While the Ukraine-Russia war has taken its toll on various industries across the globe, the military engagement between the two European nations has provided support to the companies that provide defense products, equipment, and ammunition. In this article, we will look at three companies that seem well-positioned to leverage the high demand in the defense industry, which was fueled by the Russia/Ukraine conflict. These companies are General Dynamics Corporation (NYSE:GD), Northrop Grumman Corporation (NYSE:NOC), and Olin Corporation (NYSE:OLN)

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

It is worth noting that many nations are supporting Ukraine in this war. The U.S. is also providing arsenal support to Ukraine, which includes howitzers, missile launchers, ammunition, and drones.

Because of the military aid extended to Ukraine, defense officials of the world’s largest economy have expressed their concerns over the depleting stockpiles of ammunition in the country. The officials opine that urgent actions are warranted to replenish the arsenal quickly. According to a Wall Street Journal report, one of the defense officials said that the 150mm combat rounds have come down to “uncomfortably low” levels.

In light of this discussion, it is evident that the demand for ammunition by the United States government is likely to grow, going forward. Whether it takes months or years to place orders, the prospects for defense product suppliers, including the companies mentioned above, appear to be solid.

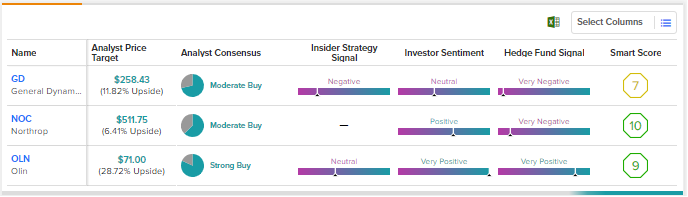

Using TipRanks’ Stock Comparison tool, a chart has been designed that might assist prospective investors in understanding Wall Street’s take on these companies.

General Dynamics Corporation (NYSE:GD)

The $63.4-billion company has expertise in making munitions, combat vehicles, weapon systems, nuclear-powered submarines, missile destroyers, and surface combatant ships. Also, the company provides related services and technological upgrades as and when required.

General Dynamics provides defense products through its Marine Systems, Combat Systems, and Technologies segments. While talking about the second-quarter results, the company’s Chairman and CEO, Phebe N. Novakovic, said, “Our defense segments demonstrated solid operating performance and had several important wins.”

Is General Dynamics’ Stock a Buy?

With solid prospects, General Dynamics’ stock appears to be a solid investment option for long-term investors.

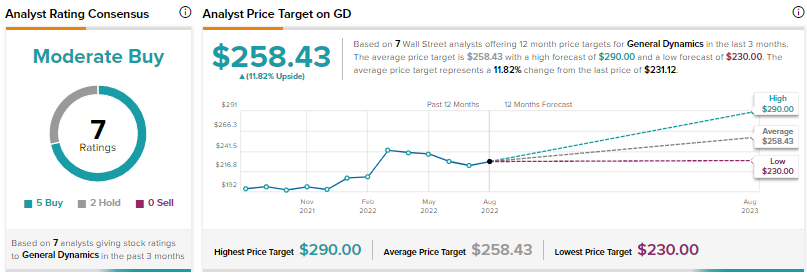

On TipRanks, the company has a Moderate Buy consensus rating based on five Buys and two Holds. Also, top retail portfolios with exposure to GD stock have increased 3.6% in the last 30 days.

GD’s average price forecast is $258.43, which represents 11.82% upside potential from the current level. While the highest price target is $290, the lowest is $230. Shares of General Dynamics have increased 11.4% year-to-date.

Northrop Grumman Corporation (NYSE:NOC)

Northrop is one of the leading companies that provides advanced aircraft systems, weapon and mission systems (missiles, munitions, and others), and technology related to surveillance and electronic warfare. The $74.4-billion company also provides launching systems for missiles.

NOC operates through four segments — Aeronautics Systems, Defense Systems, Mission Systems, and Space Systems. In July, the company’s Chairman, CEO, and President, Kathy Warden, said that the “demand for Northrop Grumman products” was strong.

Should You Buy Northrop Grumman Stock?

Shares of Northrop Grumman could be an attractive investment option for investors willing to hold the stock. Analysts on TipRanks have a Moderate Buy consensus rating on NOC stock, which is based on five Buys and three Holds.

Also, top retail investors are bullish on the stock and have increased their exposure by 2.5% in the last 30 days.

NOC’s average price target is $511.75, which mirrors 6.41% upside potential. The highest price target is $550 and the lowest is $455. NOC stock has climbed 24.8% so far this year.

Olin Corporation (NYSE:OLN)

The $8-billion company is another leading provider of ammunition in the United States. It specializes in making sporting ammunition, small caliber military ammunition, industrial cartridges, and reloading components. In addition to ammunition, the company produces and distributes chemicals.

OLN conducts its defense business through its Winchester segment. The other two segments of the company are Chlor Alkali Products and Vinyls, and Epoxy.

Is Olin a Good Stock to Buy Now?

If analysts and top retail investors are to be believed, Olin stock could prove to be an attractive investment option for prospective investors.

On TipRanks, the company sports a Strong Buy consensus rating based on nine Buys and two Holds. Also, top retail investors on TipRanks have increased their exposure to the stock by 20.6% in the past month.

It is worth noting that OLN’s average price forecast of $71 represents 28.72% upside potential from the current level. The highest price target is $102, and the lowest is $57. Year-to-date, shares of Olin have declined 1.2%.

Concluding Remarks

From the above discussion, it is evident that defense product suppliers like General Dynamics, Northrop Grumman, and Olin could be the potential beneficiaries as and when the U.S. starts replenishing its ammunition stockpiles. At this juncture, it is worth mentioning that the budget for the U.S. Department of Defense is $773 billion for the Fiscal Year 2023, up 4.1% from the previous fiscal year.

Read full Disclosure