The Pacer Global Cash Cows Dividend ETF (BATS:GCOW) offers investors a nice mix of domestic and international companies that generate strong free cash flows, and it sports an attractive 5.9% dividend yield. Let’s take a deeper dive into this $1.6 billion ETF from Pacer and find out whether it’s an attractive opportunity for investors.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

What is the GCOW ETF’s Strategy?

GCOW is part of the popular Pacer Cash Cows Index ETF Series, all of which take slightly different approaches to investing in stocks with high free cash flow yields. GCOW seeks to deliver both income and capital appreciation by investing in companies with high free cash flow yields and high dividend yields.

Free cash flow is the cash left over after a company pays for its expenses, interest, taxes, and long-term investments. Free cash flow yield is this free cash flow divided by the company’s enterprise value. A company with a high free cash flow yield can be viewed as undervalued.

Pacer explains that focusing on companies with high free cash flow yields is fruitful because “the ability to generate a high free cash flow yield indicates that a company has the capacity to pay dividends. Paying a dividend signals management is confident in the long-term viability of the business.”

Pacer also lists several additional benefits of this strategy. Focusing on companies with high free cash flow yields may lead to higher returns with lower volatility over time. Furthermore, companies with high free cash flow yields and high dividend yields have historically held up better than other stocks during market downturns.

GCOW’s Investment Process

To choose what stocks it will invest in, GCOW runs a series of screens. It starts with the 1,000 stocks in the FTSE Developed Large-Cap Index. It then narrows this universe down to the 300 companies with the highest free cash flow yields on a trailing-12-month basis. Next, it narrows this list of 300 down to the 100 companies with the highest dividend yields over the trailing 12 months. It then weights these companies by their dividends and caps each position at a maximum weighting of 2%.

By running these screens, GCOW drastically reduces the valuation and increases the dividend and free cash flow yield of its portfolio. As of June 2023, the initial universe of 1,000 stocks had an average price-to-earnings ratio of 20.3 times earnings, a free cash flow yield of just 3.4%, and a dividend yield of just 1.8%. However, after running these screens, GCOW’s portfolio of holdings had a much cheaper price-to-earnings ratio of 6.8 times earnings and much higher free cash flow and dividend yields of 8.0% and 5.7%, respectively.

GCOW’s Holdings

After screening for these companies, what does GCOW’s portfolio look like in action? This diversified ETF holds 100 stocks, and its top 10 holdings account for just 21.5% of assets. Below, you’ll find an overview of GCOW’s top 10 holdings.

The fund currently owns quite a few energy names, like top holding EOG Resources, Totalenergies, Shell, and Chevron, as these companies are producing strong free cash flows and paying substantial dividends to shareholders amid higher oil prices.

Beyond energy, GCOW owns healthcare names like AbbVie, Amgen, and Sanofi. Other well-known, high-yielding companies like IBM and automaker Stellantis also land within GCOW’s top 10 holdings.

Outside of the top 10 holdings, GCOW features several investments in tobacco companies like Altria, Philip Morris, and British American Tobacco, which are all well known for their high dividend yields and returns to shareholders. Similarly, it owns an array of global telecom providers like AT&T, Verizon, Deutsche Telekom AG, Vodafone, and Orange SA, which are also known for their high dividend payouts.

GCOW’s top 10 holdings are also rated highly by TipRanks’ Smart Score system. The Smart Score is a proprietary quantitative stock scoring system created by TipRanks. It gives stocks a score from 1 to 10 based on eight market key factors. A score of 8 or above is equivalent to an Outperform rating. An impressive seven out of GCOW’s top 10 holdings feature Outperform-equivalent Smart Scores of 8 or above.

Another thing that I like about GCOW is that while some funds focus on U.S. dividend stocks and some focus on international dividend stocks, GCOW gives investors exposure to both. The U.S. accounts for just over one-third of GCOW’s holdings, while the U.K. accounts for 14.15%. No other country accounts for a double-digit weighting, but you’ll also find stocks from Australia, Japan, Germany, France, and beyond in GCOW’s portfolio.

GCOW’s Dividend

As discussed, GCOW features an attractive dividend yield of 5.9%. This yield is higher than the yield of the 10-year Treasury Note and is also almost quadruple the 1.6% yield of the S&P 500 (SPX). GCOW launched in 2016 and has been paying a dividend for six years in a row and counting. It has also increased its dividend payout for the last two years in a row.

How Has GCOW Performed in the Past?

As of the end of September, GCOW has put up an excellent annualized total return of 15.2% over the past three years, easily outperforming the broader market. For reference, the Vanguard S&P 500 ETF (NYSEARCA:VOO) returned 10.1% on an annualized basis over the same time frame.

On the other hand, GCOW underperformed the broader market over the past five years, with an annualized return of 5.8% versus VOO’s 9.9%.

The recent returns have been strong, and given GCOW’s high dividend yield, the choppy state of the overall market, and its exposure to a mix of U.S. and international stocks, it could be positioned to outperform from here.

Is GCOW Stock a Buy, According to Analysts?

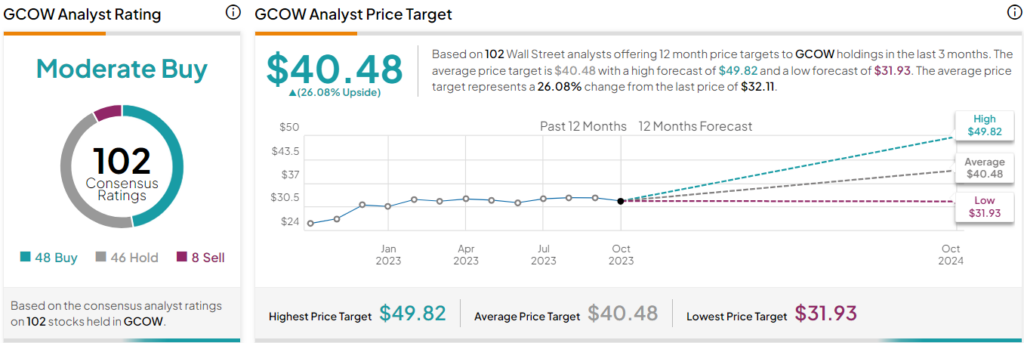

Turning to Wall Street, GCOW earns a Moderate Buy consensus rating based on 48 Buys, 46 Holds, and eight Sell ratings assigned in the past three months. The average GCOW stock price target of $40.48 implies 26.1% upside potential.

A Relatively High Expense Ratio

The primary negative aspect of GCOW is its relatively high expense ratio of 0.60%. An investor making a $10,000 investment in GCOW would pay $60 in fees during their first year of investing in the fund. These fees can add up over the long term. Assuming that the expense ratio remains at 0.60% and the fund returns 5% per year, after 10 years, this investor would pay $750 in fees.

Looking Ahead

At the end of the day, GCOW offers investors a nice mix of exposure to both U.S. and international dividend stocks, an attractive 5.9% dividend yield, and a strong portfolio of companies with high free cash flow yields that are also rated highly by TipRanks’ Smart Score system.

The fund is a bit on the pricier side, and its five-year annualized return isn’t quite as compelling as its three-year return. Nevertheless, it looks well-positioned going forward, especially in an uncertain market environment, given its high dividend yield, portfolio of strong companies with high free cash flow yields, and diversified exposure.