Amid a host of challenging factors, the markets are on a decline and the S&P 500 (SPX) index and the tech-heavy NASDAQ (NDX) are down 20.4% and 29.4%, respectively, so far in 2022.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Yesterday, we put the spotlight on some promising names that offer value to investors given their continued financial outperformance and attractive valuation metrics at current levels.

Now, perhaps you are looking for even safer investments without any desire to try your luck with individual stocks. Trust me, you wouldn’t be alone, and according to some of the greatest investment sages like Warren Buffett and John Bogle, buying a broad market index fund or Exchange Traded Fund (ETF) can yield some serious long-term returns at an undeniable level of safety.

Historically, ETFs have yielded some of the best returns in the market, with the added advantage that investors do not need to fret over which stocks to buy or sell, and importantly, when!

Let’s look at some of the most promising names in the space that can help protect your hard-earned money while letting you sleep better at night.

Vanguard’s Total Stock Market ETF (VTI)

VTI allows an investor to take a slice of the whole market pie with one share, resulting in an investment in 4,100 stocks that range from small, mid, and large caps with a balanced mix of growth stocks and value investments.

As for its current share price, it is down by 20% from its 52-week high and 21.7% so far this year. With an economic turnaround, an investment in such a broad market ETF will allow an investor to keep up with the market, and as history shows us, the market over considerable periods of time rises to new heights. Furthermore, VTI also offers a yield of 1.56%.

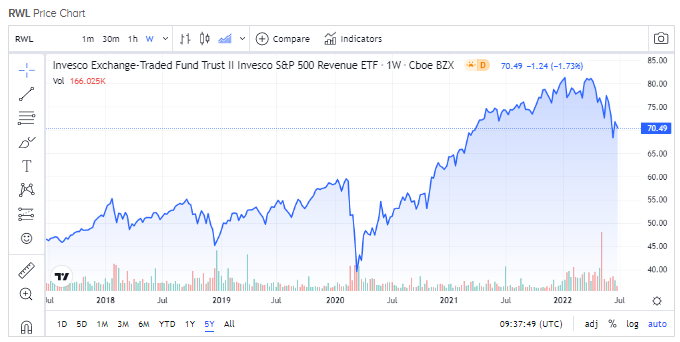

Invesco S&P 500 Value ETFs (RWL)

While RWL is down 12.5% so far in 2022, the ETF has delivered 51% over the last five years and has an expense ratio of 0.39%. RWL has a dividend yield of 1.62% and invests in large-cap names that offer growth and value.

Vanguard S&P Small cap 600 Value (VIOV)

VIOV focuses on value names in the small-cap space. While smaller stocks are generally regarded as risky, the combination of seeking value in these names and the potential upsized returns they offer is seen in this ETF’s performance. VIOV is down 15.7% so far in 2022, compared to NASDAQ’s fall of 29% and VTI’s 21.7%.

Further, VIOV offers a yield of 1.83% and has an expense ratio of 0.15%.

Avantis US Small cap Value (AVUV)

AVUV too seeks value in a similar space as VIOV and offers a yield of 1.60%. While the ETF is down 14.4% this year, it is still up over 100% from its bottom in March 2020. AVUV has an expense ratio of 0.25%.

Closing Note

Value investing is akin to trying to buy as many $10 dollar bills as possible for $6 or $7, and the time may be ripe to go looking for them. The ETFs we highlighted today are doing just that. Moreover, VIOV and AVUV can help you participate in small-cap names’ growth stories while also providing the cushion of a margin of safety.

An investor that can pass the marshmellow test is sure to reap rewards in the long run. In sticking with value and investing for the long-term, perhaps, “it PAYS to be PAY-tient.”

Read full Disclosure