil even if prices decline, as we saw this past week.

Recently, Exxon has been vocal about the Israel-Iran tensions, with CEO Darren Woods noting the Strait of Hormuz’s critical role in global oil flows, as approximately one-third of seaborne crude oil passes through it. If that chokepoint gets squeezed if tension re-escalates, Exxon’s global supply chain could face hiccups, but its ability to redirect through pipelines, such as Saudi Arabia’s to the Red Sea, should give it an edge.

Regardless, with a 42-year track record of uninterrupted annual dividend increases, Exxon has demonstrated its ability to navigate even the most challenging times in the sector, all while maintaining a reliable and growing dividend.

Is XOM a Buy, Hold, or Sell?

Currently, most analysts are bullish on XOM stock. The stock has a Moderate Buy consensus rating, based on nine Buy and six Hold ratings assigned over the past three months. No analyst rates the stock a sell. XOM’s average stock price target of $123.40 implies ~13% upside over the next twelve months.

Chevron (NYSE:CVX) | The Steady Hand with a Green Twist

Chevron produces around 3 million barrels per day, but what really sets it apart is its balanced strategy. Its Gulf of Mexico operations and Tengiz project in Kazakhstan keep the oil flowing. At the same time, its $53 billion acquisition of Hess Corporation last year added Guyana’s high-margin Stabroek block to its arsenal. Moreover, beyond oil, Chevron is investing in renewables like hydrogen and carbon capture, which could help cushion it against long-term energy shifts.

The Israel-Iran ceasefire has calmed oil markets, but Chevron is set to benefit again from higher oil prices if tensions peak, while today’s LNG deal with Energy Transfer (ET) shows the energy giant is doubling down on gas exports, a smart hedge if you can me in case crude takes a hit. It’s worth noting that Chevron is also less exposed to Strait of Hormuz risks than pure Gulf producers, thanks to its global footprint and pipeline access, such as the UAE’s Fujairah terminal.

Is CVX Stock a Good Buy?

On Wall Street, Chevron stock carries a Moderate Buy consensus rating based on 10 Buy, six Hold, and two Sell ratings. CVX’s average stock price target of $159.50 implies almost 11% upside potential over the next twelve months.

ConocoPhillips (NYSE:COP) | The Nimble Shale King

ConocoPhillips is the scrappy underdog of the trio, with a heavy focus on U.S. shale and unconventional plays. Its $22.5 billion acquisition of Marathon Oil last year strengthened its positions in the Permian and Eagle Ford, enhancing its low-cost production capacity. Boasting about 2.3 million barrels per day, COP is leaner than Exxon or Chevron but quick to ramp up output when prices climb. That makes it an ideal option for those who want to bet on short-term oil price spikes.

The Israel-Iran conflict hasn’t, of course, directly impacted Conoco’s U.S.-centric operations; however, a Strait closure could still send global prices soaring, and Conoco will be ready to capitalize on the opportunity if tensions resume.

Further, its Alaskan Willow project, slated to add 180,000 barrels per day by 2029, demonstrates that management is committed to long-term oil production (long oil). In my view, COP’s high-quality assets make it a prime pick if Middle East volatility pushes Brent above $80 again.

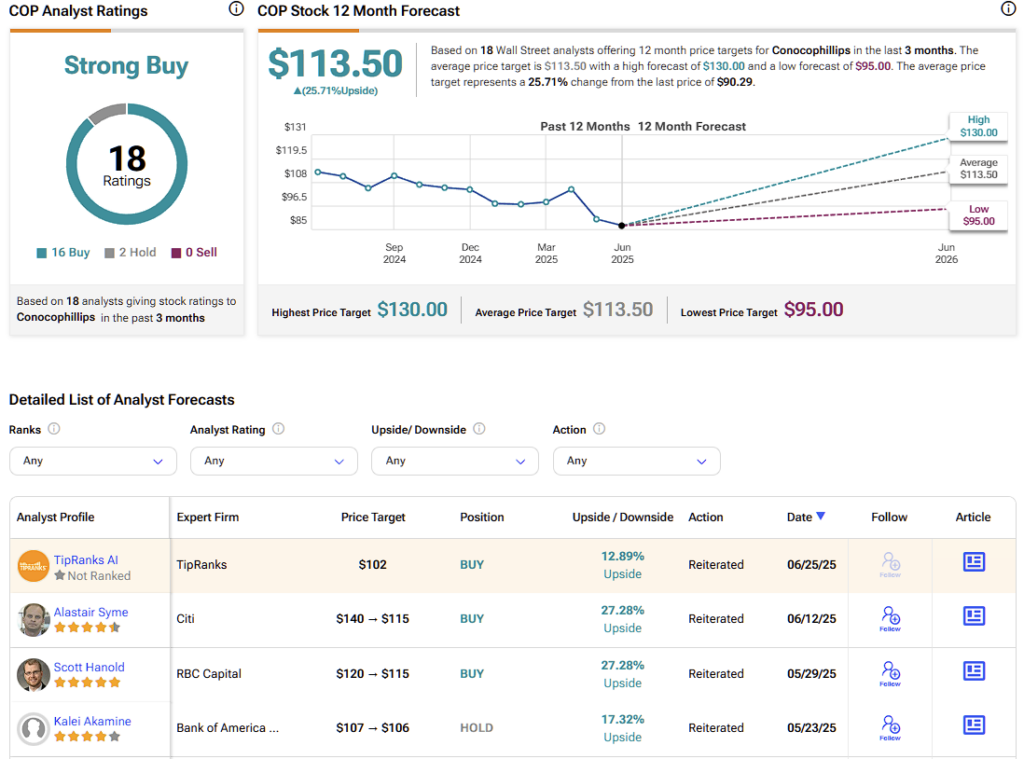

Is ConocoPhillips a Good Stock to Buy?

ConocoPhillips is currently covered by 18 Wall Street analysts, most of whom hold a bullish outlook. The stock carries a Strong Buy consensus rating with 16 analysts assigning a Buy, and only two a Hold rating over the past three months. COP’s average price target of $113.50 suggests approximately 26% upside potential over the next twelve months.

Positioning for the Next Spark

The Israel-Iran ceasefire may have taken some heat out of oil prices, but expecting long-term stability feels premature. ExxonMobil, Chevron, and ConocoPhillips each bring something unique to lean on for those who want to remain long oil: Exxon’s global muscle, Chevron’s enduring diversification, and Conoco’s shale-fueled agility.

With the Strait of Hormuz still a flashpoint and both sides itching to break the truce, these oilers are well-placed to capitalize on any price surges. Substantial dividends and smart plays (from recent acquisitions to bets on alternatives) make them dependable portfolio anchors. And if tensions flare up again in the Middle East, these three could deliver standout gains.