General Electric (GE) discovered the hard way that getting smaller is better.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

On Tuesday, the 125-year-old company announced that it is planning to form three publicly traded companies focused on growth sectors of Aviation, Healthcare, and Energy.

That’s a significant reversal of the company’s decade-old strategy of growing bigger by buying up other companies, a strategy that destroyed rather than created shareholder value.

I’m neutral on the company. (See Analysts’ Top Stocks on TipRanks)

GE Chairman and CEO H. Lawrence Culp, Jr. hailed the company’s new strategy. “At GE we have always taken immense pride in our purpose of building a world that works,” he said. “The world demands — and deserves — we bring our best to solve the biggest challenges in flight, healthcare, and energy.”

How so?

“By creating three industry-leading, global public companies, each can benefit from greater focus, tailored capital allocation, and strategic flexibility to drive long-term growth and value for customers, investors, and employees,” Culp added. “We are putting our technology expertise, leadership, and global reach to work to better serve our customers.”

Bigger Isn’t Better

For decades, GE went on a spending spree, buying up one company after another, sometimes in diverse sectors, unrelated to the company’s core competence of developing and manufacturing industrial products.

That helped the company grow its top line by leaps and bounds, but it failed to create value for its shareholders. As a result, GE’s Economic Value Added (EVA) or Economic Profit, as measured by the difference between the Return on Invested Capital (ROIC) and the Weighted Average Cost of Capital (WACC), has been negative in recent years.

That means that the company has been destroying rather than creating value as it grew its revenues.

Now, its leadership has come to realize the hard way that smaller is better, meaning that three smaller new companies will allocate capital better than one big company.

Wall Street’s Take

In the 1980s and the 1990s, Wall Street was impressed by GE’s acquisition spree and solid revenue growth. Naturally, investors thought that bigger is better, chasing after the company’s shares. As these acquisitions failed to create shareholder value, investors ran for the exits, making GE one of the worst performers among large caps.

Wall Street cheered GE’s decision to reverse strategy. Investors now think that more minor is better, sending the company’s shares higher during the Tuesday’s trading session.

The TipRanks’ stock analysis system assigns GE a Smart Score of 6 out of 10, citing insider selling and very negative investor sentiment.

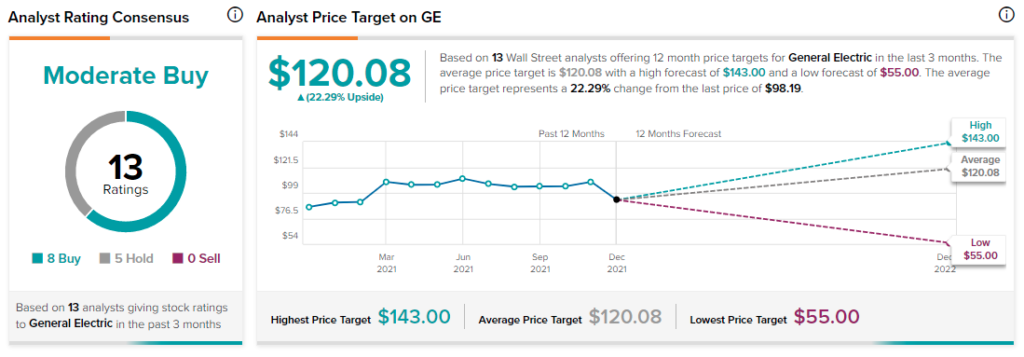

The 13 Wall Street analysts following the company’s shares in the last three months are moderately bullish for the company’s future. They have an average price target of $120.08 with a high forecast of $143 and a low forecast of $55. The average GE price target represents a 22.2% upside potential.

Disclosure: At the time of publication, Panos Mourdoukoutas didn’t own shares of GE.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates Read full disclaimer >