While we often think of ETFs as a fund that holds a basket of stocks, they can also be used as vehicles to gain exposure to the price action of other assets. These can be commodities like gold or oil or even other currencies. As cryptocurrency has burst into the mainstream over the last few years, a number of ETFs focused on giving investors exposure to Bitcoin have emerged. Bitcoin is by far the largest digital asset, with a market cap of about $480 billion.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge-fund level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Why Investors Like Bitcoin

Investors may be interested in investing in Bitcoin for a number of reasons. Because there is a maximum supply of 21 million Bitcoins, it can be viewed as a hedge against the long-term debasement of fiat currencies.

Some people are also drawn to the decentralized nature of the Bitcoin network. There is no CEO or Board of Directors in charge of Bitcoin; users are instead trusting open-source computer code. The blockchain technology behind the Bitcoin network, with its high level of security, is also a compelling feature for many users and investors.

Lastly, Bitcoin is a borderless, censorship-resistant currency that can be used worldwide. Bitcoin also gives investors diversification as a new asset class.

After a challenging 2022 in which the price of Bitcoin fell 64%, Bitcoin has surged to a 49% gain year-to-date in 2023. Inflation fears are subsiding, and risk-on sentiment is returning to the market, which is bullish for Bitcoin. It’s important to note that the following ETFs don’t invest in Bitcoin directly (more on this later). However, they enable investors to gain exposure to the price of Bitcoin by investing in Bitcoin futures.

Why Consider a Bitcoin ETF?

While some investors may prefer to simply buy and hold Bitcoin directly, there are a number of reasons that others may prefer to use an ETF to gain Bitcoin exposure. For one thing, many investors may feel it’s easier to simply buy a Bitcoin ETF and hold it in their brokerage account rather than open a new account with a crypto exchange. Some also may feel more comfortable doing this, given the high-profile collapses of several crypto exchanges in 2022.

Owning a Bitcoin ETF doesn’t come with the same risks as holding Bitcoin in your own wallet. For example, ETF investors don’t have to worry about managing the private keys to their Bitcoin. Furthermore, there may be institutional investors that aren’t permitted to buy Bitcoin directly but can buy a Bitcoin ETF. Investing in these vehicles also enables individual investors to add Bitcoin exposure to tax-advantaged retirement accounts like IRAs.

How Do These ETFs Give Investors Bitcoin Exposure?

The reason that these ETFs offer exposure to Bitcoin by using Bitcoin futures rather than by investing in Bitcoin itself is that the SEC has repeatedly rejected “spot” Bitcoin ETFs but has approved several ETFs that track Bitcoin futures. The SEC rejected spot Bitcoin ETFs because it says that they are “susceptible to fraudulent and manipulative conduct.”

Prominent examples of Bitcoin ETFs include the ProShares Bitcoin Strategy ETF (NYSEARCA:BITO), ProShares Bitcoin Short Strategy ETF (NYSEARCA:BITI), the Valkyrie Bitcoin Strategy ETF (NASDAQ:BTF), and the VanEck Bitcoin Strategy ETF (BATS:XBTF). Further, Grayscale has repeatedly tried to convert its Grayscale Bitcoin Trust (OTC:GBTC), a popular vehicle that directly invests in Bitcoin, into an ETF to no avail.

ProShares Bitcoin Strategy ETF (BITO)

The ProShares Bitcoin Strategy ETF is an offering from ProShares with $809 million in assets under management (AUM). As aforementioned, BITO does not invest directly in Bitcoin but instead “seeks to provide capital appreciation primarily through managed exposure to Bitcoin futures contracts.”

As a vehicle meant to give investors exposure to the price of Bitcoin, unsurprisingly, BITO’s performance has been largely correlated with that of Bitcoin. Bitcoin is up 49% year-to-date, less than two months into 2023, and BITO is right there alongside it with a 49.6% gain over the same time frame. One thing investors should be aware of is that BITO has a relatively high expense ratio of 0.95%.

Valkyrie Bitcoin Strategy ETF (BTF)

Like BITO, the Valykyrie Bitcoin Strategy is an actively-managed ETF that offers investors a way to gain access to the price of Bitcoin by investing in Bitcoin futures contracts. BTF is up 48.6% year-to-date, and it’s much smaller than BITO, with just $28.75 million in assets under management. Like BITO, BTF has an expense ratio of 0.95%.

VanEck Bitcoin Strategy ETF (XBTF)

The VanEck Bitcoin ETF employs the same strategy as BITO and BTF and is up 48.5% year-to-date. XBTF is a small, actively managed ETF with $31 million in assets under management. XBTF offers investors a lower expense ratio than the ETFs mentioned above, with a fee of 0.65%.

ProShares Short Bitcoin Strategy ETF (BITI)

While BITO gives investors the ability to go long on Bitcoin futures, the ProShares Short Bitcoin Strategy ETF is ProShares’ offering that allows investors to express a bearish view of Bitcoin and profit from it when Bitcoin’s price declines. It does this by seeking “daily investment results, before fees and expenses, that correspond to the inverse (-1X) of the daily performance of the S&P CME Bitcoin Futures Index.”

With Bitcoin off to a strong start in 2022, BITI has slumped, losing 35.1% year-to-date. Nevertheless, BITI could be a useful ETF for investors who feel that Bitcoin is overbought after a gain of nearly 50% year-to-date.

BITI is a much smaller ETF than its bullish ProShares counterpart BITO, with just $96.2 million in assets under management.

Like BITO, BITI has a relatively high expense ratio of 0.95%. However, this fee may still be cheaper than the cost of shorting Bitcoin on crypto exchanges.

Grayscale Bitcoin Trust (GBTC)

Lastly, while the aforementioned Grayscale Bitcoin Trust isn’t an ETF, as discussed above, it seems worthy of inclusion here, and investors can still buy it using their brokerage accounts.

GBTC is much larger than any of the other instruments mentioned above, with a market cap of $3.57 billion. Like the Bitcoin ETFs mentioned here, GBTC has tracked Bitcoin’s rise this year with a 48.4% gain year-to-date.

What makes GBTC particularly interesting for risk-tolerant investors is the fact that it trades at a large discount to its net asset value (NAV). In fact, GBTC trades at an incredible 46% discount to NAV. This means meaning that GBTC trades at just over half of what the trust is worth based on just the total amount of Bitcoin it holds.

The large discount is likely due to the fact that GBTC’s application to convert to an ETF has been rejected by the SEC. There also may be some investor hesitancy over the fact that Digital Currency Group, Grayscale’s parent company, has faced recent challenges in the form of its lending subsidiary Genesis filing for bankruptcy.

However, it should be noted that Genesis is a separate entity from Grayscale. While a vehicle like Grayscale Bitcoin Trust certainly isn’t for the faint of heart, it gives risk-tolerant investors two potential ways to win — a further increase in the price of Bitcoin and the potential for the trust to narrow its discount to NAV if Grayscale finds a way to do that.

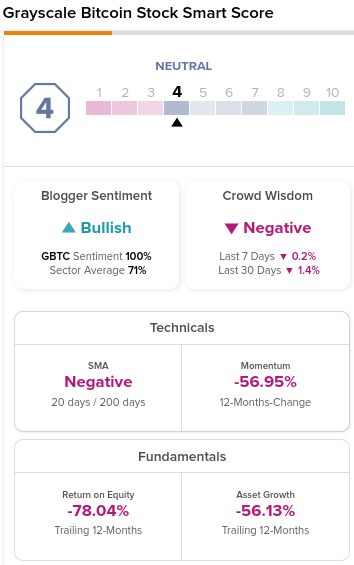

The Grayscale Bitcoin Trust has a neutral Smart Score of 4 out of 10. Meanwhile, blogger sentiment is positive, and crowd wisdom is negative.

The Takeaway

After Bitcoin’s monster start to 2023, many investors are looking to get exposure to it. While some investors may choose to invest in Bitcoin directly, investing in Bitcoin ETFs is a sensible alternative for investors who would rather gain exposure to Bitcoin in ETF form.

Of the vehicles discussed here, my two top choices are BITO and GBTC, based on their larger market caps. GBTC isn’t for everyone, but it may offer the highest risk-reward profile, while BITO is the strongest choice for the more vanilla Bitcoin futures ETFs.

I’m personally bullish on Bitcoin, so I wouldn’t buy BITI, the ETF that shorts Bitcoin. However, tactically, it can be a good tool to use if and when investors believe that Bitcoin is overbought or due for a correction. Nevertheless, it has a very small market cap and a relatively high expense fee.